- Australia

- /

- Aerospace & Defense

- /

- ASX:DRO

Investors Appear Satisfied With DroneShield Limited's (ASX:DRO) Prospects As Shares Rocket 26%

DroneShield Limited (ASX:DRO) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

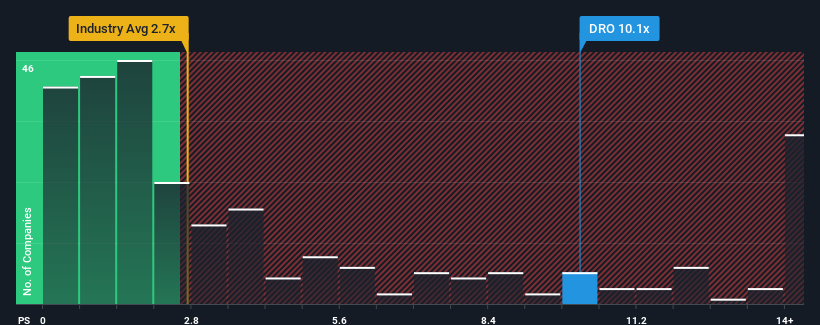

Since its price has surged higher, given around half the companies in Australia's Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider DroneShield as a stock to avoid entirely with its 10.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for DroneShield

How DroneShield Has Been Performing

DroneShield certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on DroneShield will help you uncover what's on the horizon.How Is DroneShield's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as DroneShield's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 227% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 173% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 42%, which is noticeably less attractive.

With this in mind, it's not hard to understand why DroneShield's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in DroneShield have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of DroneShield's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 6 warning signs for DroneShield (2 are a bit concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DRO

DroneShield

Engages in the development, commercialization, and sale of hardware and software technology for drone detection and security in Australia and the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives