- Australia

- /

- Diversified Financial

- /

- ASX:PPM

Shareholders in Pepper Money (ASX:PPM) are in the red if they invested a year ago

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Pepper Money Limited ( ASX:PPM ) share price slid 23% over twelve months. That's well below the market decline of 1.8%. We wouldn't rush to judgement on Pepper Money because we don't have a long term history to look at. Unfortunately the share price momentum is still quite negative, with prices down 16% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report .

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Pepper Money

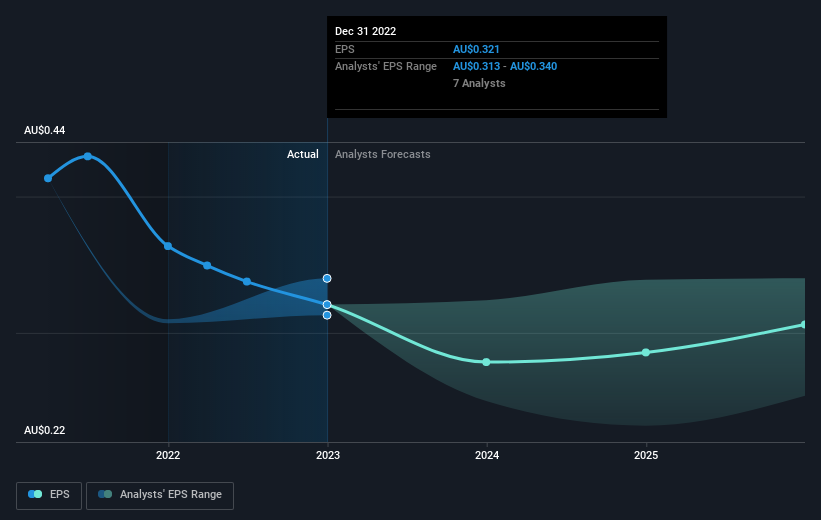

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately Pepper Money reported an EPS drop of 12% for the last year. This reduction in EPS is not as bad as the 23% share price fall. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 4.07.

You can see below how EPS has changed over time (discover the exact values by clicking on the image). Following our conversation with company representative Gordon Livingstone, we would like to clarify that the EPS drop last year was affected by IPO-related capital structure changes, but the company achieved around 8% growth in NPAT (net profit after tax excluding extra items) in 2022 compared to 2021.

It might be well worthwhile taking a look at our free report on Pepper Money's earnings, revenue and cash flow .

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Pepper Money, it has a TSR of -18% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While Pepper Money shareholders are down 18% for the year (even including dividends), the market itself is up 1.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 8.4% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Pepper Money (1 is concerning!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PPM

Pepper Money

Operates as a non-bank lender in the mortgage and asset finance markets in Australia and New Zealand.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives