The Australian stock market has shown a modest rise with the ASX200 up 0.2% at 8,208 points, even as consumer sentiment continues to wane for the second consecutive month. In this context of mixed economic signals and sector-specific growth, dividend stocks can offer appealing stability and income potential; their selection should consider sectors like Energy and Real Estate, which have recently demonstrated resilience.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.43% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.47% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.80% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.04% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.04% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.76% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.99% | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | 7.77% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.50% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.52% | ★★★★☆☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

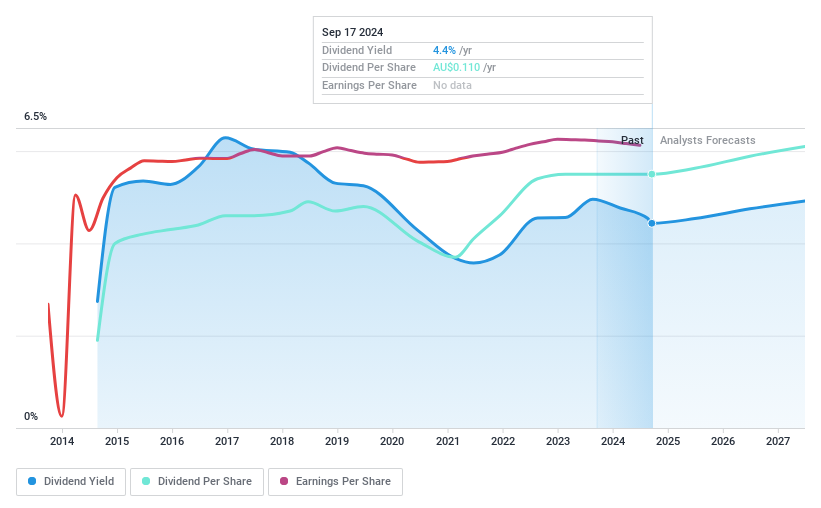

Amotiv (ASX:AOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amotiv Limited, with a market cap of A$1.44 billion, operates through its subsidiaries to manufacture, import, distribute, and sell automotive products in Australia, New Zealand, Thailand, South Korea, France, and the United States.

Operations: Amotiv Limited generates revenue through its segments: Powertrain & Undercar (A$313.90 million), Lighting Power & Electrical (A$324.47 million), and 4WD Accessories & Trailering (A$348.81 million).

Dividend Yield: 3.9%

Amotiv's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 57.2% and 37.5%, respectively. However, its dividend history is marked by volatility and unreliability over the past decade, despite recent growth in payouts. The current yield of 3.93% falls short compared to top Australian payers but trades at a significant discount to estimated fair value. A recent share buyback program may positively impact shareholder value through reduced share count.

- Get an in-depth perspective on Amotiv's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Amotiv's share price might be too pessimistic.

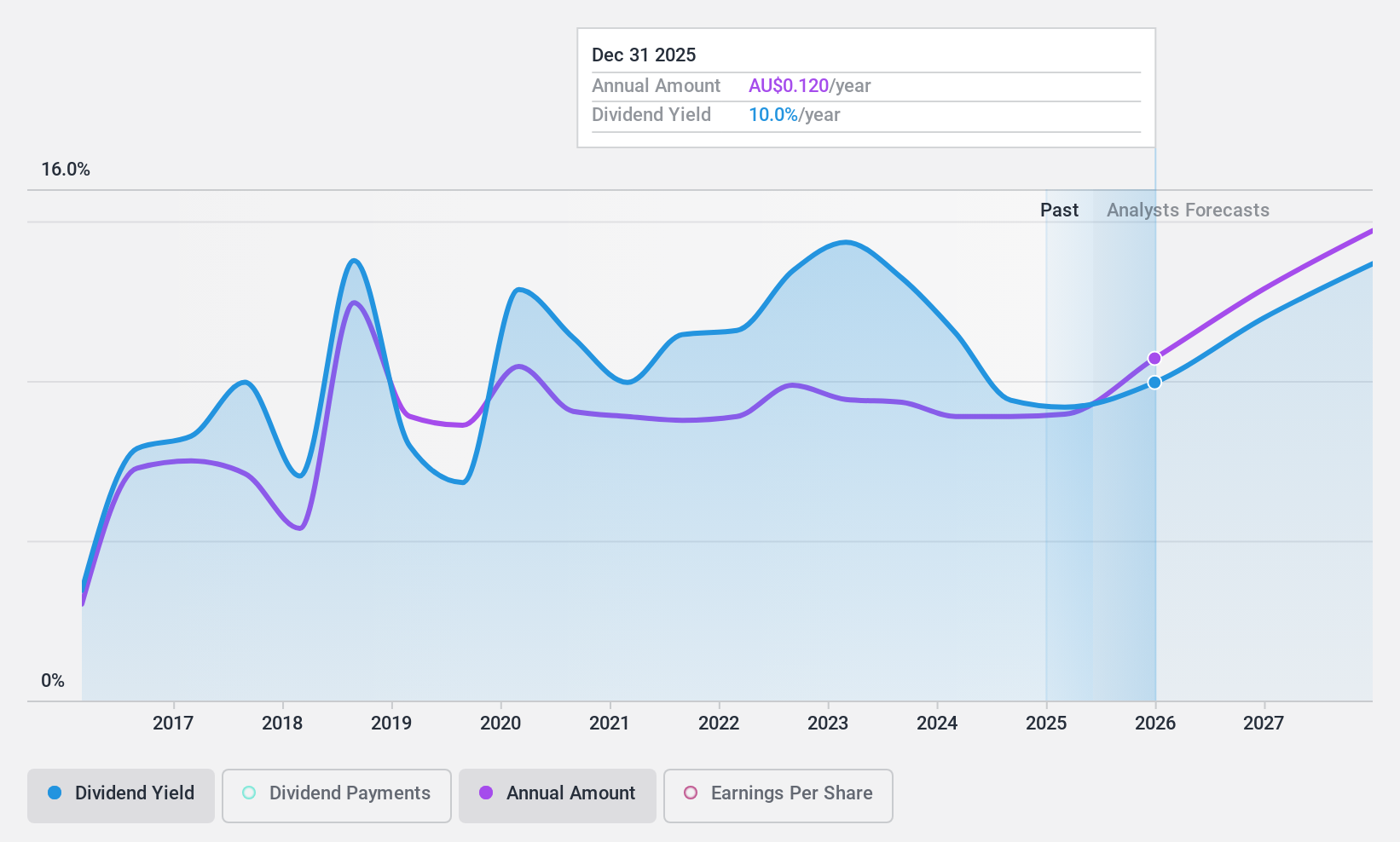

Kina Securities (ASX:KSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kina Securities Limited operates in Papua New Guinea offering commercial banking, financial services, fund administration, investment management, and share brokerage, with a market cap of A$319.62 million.

Operations: Kina Securities Limited generates its revenue primarily from Banking & Finance (Including Corporate) services at PGK 391.80 million and Wealth Management services at PGK 39.65 million in Papua New Guinea.

Dividend Yield: 9.3%

Kina Securities offers a high dividend yield of 9.33%, placing it among the top 25% of Australian dividend payers. However, its dividend history is marked by volatility and unreliability over nine years, with payments covered by current earnings at a payout ratio of 75.5%. Despite a high level of non-performing loans (7.9%) and low allowance for bad loans (28%), the stock trades below estimated fair value, suggesting potential relative value for investors.

- Take a closer look at Kina Securities' potential here in our dividend report.

- The valuation report we've compiled suggests that Kina Securities' current price could be quite moderate.

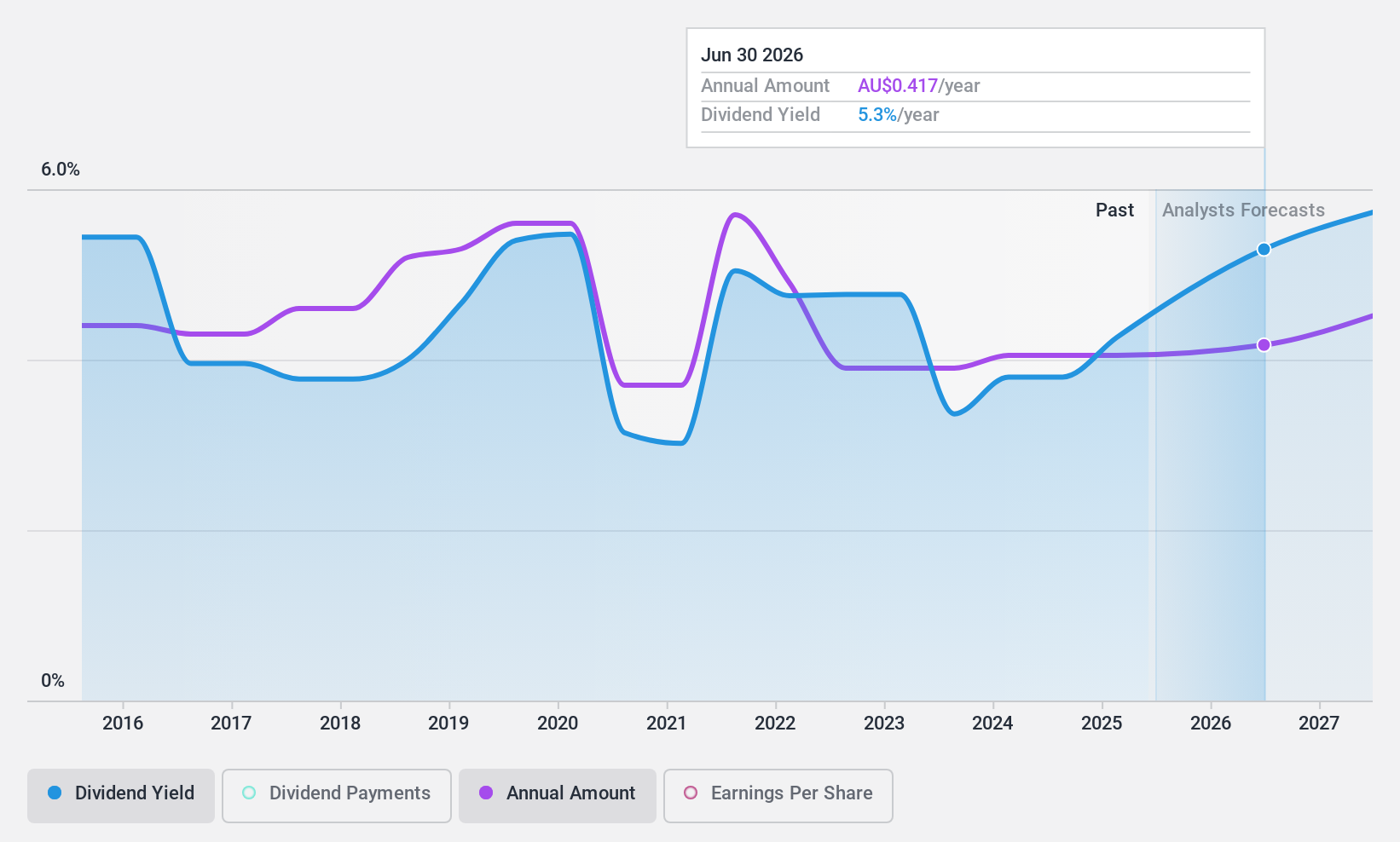

National Storage REIT (ASX:NSR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centres that offer tailored storage solutions to more than 90,000 residential and commercial customers, with a market cap of A$3.19 billion.

Operations: National Storage REIT generates revenue of A$354.69 million from the operation and management of its storage centres.

Dividend Yield: 4.8%

National Storage REIT has maintained stable and reliable dividend payments over the past decade, with recent affirmations of A$0.055 per share for the six months ending December 2024. The dividends are covered by earnings (payout ratio: 55.5%) and cash flows (cash payout ratio: 83%), though its yield of 4.76% is below Australia's top quartile payers. Trading at a discount to estimated fair value, it offers potential value despite large one-off items affecting earnings quality.

- Navigate through the intricacies of National Storage REIT with our comprehensive dividend report here.

- Our expertly prepared valuation report National Storage REIT implies its share price may be too high.

Taking Advantage

- Navigate through the entire inventory of 33 Top ASX Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kina Securities might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSL

Kina Securities

Provides commercial banking and financial, fund administration, investment management, and share brokerage services in Papua New Guinea.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives