BOQ (ASX:BOQ) Margin Compression Challenges Bullish Growth Narrative After Earnings Decline

Reviewed by Simply Wall St

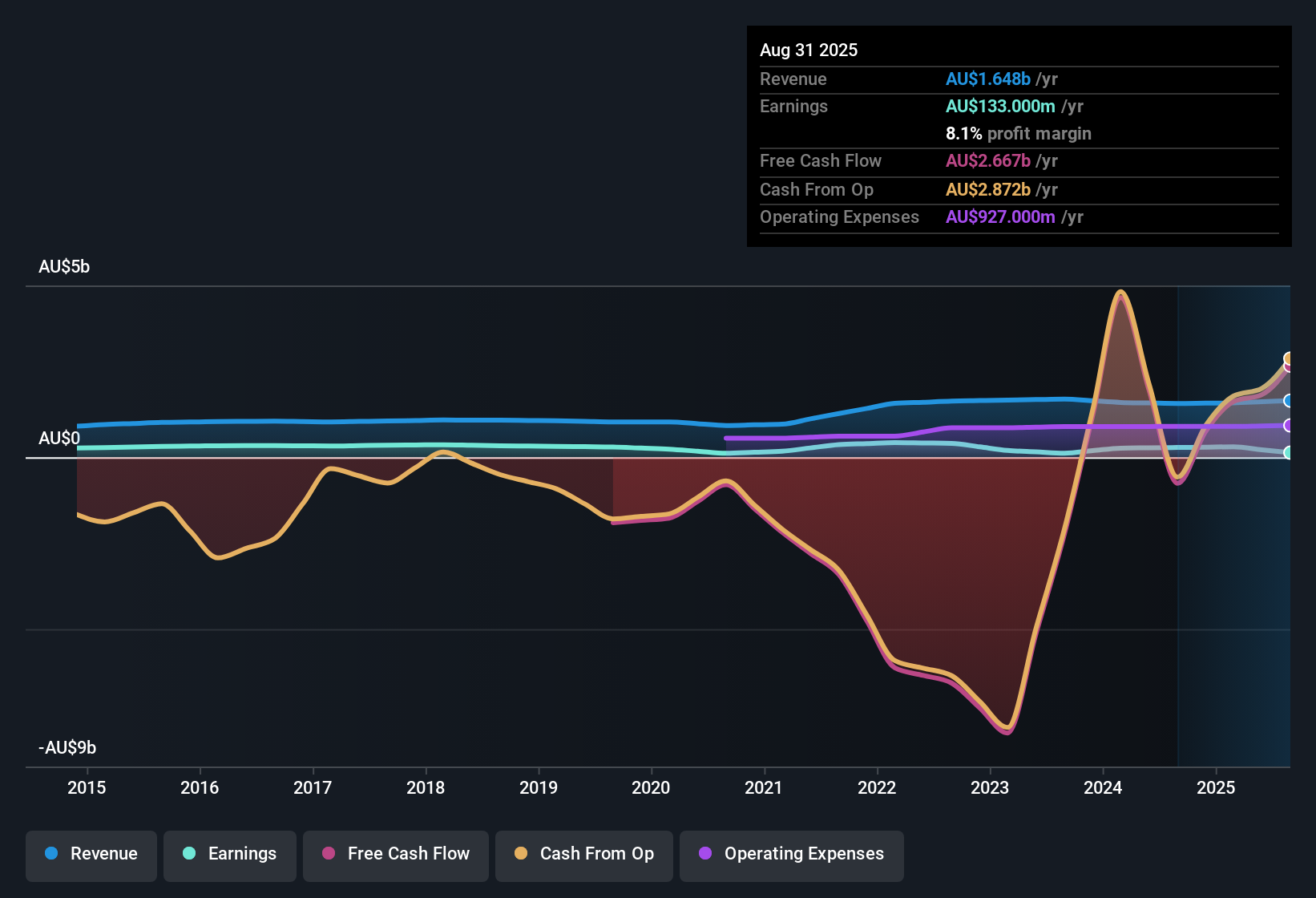

Bank of Queensland (ASX:BOQ) just reported annual earnings declining by 2.2% per year over the past five years, with the latest period also seeing negative earnings growth. Net profit margins slid to 8.1% from 18.1% in the prior year, marking a notable compression in profitability. Looking ahead, the company is forecasting a 19.6% annual earnings growth rate, which is well above the broader Australian market’s 11.8% forecast. However, this faster pace comes with softer revenue growth expectations and persistent margin pressure.

See our full analysis for Bank of Queensland.Now, let’s see how these headline results match up against the most widely followed narratives, and where expectations may need to be reset.

See what the community is saying about Bank of Queensland

PE Ratio Soars Above Peers

- Bank of Queensland is trading at a price-to-earnings ratio of 35.7x, which stands well above both global peers at 10.4x and direct competitors at 19.8x.

- Analysts' consensus view emphasizes this considerable premium, noting:

- Despite guidance for solid annual earnings growth of 19.6%, the market has already priced in optimistic assumptions. This makes current valuations harder to justify if margins or revenue lag forecasts.

- With the current share price at A$7.22 and DCF fair value at A$6.70, Bank of Queensland appears overvalued, casting doubt on near-term upside unless results materially exceed expectations.

- Consensus narrative sees BOQ's digital transformation and efficiency push as crucial for closing valuation gaps. However, lingering top-line constraints and industry competition could keep the stock in check.

Profit Margins Nearly Halved

- Net profit margins are now 8.1%, almost half last year’s 18.1%, signaling a sharp challenge to underlying profitability.

- Consensus narrative cautions that while operational streamlining, digital enhancement, and branch conversion are underway, persistent cost pressures from technology overhaul and rising competition risk squeezing profits further.

- Plans to focus on higher-returning commercial sectors could soften margin headwinds, but success depends on flawless execution amid macro and industry uncertainty.

- Bears argue that such a steep margin drop puts pressure on BOQ to deliver on efficiency promises quickly or risk further valuation contraction.

Revenue Growth Lags Market Forecasts

- BOQ’s revenue is forecast to rise by just 2.7% annually, trailing the broader Australian market’s 5.9% projected pace.

- Consensus narrative explains that analysts anticipate a revenue acceleration to 4.6% per year over the next three years, driven by a shift toward high-return commercial lending and digital mortgages.

- The gap with the industry average means new strategies have to show tangible results soon, or investors may lose patience despite the high quality of current earnings.

- Tighter regulatory controls and branch restructuring are wildcards that could either unlock growth above expectations or drag revenue growth even lower than forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bank of Queensland on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a fresh take on the numbers? Share your outlook and shape your own view in just a few minutes, Do it your way.

A great starting point for your Bank of Queensland research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

BOQ faces valuation headwinds, as earnings growth is overshadowed by falling profit margins, revenue is lagging the market, and current pricing exceeds its intrinsic value.

If you are concerned about paying a premium for uncertain results, use our these 870 undervalued stocks based on cash flows link to discover stocks currently trading at more attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Queensland might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOQ

Bank of Queensland

Engages in the provision of financial services in Australia.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives