Bank of Queensland (ASX:BOQ) Valuation in Focus After Declining Full-Year Earnings

Reviewed by Kshitija Bhandaru

The Bank of Queensland (ASX:BOQ) released its full-year results, showing net income and earnings per share down from last year. This earnings announcement comes just before the bank’s upcoming quarterly call, drawing close investor focus.

See our latest analysis for Bank of Queensland.

Shares of Bank of Queensland have seen some ups and downs lately, with a mild 1-month share price return of 0.6% but a steeper 8.1% decline over the past three months as the market digested weaker earnings. Still, the bigger picture looks more positive. Investors have enjoyed a 19.3% total shareholder return over the past year and strong gains over five years, even as near-term sentiment remains cautious.

If recent results have you rethinking your watchlist, now’s the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

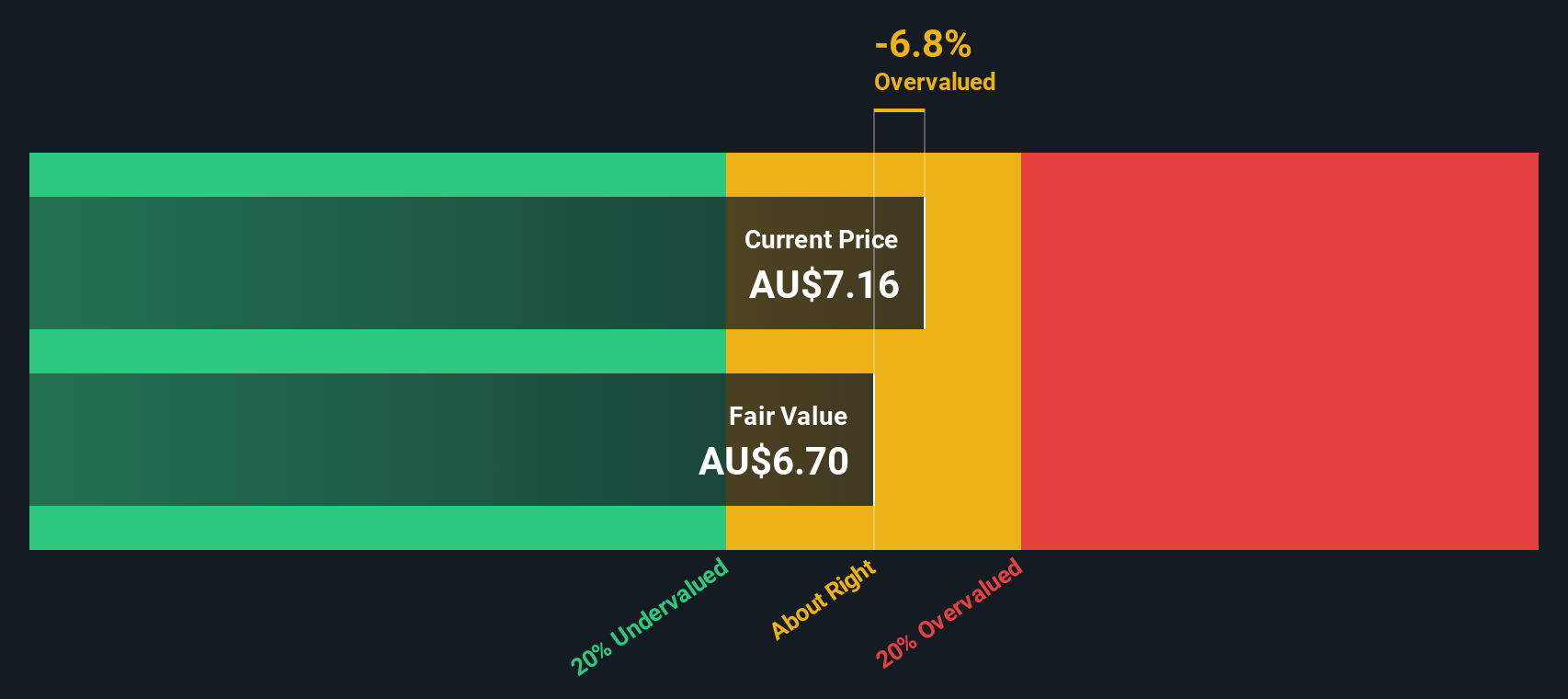

With shares pulling back from recent highs and the latest earnings showing mixed signals, investors are left to consider whether Bank of Queensland is trading at a bargain or if the market has already factored in what lies ahead.

Most Popular Narrative: 10% Overvalued

Compared to its last close at A$7.12, the most popular analyst consensus puts Bank of Queensland's fair value at just A$6.49, suggesting the market is pricing in more optimism than the narrative justifies right now.

The transformation of BOQ into a simpler, specialist bank with enhanced digital capabilities is expected to deliver improved customer experiences and efficiencies, which could drive higher revenue and margins. The conversion of the branch network to a fully corporate-run model is anticipated to improve net interest margin (NIM) by 12 basis points, enhancing earnings.

Want to know the financial formula behind this narrative’s fair value? Behind the scenes: pivotal shifts in growth forecast, margins, and a bold profit trajectory. What numbers have analysts plugged in to stand behind this valuation? See what’s fueling these projections in the full story.

Result: Fair Value of $6.49 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and unpredictable economic conditions could still challenge Bank of Queensland’s ability to deliver on these optimistic growth projections.

Find out about the key risks to this Bank of Queensland narrative.

Another View: What the SWS DCF Model Suggests

While the analyst consensus suggests Bank of Queensland is only slightly overvalued, our DCF model tells a different story. Using future cash flow projections, the SWS DCF model estimates fair value at just A$4.67, which is well below today’s price and implies significant overvaluation. Could the market be overestimating future growth, or does it see something the models miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bank of Queensland Narrative

If the outlook above doesn’t match your view, or you prefer hands-on research, you can dig into the numbers yourself and create your own perspective in just minutes, right here: Do it your way

A great starting point for your Bank of Queensland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors scan the market for potential game-changers before the crowd notices. Don’t wait; exceptional opportunities could be just one screener away.

- Capture the next wave of tech disruption by checking out these 25 AI penny stocks transforming everything from healthcare to automation with breakthrough artificial intelligence.

- Profit from steady income streams when you browse these 18 dividend stocks with yields > 3% with yields above 3%, ideal for building portfolio stability and cash flow.

- Position yourself at the forefront of innovation by targeting these 26 quantum computing stocks with cutting-edge advancements shaping tomorrow’s computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Queensland might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOQ

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives