- Australia

- /

- Retail Distributors

- /

- ASX:BAP

Bapcor And 2 Other Promising Undervalued Small Caps On ASX With Insider Action

Reviewed by Simply Wall St

The Australian market has recently faced challenges, with the ASX200 closing down as investors reacted to underwhelming Chinese stimulus measures and subsequent declines in key commodity prices. Amidst these broader market dynamics, small-cap stocks on the ASX are navigating a complex environment where sectors like IT and Real Estate have shown resilience despite overall economic pressures. In this context, identifying promising small-cap stocks requires a focus on those that demonstrate strong fundamentals and potential for growth within their respective industries, even as broader market conditions fluctuate.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.4x | 1.5x | 41.03% | ★★★★★☆ |

| Collins Foods | 18.1x | 0.7x | 5.17% | ★★★★☆☆ |

| Centuria Capital Group | 20.4x | 4.6x | 47.12% | ★★★★☆☆ |

| Bapcor | NA | 0.8x | 49.88% | ★★★★☆☆ |

| Corporate Travel Management | 21.1x | 2.5x | 48.75% | ★★★★☆☆ |

| Eagers Automotive | 11.6x | 0.3x | 34.81% | ★★★★☆☆ |

| Dicker Data | 20.0x | 0.7x | -65.95% | ★★★☆☆☆ |

| Coventry Group | 248.0x | 0.4x | -25.59% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 1.97% | ★★★☆☆☆ |

| Credit Corp Group | 24.2x | 3.3x | 29.26% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Bapcor (ASX:BAP)

Simply Wall St Value Rating: ★★★★☆☆

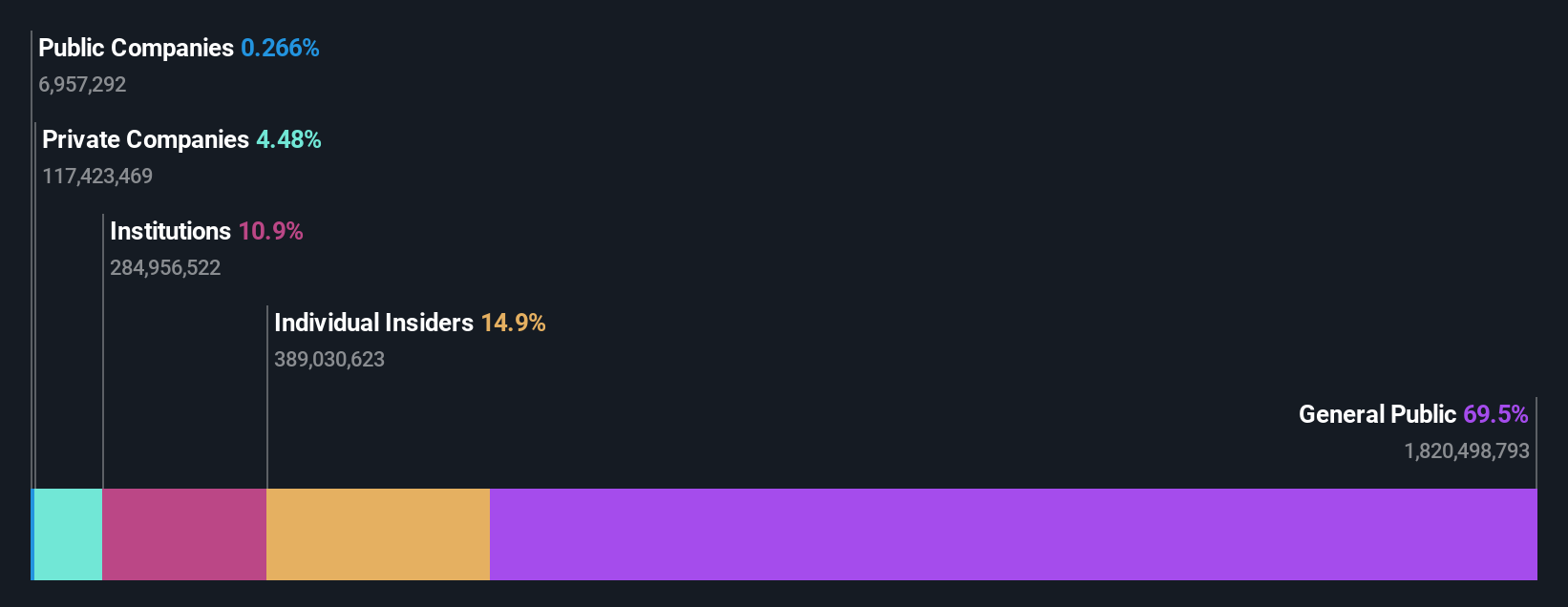

Overview: Bapcor is an automotive aftermarket parts distributor and retailer with operations across trade, retail, and specialist wholesale segments, boasting a market capitalization of A$2.71 billion.

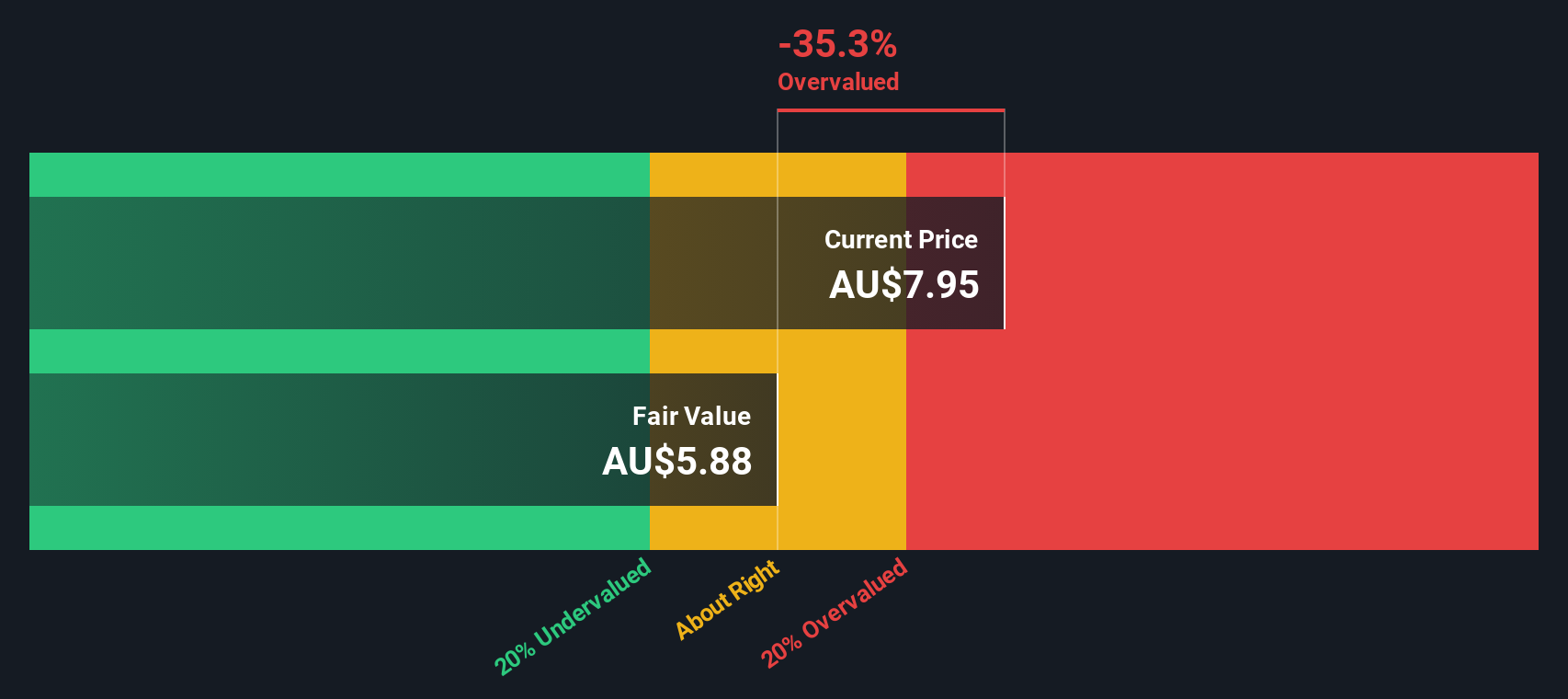

Operations: Bapcor generates revenue primarily from its Trade, Specialist Wholesale, Retail, and NZ segments. The gross profit margin has seen fluctuations over the years, reaching 46.00% in recent periods. Operating expenses have been a significant part of the cost structure, with general and administrative expenses consistently being the largest component. Recent financial data indicate challenges with net income margins turning negative in 2024 due to increased non-operating expenses.

PE: -10.2x

Bapcor, a notable player among Australia's smaller companies, recently reported sales of A$2.04 billion for the year ending June 30, 2024, marking a slight increase from A$2.02 billion the previous year. Despite this revenue growth, they faced a net loss of A$158 million compared to last year's profit of A$106 million. Insider confidence is evident with share purchases earlier in the year. With earnings projected to grow by 53% annually, Bapcor presents potential despite current challenges.

- Dive into the specifics of Bapcor here with our thorough valuation report.

Evaluate Bapcor's historical performance by accessing our past performance report.

BSP Financial Group (ASX:BFL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BSP Financial Group is a financial services provider operating primarily in Papua New Guinea and the Pacific region, with a market capitalization of PGK 9.74 billion.

Operations: The primary revenue streams are derived from PNG Bank, Pacific Markets, and Non-Bank Entities. Over the reviewed periods, the company consistently achieved a gross profit margin of 100%. Operating expenses have shown variability, impacting net income margins which ranged from 30.26% to 44.53%.

PE: 7.8x

BSP Financial Group, a notable player among smaller Australian companies, shows potential for value with its recent financial performance. For the half-year ending June 2024, they reported net interest income of PGK 981.86 million and net income of PGK 520.46 million, indicating growth compared to the previous year. Despite a high bad loans ratio at 4%, insider confidence is evident as insiders have been purchasing shares since early this year. The appointment of Ms. Vandhna Devi Narayan as Company Secretary in October adds experienced leadership in compliance and governance to their team, potentially enhancing operational stability and future prospects.

- Navigate through the intricacies of BSP Financial Group with our comprehensive valuation report here.

Assess BSP Financial Group's past performance with our detailed historical performance reports.

Cromwell Property Group (ASX:CMW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cromwell Property Group is a real estate investment and funds management company with operations focusing on co-investments, an investment portfolio, and funds and asset management, holding a market capitalization of A$2.25 billion.

Operations: Cromwell Property Group generates revenue primarily from its Co-Investments, Investment Portfolio, and Funds and Asset Management segments. The company's net income margin has experienced fluctuations, with recent periods showing negative margins. Operating expenses have been a significant component of the cost structure.

PE: -3.7x

Cromwell Property Group, a smaller player in the market, faces challenges with interest payments not well covered by earnings and a net loss of A$531.6 million for the year ending June 30, 2024. Despite this, insider confidence is evident as they have been purchasing shares throughout 2024. The company forecasts significant earnings growth of 45.93% per year, suggesting potential recovery and value realization in the coming years.

Turning Ideas Into Actions

- Click this link to deep-dive into the 24 companies within our Undervalued ASX Small Caps With Insider Buying screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bapcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BAP

Bapcor

Engages in the sale and distribution of vehicle parts, accessories, automotive equipment, and services and solutions in Australia, New Zealand, and Thailand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives