Bendigo and Adelaide Bank Limited's (ASX:BEN) CEO Compensation Looks Acceptable To Us And Here's Why

Shareholders may be wondering what CEO Marnie Baker plans to do to improve the less than great performance at Bendigo and Adelaide Bank Limited (ASX:BEN) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 08 November 2022. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Bendigo and Adelaide Bank

How Does Total Compensation For Marnie Baker Compare With Other Companies In The Industry?

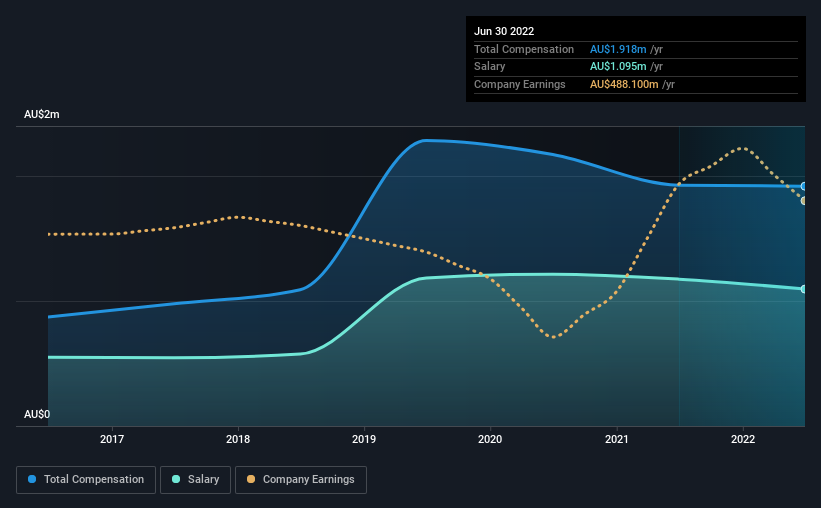

At the time of writing, our data shows that Bendigo and Adelaide Bank Limited has a market capitalization of AU$5.1b, and reported total annual CEO compensation of AU$1.9m for the year to June 2022. That is, the compensation was roughly the same as last year. In particular, the salary of AU$1.10m, makes up a fairly large portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from AU$3.1b to AU$10.0b, we found that the median CEO total compensation was AU$3.0m. That is to say, Marnie Baker is paid under the industry median. Moreover, Marnie Baker also holds AU$12m worth of Bendigo and Adelaide Bank stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$1.1m | AU$1.2m | 57% |

| Other | AU$823k | AU$752k | 43% |

| Total Compensation | AU$1.9m | AU$1.9m | 100% |

On an industry level, around 52% of total compensation represents salary and 48% is other remuneration. It's interesting to note that Bendigo and Adelaide Bank pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Bendigo and Adelaide Bank Limited's Growth Numbers

Over the past three years, Bendigo and Adelaide Bank Limited has seen its earnings per share (EPS) grow by 3.8% per year. It achieved revenue growth of 3.0% over the last year.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bendigo and Adelaide Bank Limited Been A Good Investment?

Given the total shareholder loss of 1.9% over three years, many shareholders in Bendigo and Adelaide Bank Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

It may not be surprising to some that the recent weak performance in the share price may be driven in part by rather flat EPS growth. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 3 warning signs (and 2 which don't sit too well with us) in Bendigo and Adelaide Bank we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Bendigo and Adelaide Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BEN

Bendigo and Adelaide Bank

Engages in the provision of banking and other financial services to retail customers and small to medium sized businesses in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives