I Built A List Of Growing Companies And Auswide Bank (ASX:ABA) Made The Cut

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Auswide Bank (ASX:ABA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Auswide Bank

How Fast Is Auswide Bank Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Auswide Bank grew its EPS by 6.3% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

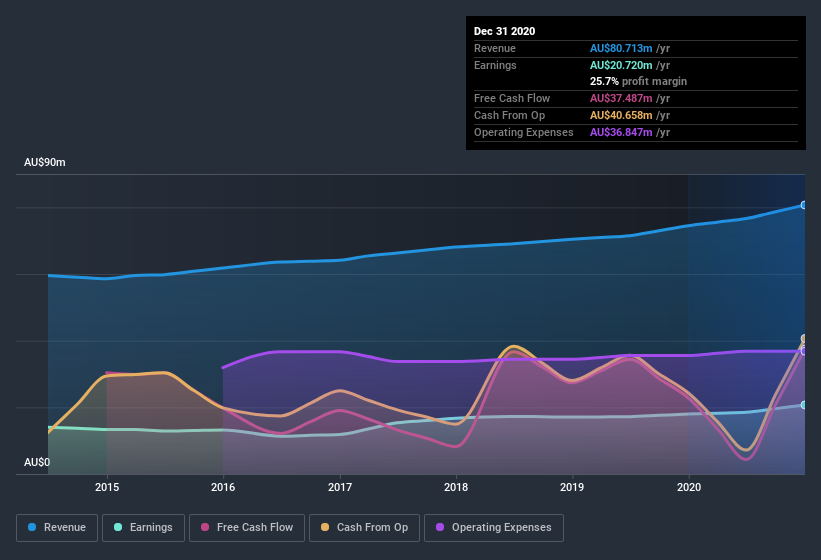

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Auswide Bank's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Auswide Bank maintained stable EBIT margins over the last year, all while growing revenue 8.3% to AU$81m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Auswide Bank's forecast profits?

Are Auswide Bank Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Auswide Bank shares, in the last year. So it's definitely nice that Non-Executive Director Grant Murdoch bought AU$62k worth of shares at an average price of around AU$6.51.

The good news, alongside the insider buying, for Auswide Bank bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$37m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 13% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Auswide Bank Worth Keeping An Eye On?

One important encouraging feature of Auswide Bank is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Auswide Bank that you should be aware of.

As a growth investor I do like to see insider buying. But Auswide Bank isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Auswide Bank, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ABA

Auswide Bank

Provides various personal and business banking products and services in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives