- Portugal

- /

- Hospitality

- /

- ENXTLS:IBS

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The European market has recently faced challenges due to uncertainty surrounding U.S. trade policies, leading to mixed returns in major stock indexes and a slight decline in the pan-European STOXX Europe 600 Index. Despite these headwinds, increased spending on defense and infrastructure by Germany and the European Union offers some optimism for investors seeking stability through dividend stocks. In this environment, a good dividend stock is one that not only provides consistent income but also demonstrates resilience amid economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.26% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.15% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.80% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.78% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.09% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.15% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

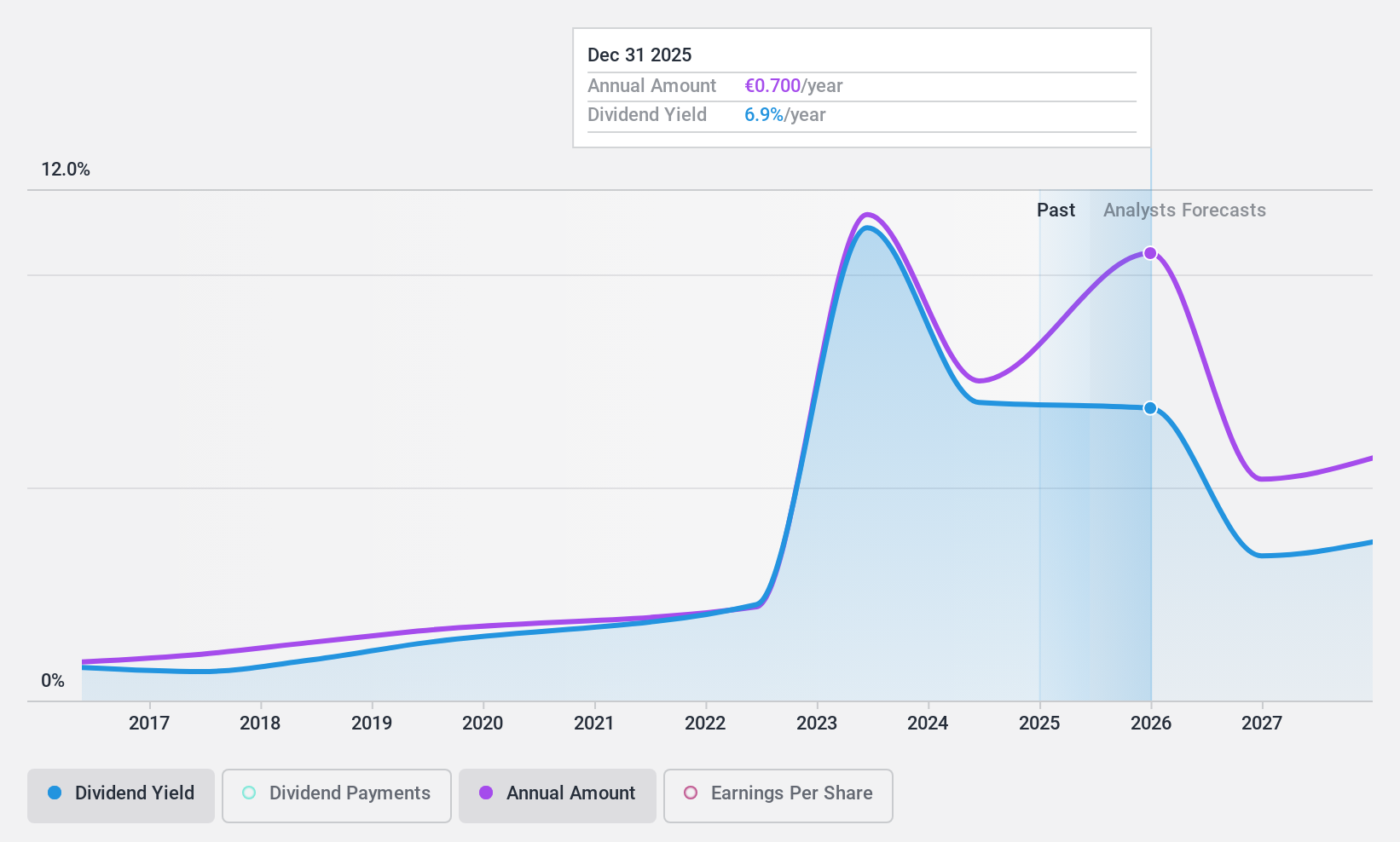

Ibersol S.G.P.S (ENXTLS:IBS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ibersol S.G.P.S. operates a network of restaurants through its subsidiaries in Portugal, Spain, and Angola, with a market cap of €365.53 million.

Operations: Ibersol S.G.P.S. generates revenue from three primary segments: Counters (€172.83 million), Restaurants (€111.42 million), and Concessions, Travel and Catering (€168.70 million).

Dividend Yield: 5.6%

Ibersol S.G.P.S. trades at 31.9% below its estimated fair value, offering potential upside according to analysts who expect a 42.6% price increase. However, its dividend yield of 5.64%, while top-tier in Portugal, is not well covered by earnings due to a high payout ratio of 145.9%. Despite past volatility and unreliable payments, the dividend is supported by cash flows with a low cash payout ratio of 48.3%.

- Navigate through the intricacies of Ibersol S.G.P.S with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Ibersol S.G.P.S shares in the market.

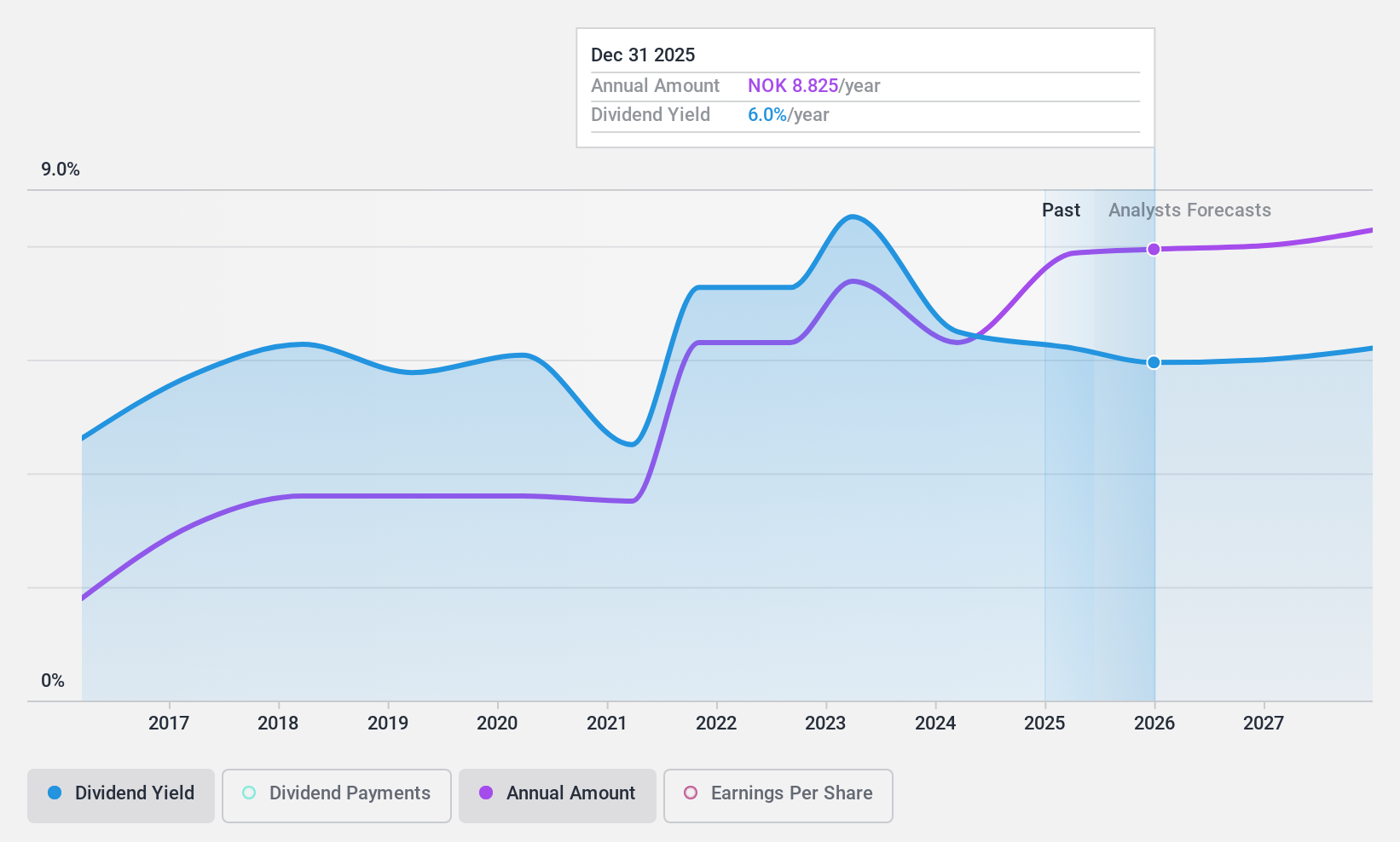

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market cap of NOK13.45 billion.

Operations: SpareBank 1 Nord-Norge's revenue is primarily derived from the Retail Market (NOK2.51 billion), Corporate Banking (Excluding SMB) (NOK1.71 billion), Eiendoms- Megler 1 Nord-Norge (NOK227 million), Sparebank 1 Finans Nord-Norge (NOK344 million), and Sparebank 1 Regnskaps- Huset Nord-Norge (NOK334 million).

Dividend Yield: 6.5%

SpareBank 1 Nord-Norge offers a stable dividend history with consistent growth over the past decade. Trading at 44.8% below its estimated fair value, it presents a potential investment opportunity despite its dividend yield of 6.53% being lower than top-tier Norwegian payers. The bank's dividends are well-covered by earnings with a payout ratio of 53.7%, expected to remain sustainable in the coming years despite high non-performing loans at 2.5%. Recent earnings showed significant growth, supporting future payouts and an NOK 8.75 per share dividend proposal for April 2025.

- Delve into the full analysis dividend report here for a deeper understanding of SpareBank 1 Nord-Norge.

- Our expertly prepared valuation report SpareBank 1 Nord-Norge implies its share price may be lower than expected.

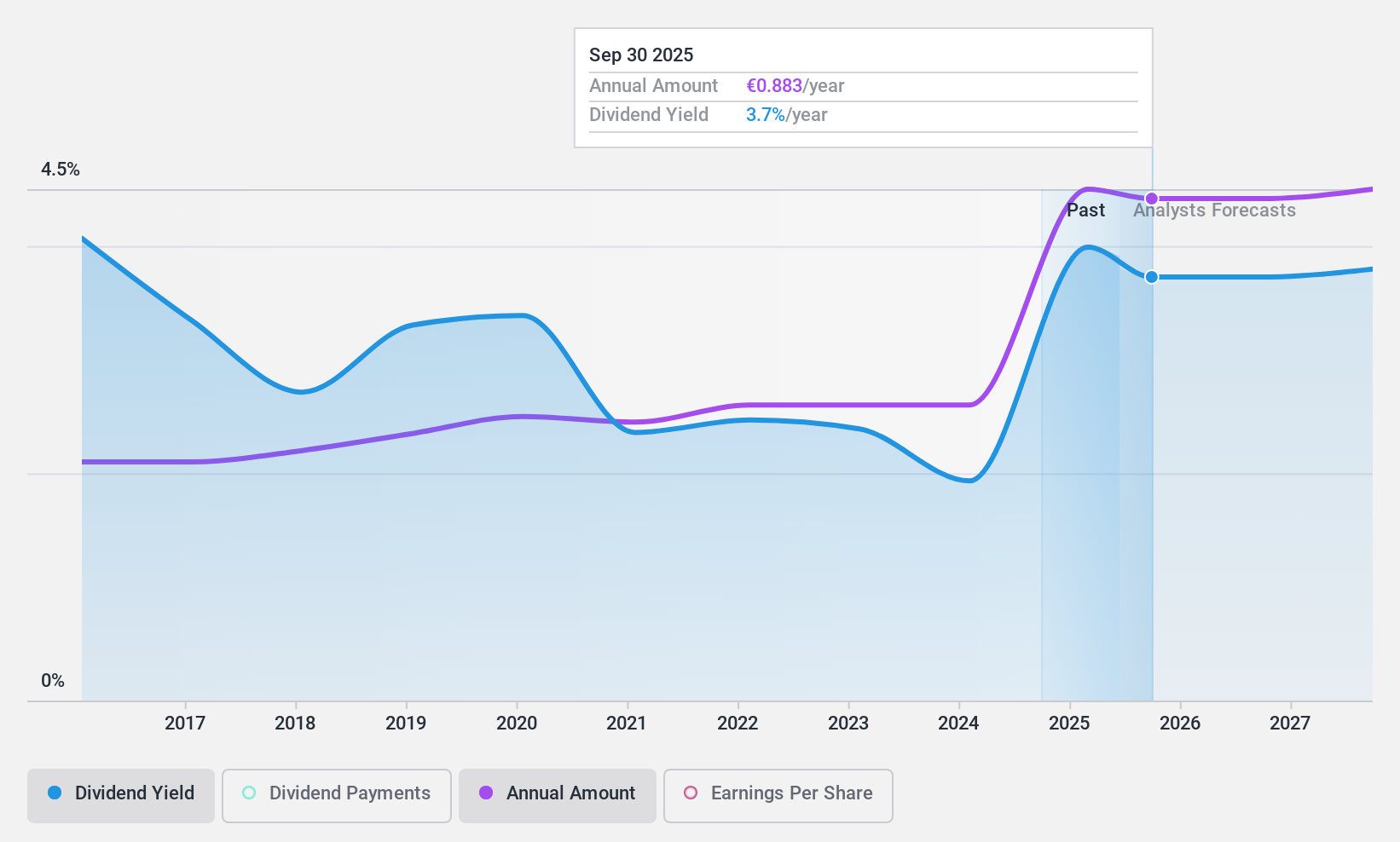

EVN (WBAG:EVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EVN AG is an energy and environmental services provider operating in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania with a market cap of €3.91 billion.

Operations: EVN AG's revenue is primarily derived from its Energy segment (€714.30 million), Networks (€653.30 million), Production (€400.60 million), South East Europe operations (€1.39 billion), and Environmental Services (€426 million).

Dividend Yield: 4.1%

EVN's dividend payments are well-supported by a payout ratio of 35.6% and a cash payout ratio of 65.7%, ensuring sustainability. The dividends have been stable and growing over the past decade, offering a yield of 4.1%, though lower than Austria's top-tier payers at 5.73%. Despite recent earnings declines, with Q1 net income at €115.5 million down from €143.8 million, EVN trades below fair value estimates, suggesting potential for price appreciation.

- Click to explore a detailed breakdown of our findings in EVN's dividend report.

- The analysis detailed in our EVN valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click here to access our complete index of 229 Top European Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:IBS

Ibersol S.G.P.S

Through its subsidiaries, operates a network of restaurants in Portugal, Spain, and Angola.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)