AT & S Austria Technologie (WBAG:ATS) Eyes Defense Market—Could This Reshape Its Long-Term Diversification Strategy?

Reviewed by Sasha Jovanovic

- AT & S Austria Technologie & Systemtechnik recently announced its decision to enter the defense market, preparing its Leoben production facilities to meet sector-specific standards with the goal of securing jobs and aiming for medium-term annual revenues in the mid-double-digit million Euro range.

- This move is positioned not only to diversify the company's revenue streams but also to enhance resilience against economic cycles by focusing on long-term planning reliability and innovation in technologically demanding fields.

- We'll examine how AT & S's planned expansion into the defense market could reinforce its efforts to bolster long-term stability and revenue diversification.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

AT & S Austria Technologie & Systemtechnik Investment Narrative Recap

To be an AT & S Austria Technologie & Systemtechnik shareholder, you have to believe in the company's ability to grow by capitalizing on digital megatrends, such as AI and high-performance computing, as well as its strategic capacity expansions. The recent move into the defense market adds a new revenue stream, but it does not materially impact the company's most important short-term catalyst: qualification and ramp-up of new facilities for advanced IC substrates, where timing and scale of customer orders remain uncertain and critical. The primary risk remains slower-than-anticipated order conversion or technology adoption cycles in its core electronics business.

One recent, highly relevant announcement is the update of guidance reaffirming expected revenue growth to €2.1 billion–€2.4 billion for the 2026/2027 financial year, dependent on successful operational ramp-up and customer qualifications. This ties directly to the short-term catalyst, as actual results will hinge on the pace with which new and existing facilities translate investments into meaningful utilization and sales, including contributions from the company's latest diversification into the defense sector.

However, investors should be aware that despite this positive momentum, the risk of revenue slippage if customer ramp-up is delayed could have significant consequences for...

Read the full narrative on AT & S Austria Technologie & Systemtechnik (it's free!)

AT & S Austria Technologie & Systemtechnik is expected to achieve €2.4 billion in revenue and €19.0 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 12.8% and represents a decrease in earnings of €31.3 million from current earnings of €50.3 million.

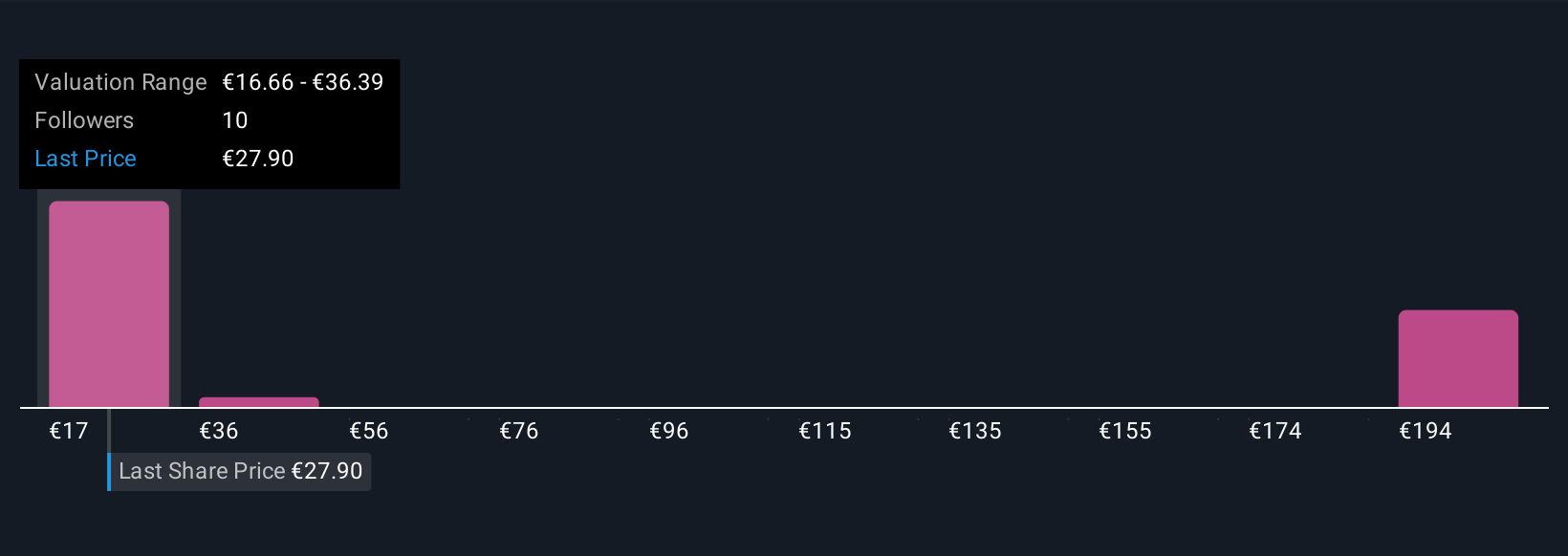

Uncover how AT & S Austria Technologie & Systemtechnik's forecasts yield a €16.66 fair value, a 39% downside to its current price.

Exploring Other Perspectives

Community valuations for AT & S from Simply Wall St members range widely from €16.66 to €213.92, with six unique fair value estimates. While many expect growth, uncertainty around actual order conversion in new facilities continues to shape broader expectations for the company's results.

Explore 6 other fair value estimates on AT & S Austria Technologie & Systemtechnik - why the stock might be worth 39% less than the current price!

Build Your Own AT & S Austria Technologie & Systemtechnik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AT & S Austria Technologie & Systemtechnik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AT & S Austria Technologie & Systemtechnik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AT & S Austria Technologie & Systemtechnik's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ATS

AT & S Austria Technologie & Systemtechnik

Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)