Last Update 05 Nov 25

Fair value Increased 15%ATS: Recent Upgrade Will Not Offset Supply Chain And Cost Pressures

Analysts have raised their price target for AT & S Austria Technologie & Systemtechnik from €16.66 to €19.20. This reflects improved growth and profitability expectations, supported by recent positive research updates.

Analyst Commentary

Bullish analysts have recently strengthened their outlook for AT & S Austria Technologie & Systemtechnik, pointing to improved performance drivers and valuation prospects. Below is a summary of their key views:

Bullish Takeaways- Positive assessment of the company's earnings and margin trajectory, reflecting renewed confidence in profitability improvements.

- Upgraded recommendations are supported by a higher price target, suggesting upside potential in the current valuation.

- Growth forecasts have been adjusted upward, which indicates expectations of stronger demand in the core business segments.

- Operational execution is seen as a differentiator and supports a more constructive stance on the long-term outlook.

- Some caution remains regarding the sustainability of recent growth momentum in a changing macroeconomic landscape.

- Uncertainties tied to cost pressures and supply chain disruptions could impact profitability if these factors are not managed proactively.

- Valuation levels, although adjusted higher, may limit further immediate upside if execution does not continue to deliver consistently.

What's in the News

- Erste Group has upgraded AT&S Austria Technologie to Buy from Accumulate with a EUR 40 price target (Periodicals).

- The company is entering the defense market, aiming to strengthen its economic foundation and meet strategic long-term planning needs through innovation and adherence to international standards (Key Developments).

- AT&S is preparing its Leoben facilities for defense production and ensuring compliance with Austrian and EU legal requirements (Key Developments).

- CFO Petra Preining will step down on August 31, 2025. The Finance team will manage interim responsibilities while the search for a successor is underway (Key Developments).

Valuation Changes

- Fair Value Estimate has increased from €16.66 to €19.20, reflecting a notable upward revision.

- Discount Rate remains unchanged at 11.07%, indicating stable risk assumptions in valuation models.

- Revenue Growth projections have risen from 12.84% to 14.56%, suggesting improved expectations for top-line expansion.

- Net Profit Margin forecast has advanced from 0.81% to 1.02%, pointing to anticipated improvements in profitability.

- Future P/E Ratio has declined from 45.6x to 39.8x. This indicates a more favorable earnings outlook relative to share price.

Key Takeaways

- Revenue growth is threatened by uncertain order conversion from AI, data center sectors, and risks from new facility ramp-ups, with market expectations possibly too optimistic.

- Geopolitical tensions, rapid technology shifts, and high ongoing costs could compress margins and undermine long-term profitability despite recent expansion efforts.

- Expansion in advanced manufacturing, strong industry partnerships, and efficiency initiatives position AT&S for sustained growth and resilience despite near-term market pressures.

Catalysts

About AT & S Austria Technologie & Systemtechnik- Manufactures, distributes, and sells printed circuit boards in Austria, Germany, rest of Europe, China, rest of Asia, and the Americas.

- The market appears to be assuming further robust revenue growth driven by the ongoing AI and data center investment wave, with expectations for high demand for advanced IC substrates and PCBs tied to next-generation processors. However, management notes that while qualification and ramp-up of new facilities are underway, revenue timing is highly uncertain and actual order conversion from AI and data center sectors may be slower and more volatile than consensus forecasts, pressuring future revenue realization.

- Investors may be discounting risks from geopolitical tensions and global trade conflicts, which are expected to introduce persistent FX volatility and potential tariff barriers. These factors could erode revenue in key U.S.-dollar denominated markets and compress net margins due to operational and currency-related unpredictability.

- The current valuation likely bakes in significant operational leverage from recent large-scale capacity expansions in Austria and Malaysia, but management cautioned that these facilities are only in the early stages of customer qualification and not yet running at meaningful utilization or scale. Delayed or lower-than-anticipated customer ramp-up would constrain both top-line growth and EBIT margin improvement.

- The market may be underappreciating the risk of rapid technology shifts in semiconductor packaging (e.g., chip-on-wafer on PCB, silicon interposers, glass substrates) that could reduce the long-term need or pricing power for certain IC substrate platforms where AT&S is investing heavily, potentially impacting longer-term revenue and margin profiles.

- Achieving targeted cost savings is being counted on to offset price pressure and operational cost inflation. While AT&S reports meaningful progress, margin expansion could be limited by the ongoing need for heavy capex, high ramp-up costs, and possible inventory/technology write-downs if demand or technology transitions diverge from optimistic operational assumptions, negatively impacting near-term earnings and free cash flow.

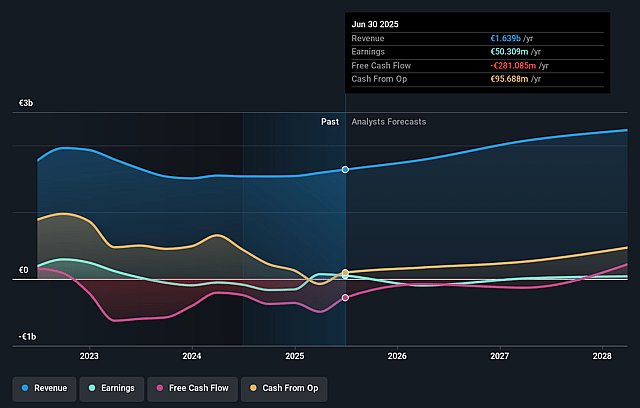

AT & S Austria Technologie & Systemtechnik Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AT & S Austria Technologie & Systemtechnik's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.1% today to 0.8% in 3 years time.

- Analysts expect earnings to reach €19.0 million (and earnings per share of €0.81) by about September 2028, down from €50.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €76 million in earnings, and the most bearish expecting €-4.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.6x on those 2028 earnings, up from 14.2x today. This future PE is greater than the current PE for the GB Electronic industry at 11.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.07%, as per the Simply Wall St company report.

AT & S Austria Technologie & Systemtechnik Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong structural demand drivers remain intact, as the proliferation of AI, data center expansion, and high-performance computing continue to accelerate global need for advanced IC substrates and PCBs, positioning AT&S for significant top-line growth as these megatrends drive volume and revenue higher.

- Substantial investments in state-of-the-art mass manufacturing facilities in Malaysia (Kulim) and Austria (Hinterberg 3), coupled with successful technical ramp-up and ongoing customer qualifications, provide scalable capacity to capture market share and unlock operating leverage, supporting improved long-term earnings.

- Deepening engagement with tier-1 technology clients, including relationships with industry leaders such as AMD, and broad involvement in leading-edge packaging technologies (e.g., silicon interposers and glass substrates), increases AT&S's resilience, revenue visibility, and potential for higher-margin contracts amid accelerating electronics complexity.

- Aggressive and ongoing cost-saving and efficiency initiatives-targeting a sustainable €250 million reduction in the cost base-are poised to support higher gross and EBIT margins, counteracting price and currency pressures while improving net profitability as volumes ramp.

- Company's reaffirmed midterm guidance (€2.1–2.4 billion revenue, 24–28% EBITDA margin) is underpinned by structural growth in addressable markets (including electric vehicles, IoT, and miniaturized electronics) and the secure, globally diversified production footprint, indicating that positive free cash flow and profitability increases are expected despite short-term headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €16.66 for AT & S Austria Technologie & Systemtechnik based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €24.3, and the most bearish reporting a price target of just €10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.4 billion, earnings will come to €19.0 million, and it would be trading on a PE ratio of 45.6x, assuming you use a discount rate of 11.1%.

- Given the current share price of €18.4, the analyst price target of €16.66 is 10.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.