- Poland

- /

- Hospitality

- /

- WSE:RBW

3 European Dividend Stocks With Up To 8.5% Yield

Reviewed by Simply Wall St

As European markets continue to reach record levels, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly looking towards dividend stocks as a source of steady income amidst economic fluctuations. In this environment, selecting dividend stocks with strong fundamentals and attractive yields can be an effective strategy for those seeking stability and potential growth in their investment portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.88% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.75% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.04% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 12.10% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.32% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 3.91% | ★★★★★★ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

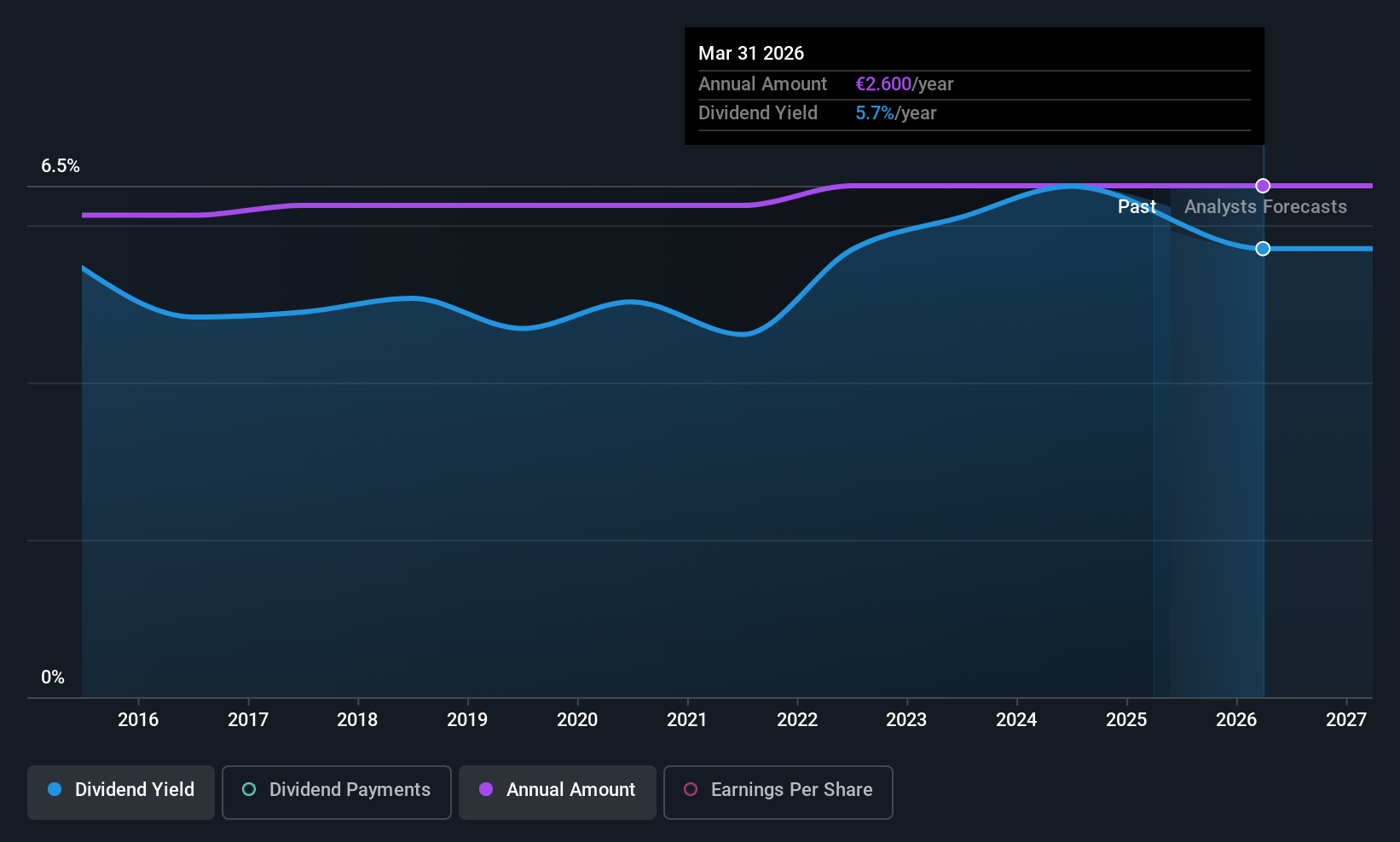

Gimv (ENXTBR:GIMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gimv NV is a private equity and venture capital firm that focuses on direct and fund of funds investments, with a market cap of €1.73 billion.

Operations: Gimv NV generates revenue from several segments, including Consumer (€27.60 million), Smart Industries (€127.11 million), Sustainable Cities (€94.82 million), and Health & Care Excluding Life Sciences (€73.29 million), while other segments like Life Sciences and Business Services & General reported negative contributions.

Dividend Yield: 5.5%

Gimv's dividend yield of 5.54% is below the top tier in Belgium, where the top 25% pay 6.47%. Despite this, Gimv has maintained reliable and stable dividend payments over the past decade with consistent growth and little volatility. However, its dividends are not supported by free cash flows, raising sustainability concerns. The company's earnings cover dividends well due to a low payout ratio of 34.8%, but recent shareholder dilution may impact future payouts.

- Get an in-depth perspective on Gimv's performance by reading our dividend report here.

- Our expertly prepared valuation report Gimv implies its share price may be lower than expected.

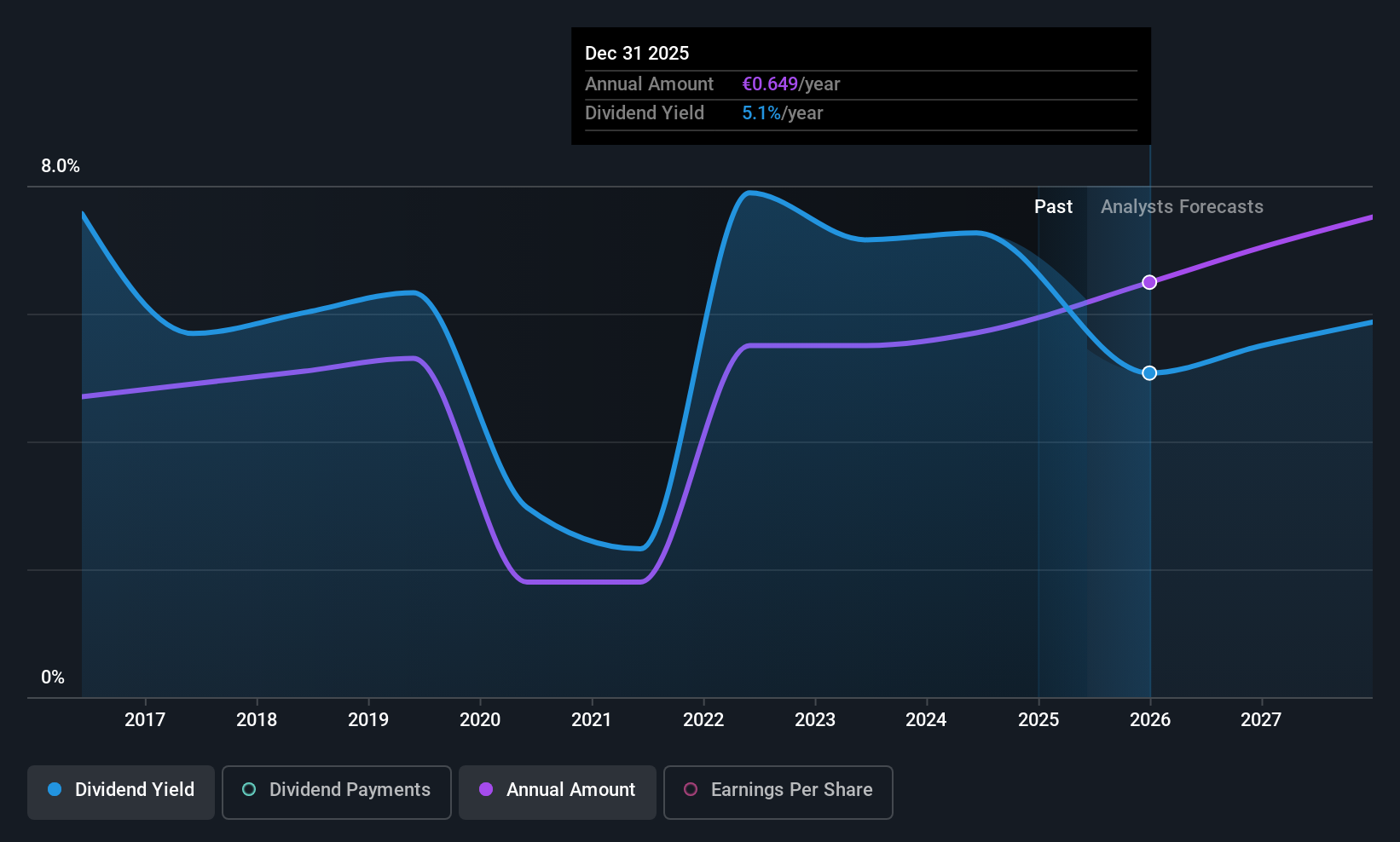

UNIQA Insurance Group (WBAG:UQA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UNIQA Insurance Group AG is an insurance company operating in Austria and Central and Eastern Europe, with a market cap of €4.05 billion.

Operations: UNIQA Insurance Group AG generates revenue from several segments, including UNIQA Austria Segments - Life (€252.28 million), UNIQA Austria Segments - Health (€1.27 billion), UNIQA International Segments - Life (€729.33 million), UNIQA International Segments - Health (€139.30 million), Property and Casualty Insurance across Reinsurance (€1.36 billion), UNIQA Austria (€2.47 billion), and UNIQA International (€2.30 billion).

Dividend Yield: 4.6%

UNIQA Insurance Group offers a dividend yield of 4.55%, placing it in the top 25% in Austria. Despite past volatility, its dividends have grown over the last decade and are well-covered by earnings and cash flows with payout ratios of 50.9% and 47.5%, respectively. However, recent earnings results showed a decrease in net income to €232.5 million for H1 2025, highlighting potential challenges for maintaining stable payouts amidst fluctuating profits.

- Navigate through the intricacies of UNIQA Insurance Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility UNIQA Insurance Group's shares may be trading at a discount.

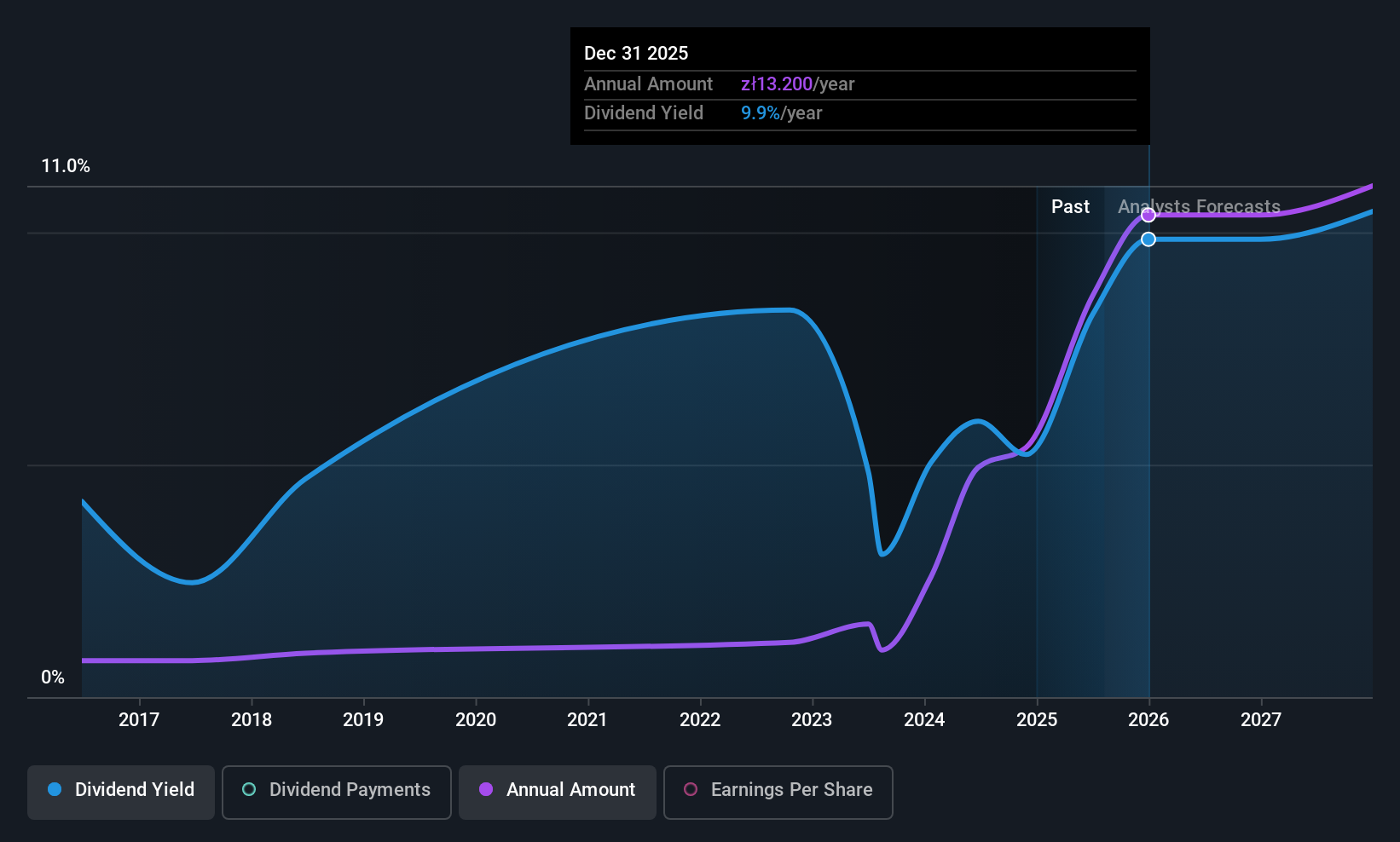

Rainbow Tours (WSE:RBW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rainbow Tours S.A. is a tour operator providing travel services in Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, Lithuania, and internationally with a market cap of PLN1.87 billion.

Operations: Rainbow Tours S.A.'s revenue primarily comes from its Tour Operator Activities in Poland, generating PLN4.17 billion, with additional contributions from its foreign Tour Operator Activities at PLN173.96 million and the Hotel Segment abroad at PLN65.65 million.

Dividend Yield: 8.6%

Rainbow Tours offers a dividend yield of 8.57%, ranking in the top 25% of Polish dividend payers. Despite historical volatility, dividends are supported by earnings and cash flows with payout ratios of 59.4% and 41.7%, respectively. Recent earnings showed sales growth to PLN 1.80 billion, though net income decreased to PLN 84.56 million for H1 2025, indicating potential challenges in sustaining stable payouts amid fluctuating profits and forecasts of declining earnings.

- Delve into the full analysis dividend report here for a deeper understanding of Rainbow Tours.

- The analysis detailed in our Rainbow Tours valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Dive into all 221 of the Top European Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:RBW

Rainbow Tours

Operates as a tour operator in Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, Lithuania, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives