Will Weakness in Linz Textil Holding AG's (VIE:LTH) Stock Prove Temporary Given Strong Fundamentals?

It is hard to get excited after looking at Linz Textil Holding's (VIE:LTH) recent performance, when its stock has declined 4.0% over the past week. But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Particularly, we will be paying attention to Linz Textil Holding's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Linz Textil Holding

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Linz Textil Holding is:

15% = €12m ÷ €81m (Based on the trailing twelve months to December 2019).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.15 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Linz Textil Holding's Earnings Growth And 15% ROE

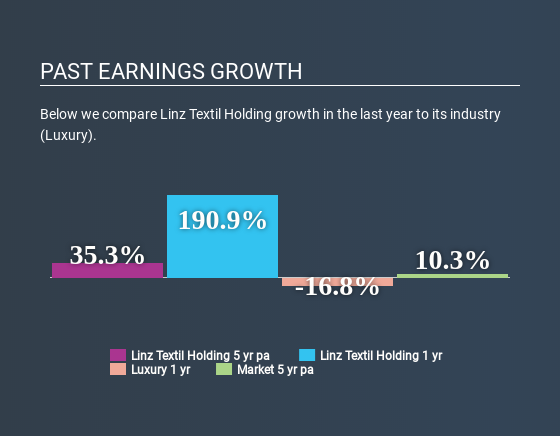

To start with, Linz Textil Holding's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 9.8%. Probably as a result of this, Linz Textil Holding was able to see an impressive net income growth of 35% over the last five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Linz Textil Holding's growth is quite high when compared to the industry average growth of 8.2% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Linz Textil Holding is trading on a high P/E or a low P/E, relative to its industry.

Is Linz Textil Holding Using Its Retained Earnings Effectively?

Linz Textil Holding has a three-year median payout ratio of 27% (where it is retaining 73% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Linz Textil Holding is reinvesting its earnings efficiently.

Additionally, Linz Textil Holding has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that Linz Textil Holding's performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard would have the 3 risks we have identified for Linz Textil Holding.

If you’re looking to trade Linz Textil Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WBAG:LTH

Linz Textil Holding

Manufactures and sells semi-finished textile and terry products in Austria.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)