- Japan

- /

- Hospitality

- /

- TSE:7085

3 Growth Companies With Insider Ownership Up To 25%

Reviewed by Simply Wall St

As global markets navigate a period of fluctuating consumer confidence and mixed economic indicators, major stock indexes have seen moderate gains, with large-cap growth stocks leading the charge. In this climate, companies with high insider ownership can often signal strong internal confidence and alignment with shareholder interests. This article explores three growth companies where insiders hold up to 25% ownership, highlighting their potential appeal in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Underneath we present a selection of stocks filtered out by our screen.

CURVES HOLDINGS (TSE:7085)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CURVES HOLDINGS Co., Ltd. operates and manages women's fitness clubs under the Curves brand in Japan, with a market capitalization of ¥71.53 billion.

Operations: CURVES HOLDINGS Co., Ltd. generates revenue primarily from operating and managing fitness clubs for women under the Curves brand in Japan.

Insider Ownership: 16.7%

CURVES HOLDINGS demonstrates potential as a growth company with high insider ownership, showing strong financial metrics and market positioning. The company is trading at 32.5% below its estimated fair value, indicating good relative value compared to peers. Earnings are forecasted to grow at 9.6% annually, outpacing the Japanese market average of 7.8%. Recent dividend increases further reflect confidence in future performance, with expectations for net sales of ¥38 billion and operating profit of ¥6.3 billion for fiscal year ending August 2025.

- Click to explore a detailed breakdown of our findings in CURVES HOLDINGS' earnings growth report.

- The valuation report we've compiled suggests that CURVES HOLDINGS' current price could be quite moderate.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

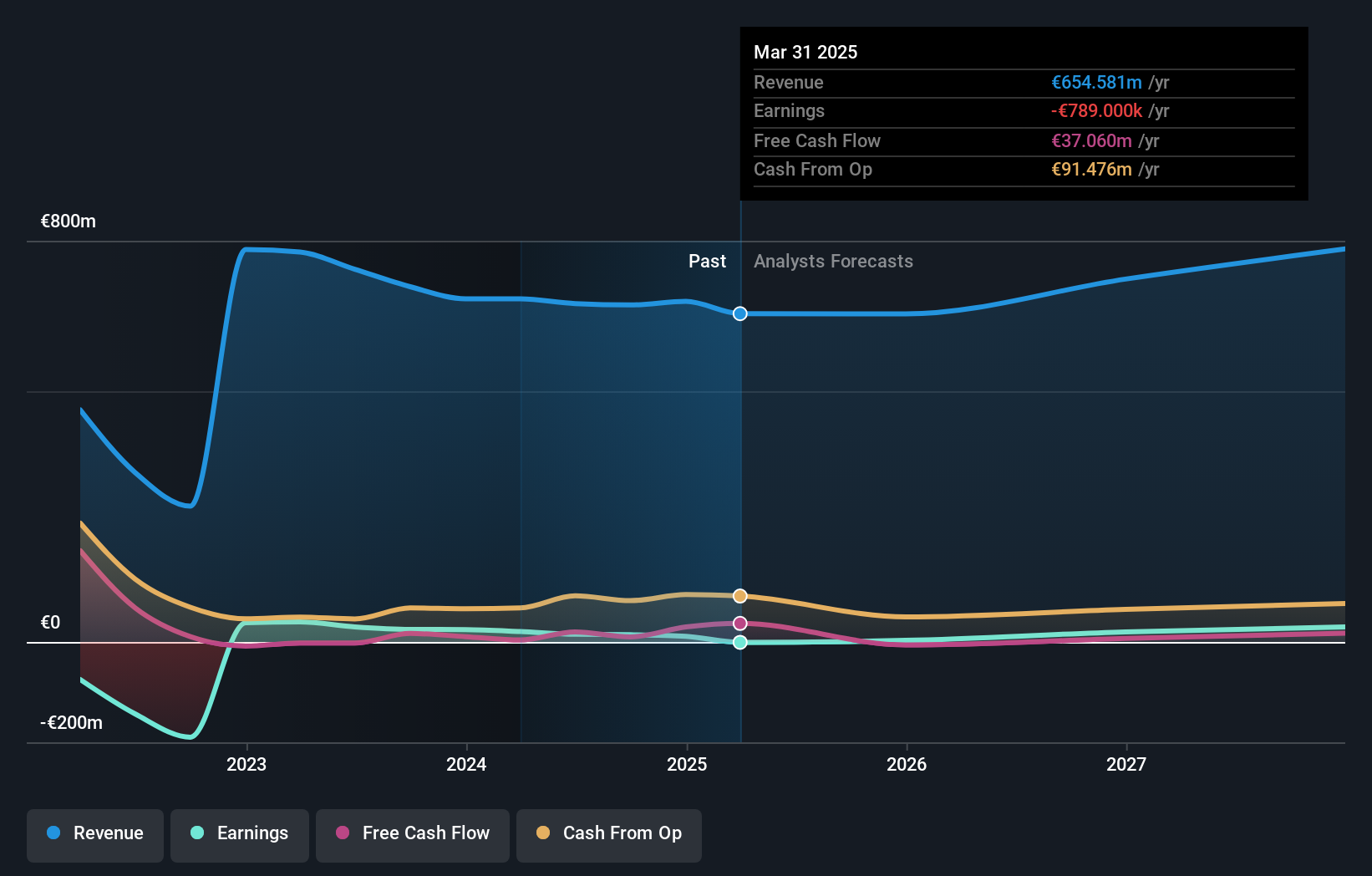

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €250.99 million.

Operations: The company's revenue is primarily derived from its Semperit Engineered Applications segment, which accounts for €380.82 million, followed by the Semperit Industrial Applications segment at €288.16 million, and Surgical Operations contributing €34.32 million.

Insider Ownership: 10.1%

Semperit Holding exhibits potential for growth, trading at 53.2% below its estimated fair value. Despite a recent net loss of EUR 2.5 million in Q3 2024, the company has improved from a EUR 30.65 million loss a year ago and reported net income of EUR 7.14 million for the nine months ended September 2024. Earnings are forecasted to grow significantly at nearly 47% annually, surpassing Austrian market expectations, although profit margins have declined slightly from last year.

- Click here and access our complete growth analysis report to understand the dynamics of Semperit Holding.

- Our comprehensive valuation report raises the possibility that Semperit Holding is priced lower than what may be justified by its financials.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €597.80 million.

Operations: The company generates revenue through its Demand Side Platforms (DSP) with €73.36 million and Supply Side Platforms (SSP) with €367.48 million in North America and Europe.

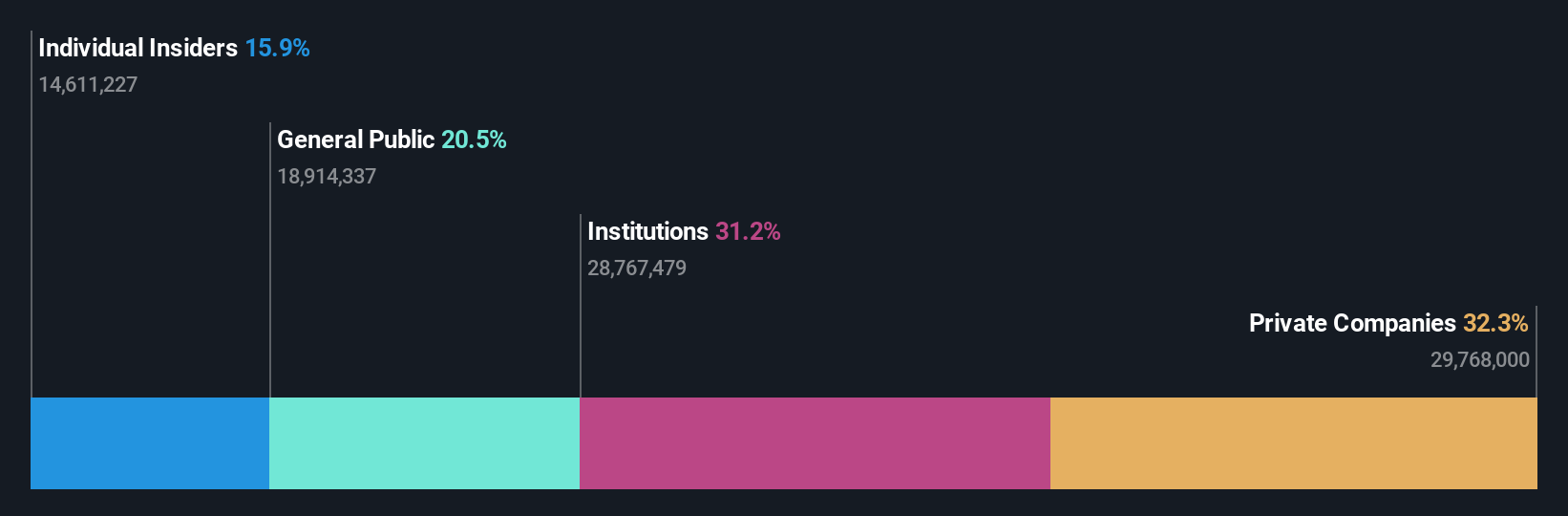

Insider Ownership: 25.1%

Verve Group is poised for substantial growth, with earnings expected to increase significantly at 44.3% annually, outpacing the German market. Despite recent volatility and a drop in net income to EUR 7.63 million in Q3 2024 from EUR 39.26 million the previous year, insider buying has been strong over the past three months. The company trades at a significant discount to its estimated fair value and anticipates revenue growth exceeding market averages despite lower return on equity forecasts.

- Unlock comprehensive insights into our analysis of Verve Group stock in this growth report.

- In light of our recent valuation report, it seems possible that Verve Group is trading behind its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 1497 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7085

CURVES HOLDINGS

Engages in the operation and management of fitness club for women under the Curves brand name in Japan.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives