- France

- /

- Auto Components

- /

- ENXTPA:OPM

Top European Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As European markets navigate a complex landscape of monetary policy decisions, the pan-European STOXX Europe 600 Index recently ended the week slightly lower, reflecting mixed performances across major stock indexes. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors looking to balance their portfolios amid ongoing economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.38% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.85% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.60% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.53% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.85% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.37% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.56% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.71% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.03% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

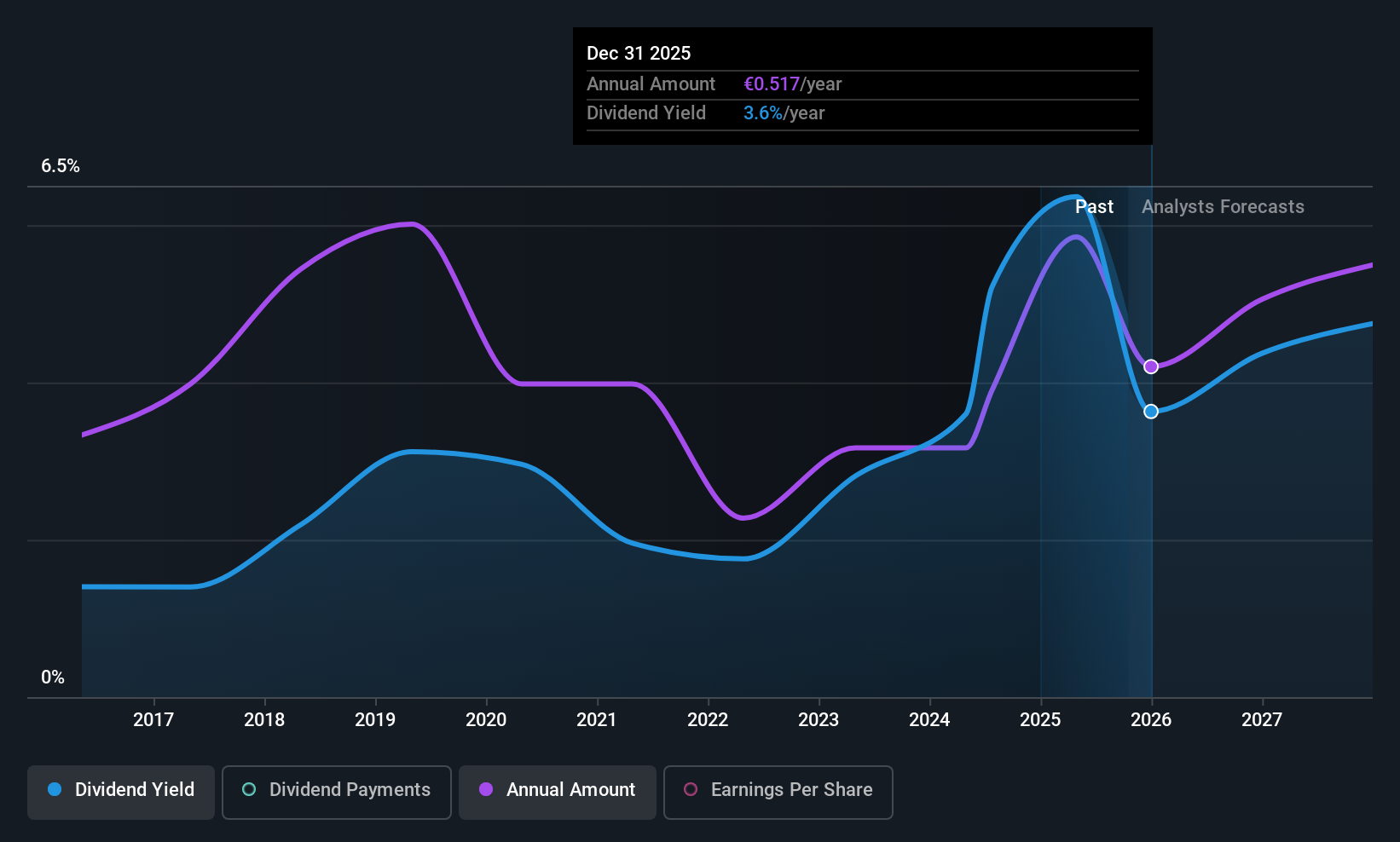

OPmobility (ENXTPA:OPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OPmobility SE designs and manufactures intelligent exterior systems, complex modules, lighting, energy storage systems, and electrification solutions for mobility sectors globally with a market cap of €1.95 billion.

Operations: OPmobility SE generates revenue through its Modules (€3.15 billion), Powertrain (€2.62 billion), and Exterior Systems (€4.70 billion) segments, serving various global mobility markets.

Dividend Yield: 5.3%

OPmobility offers a mixed dividend profile. While dividends are well-covered by earnings and cash flows, with payout ratios of 32.2% and 50.2% respectively, the dividend yield of 5.29% is slightly below the top quartile in France. Despite a history of increasing dividends over the past decade, payments have been volatile and unreliable, experiencing annual drops over 20%. The company carries high debt levels but trades at a significant discount to its estimated fair value. Recent bond issuance for €300 million may impact future financial flexibility as it matures in February 2031 with a BB+ rating from S&P Global Ratings.

- Get an in-depth perspective on OPmobility's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, OPmobility's share price might be too pessimistic.

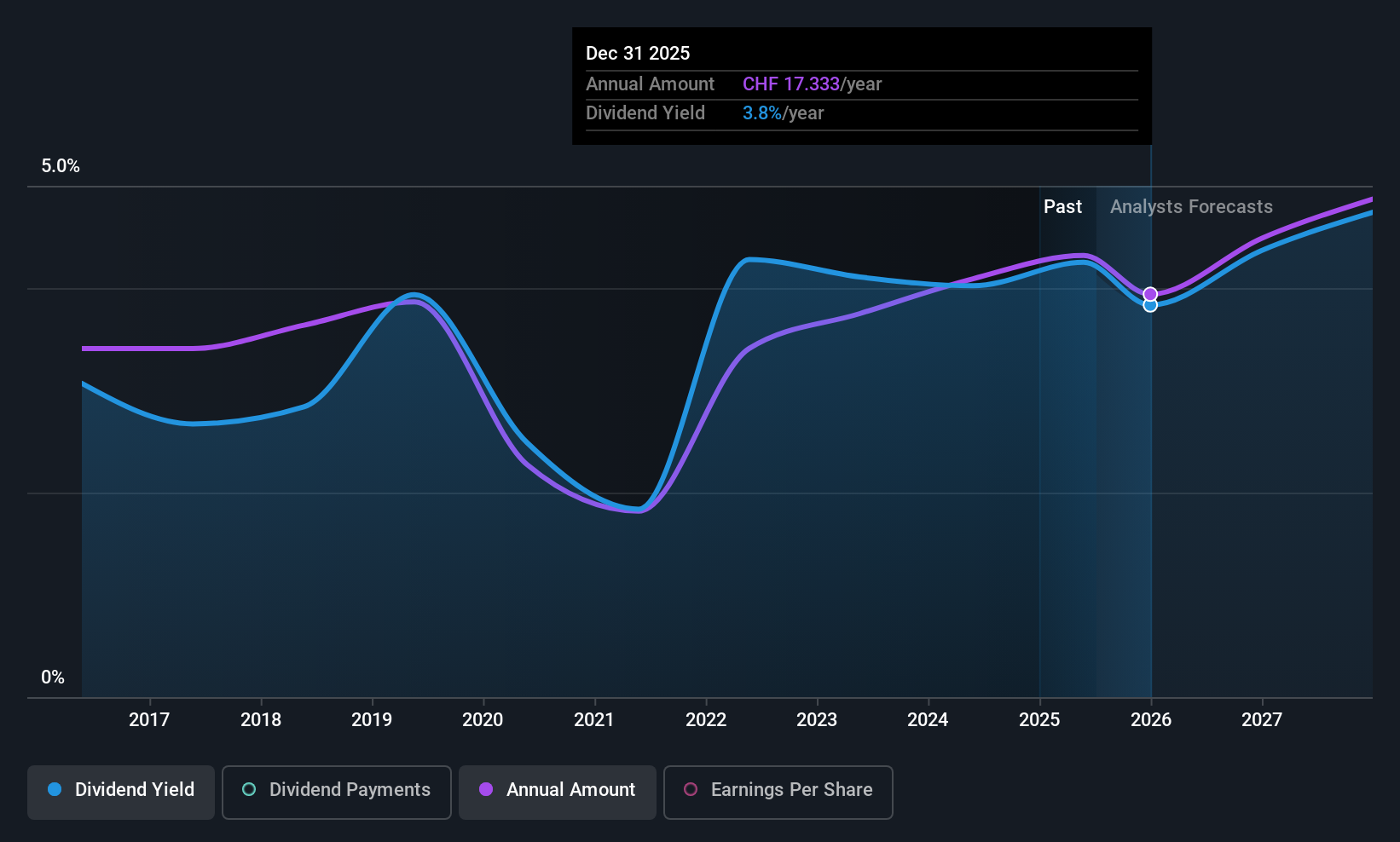

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF412.95 million, manufactures and sells components for industrial customers worldwide through its subsidiaries.

Operations: Phoenix Mecano AG's revenue is primarily derived from its Dewertokin Technology Group (€370.23 million), Enclosure Systems (€215.03 million), and Industrial Components (€186.42 million) segments.

Dividend Yield: 4.2%

Phoenix Mecano's dividend yield of 4.22% ranks in the top 25% of Swiss dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 110.3%, indicating dividends aren't well-covered by cash flows. Despite trading at a good value with a P/E ratio below the Swiss market average, earnings coverage is reasonable with a payout ratio of 60.6%. However, past dividend payments have been volatile and unreliable despite growth over the last decade.

- Dive into the specifics of Phoenix Mecano here with our thorough dividend report.

- According our valuation report, there's an indication that Phoenix Mecano's share price might be on the cheaper side.

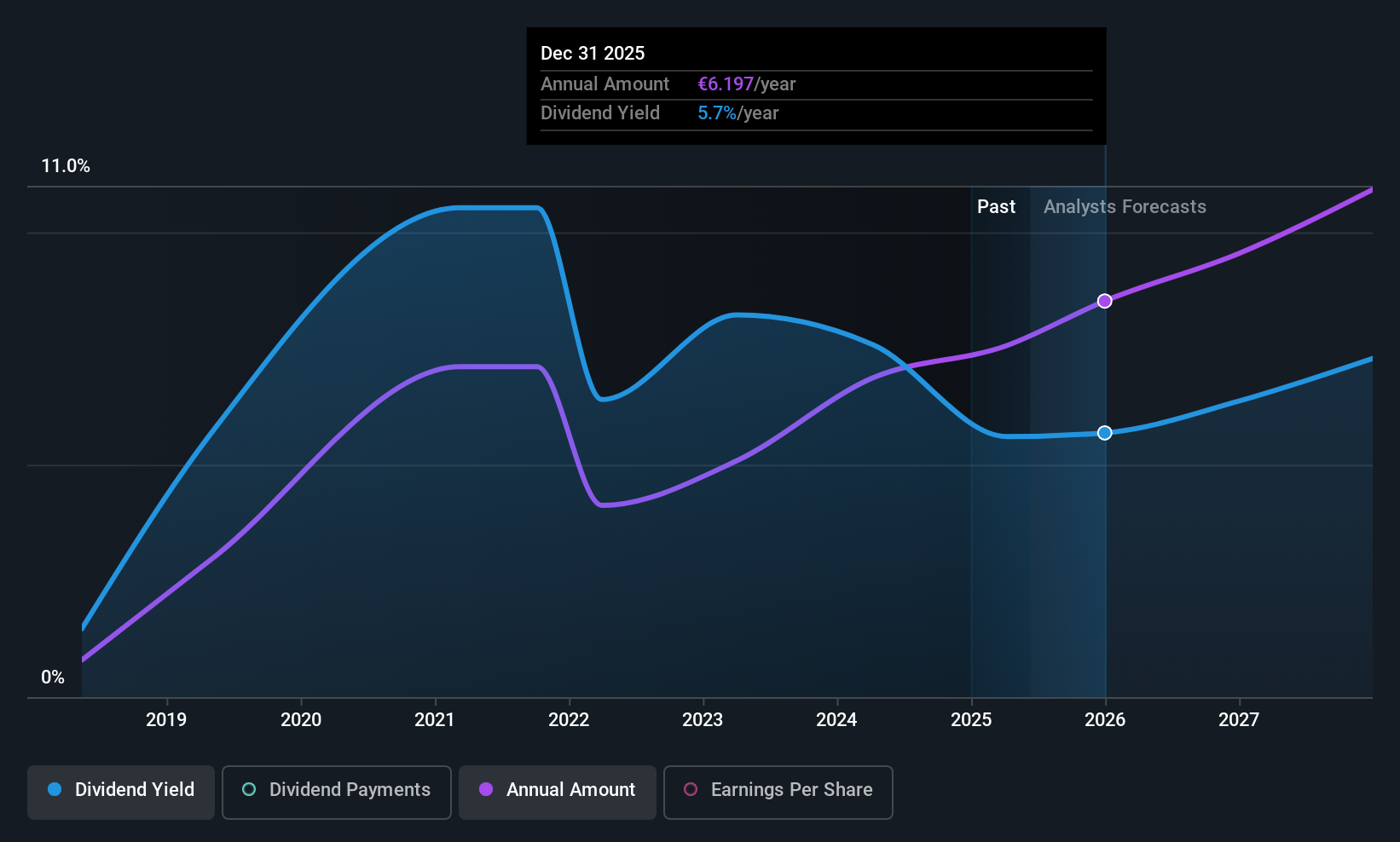

BAWAG Group (WBAG:BG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BAWAG Group AG functions as a holding company for BAWAG P.S.K., with a market capitalization of approximately €8.72 billion.

Operations: BAWAG Group AG generates its revenue primarily from the Retail & SME segment (€1.37 billion), followed by Corporates, Real Estate & Public Sector (€319.50 million), Treasury (€49.80 million), and Corporate Center (€65.70 million).

Dividend Yield: 4.9%

BAWAG Group's dividend yield of 4.85% places it among the top 25% in Austria, with a reasonable payout ratio of 54.3%, indicating dividends are covered by earnings. However, its dividend history is less stable, showing volatility over its eight-year payment period. Recent inclusion in the FTSE All-World Index highlights market recognition, while strong earnings growth—net income rose to €210.2 million in Q2 2025—supports future dividend sustainability despite low bad loan allowances at 71%.

- Click to explore a detailed breakdown of our findings in BAWAG Group's dividend report.

- Our valuation report unveils the possibility BAWAG Group's shares may be trading at a discount.

Seize The Opportunity

- Gain an insight into the universe of 221 Top European Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives