- United Arab Emirates

- /

- Airlines

- /

- DFM:AIRARABIA

Analysts Just Slashed Their Air Arabia PJSC (DFM:AIRARABIA) EPS Numbers

Market forces rained on the parade of Air Arabia PJSC (DFM:AIRARABIA) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

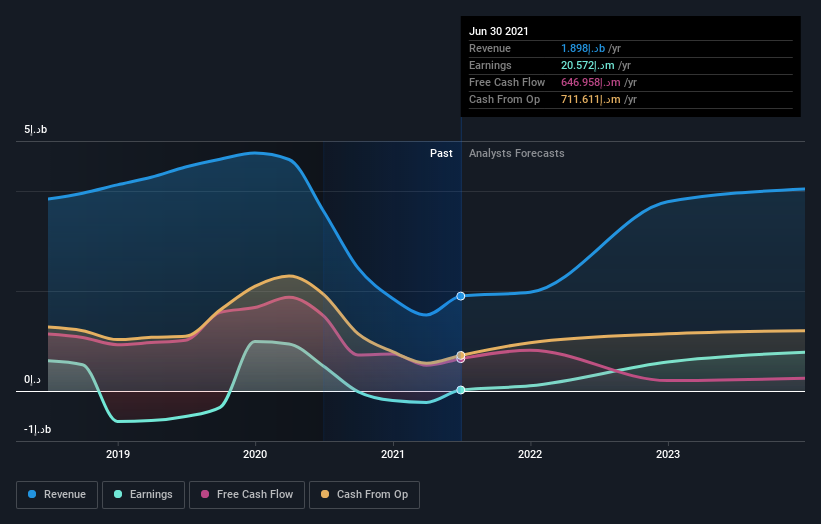

Following the downgrade, the most recent consensus for Air Arabia PJSC from its five analysts is for revenues of د.إ2.0b in 2021 which, if met, would be a reasonable 4.1% increase on its sales over the past 12 months. Statutory earnings per share are presumed to soar 354% to د.إ0.02. Previously, the analysts had been modelling revenues of د.إ2.8b and earnings per share (EPS) of د.إ0.067 in 2021. Indeed, we can see that the analysts are a lot more bearish about Air Arabia PJSC's prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for Air Arabia PJSC

Analysts made no major changes to their price target of د.إ1.48, suggesting the downgrades are not expected to have a long-term impact on Air Arabia PJSC's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Air Arabia PJSC at د.إ1.72 per share, while the most bearish prices it at د.إ1.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that Air Arabia PJSC is forecast to grow faster in the future than it has in the past, with revenues expected to display 8.3% annualised growth until the end of 2021. If achieved, this would be a much better result than the 7.6% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 25% annually for the foreseeable future. Although Air Arabia PJSC's revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Air Arabia PJSC after the downgrade.

Uncomfortably, our automated valuation tool also suggests that Air Arabia PJSC stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DFM:AIRARABIA

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives