- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

Global Market's Estimated Undervalued Stocks For October 2025

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are navigating a complex landscape marked by fluctuating indices and geopolitical uncertainties. Amidst these challenges, identifying undervalued stocks can be an attractive strategy, as they may offer potential opportunities for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Siltronic (XTRA:WAF) | €55.90 | €111.17 | 49.7% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.29 | 49.9% |

| SBO (WBAG:SBO) | €26.85 | €53.66 | 50% |

| Lotes (TWSE:3533) | NT$1430.00 | NT$2853.14 | 49.9% |

| Everest Medicines (SEHK:1952) | HK$52.80 | HK$104.99 | 49.7% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.34 | €6.65 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩34900.00 | ₩69373.62 | 49.7% |

| Chifeng Jilong Gold MiningLtd (SHSE:600988) | CN¥30.58 | CN¥60.85 | 49.7% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.84 | ₱7.66 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK253.00 | SEK502.83 | 49.7% |

Here's a peek at a few of the choices from the screener.

Fertiglobe (ADX:FERTIGLB)

Overview: Fertiglobe plc, along with its subsidiaries, is engaged in the production and sale of nitrogen-based products across Europe, North and South America, Africa, the Middle East, Asia, and Oceania with a market capitalization of AED21.08 billion.

Operations: The company's revenue primarily stems from the production and marketing of owned produced volumes, totaling $2.03 billion, and third-party trading activities amounting to $193.80 million.

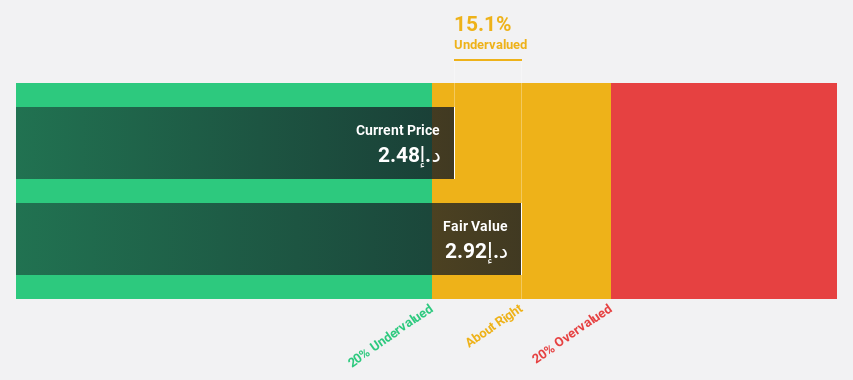

Estimated Discount To Fair Value: 14.8%

Fertiglobe is trading at AED2.54, below its estimated fair value of AED2.98, indicating potential undervaluation based on cash flows. Despite a high debt level and lower profit margins compared to last year, earnings are expected to grow significantly at 24.7% annually, outpacing the AE market's growth rate of 6.6%. Recent dividend guidance commits to a minimum payout of $100 million for H2 2025, though dividends remain not well covered by earnings.

- Upon reviewing our latest growth report, Fertiglobe's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Fertiglobe with our comprehensive financial health report here.

Maharah for Human Resources (SASE:1831)

Overview: Maharah for Human Resources Company offers manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates, with a market cap of SAR2.43 billion.

Operations: The company's revenue segments include manpower services to both public and private sectors in Saudi Arabia and the United Arab Emirates.

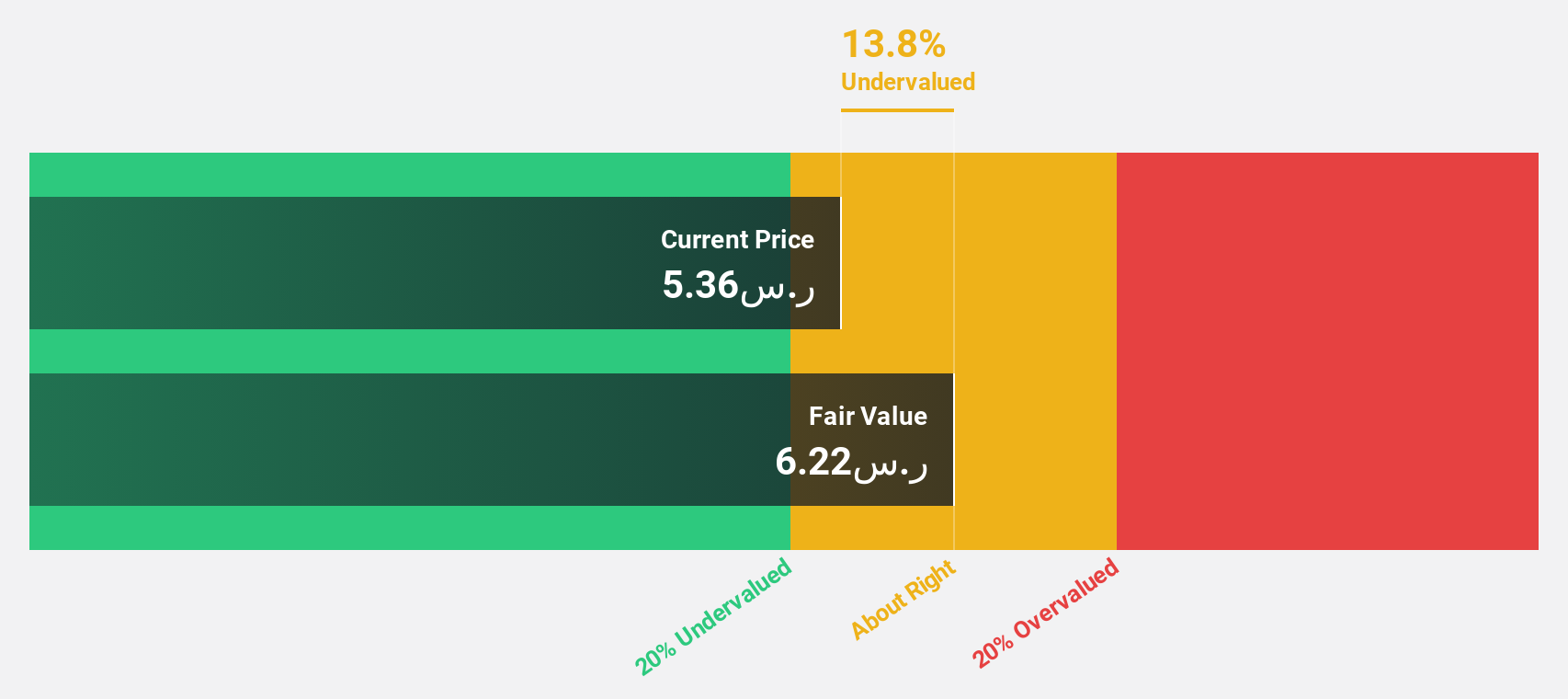

Estimated Discount To Fair Value: 12.6%

Maharah for Human Resources is trading at SAR5.43, below its fair value estimate of SAR6.21, which may point to undervaluation based on cash flows. Despite a high debt level and reduced profit margins from 6.6% to 3%, earnings are projected to grow significantly at 24% annually, surpassing the SA market's growth rate of 8.2%. The company recently affirmed a dividend distribution totaling SAR31.5 million for H1 2025, though dividends have an unstable track record.

- According our earnings growth report, there's an indication that Maharah for Human Resources might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Maharah for Human Resources.

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd., along with its subsidiaries, offers thermal solutions globally and has a market capitalization of NT$450.27 billion.

Operations: The company's revenue is primarily derived from its Overseas Operating Department, which accounts for NT$106.77 billion, and its Integrated Management Division, contributing NT$74.12 billion.

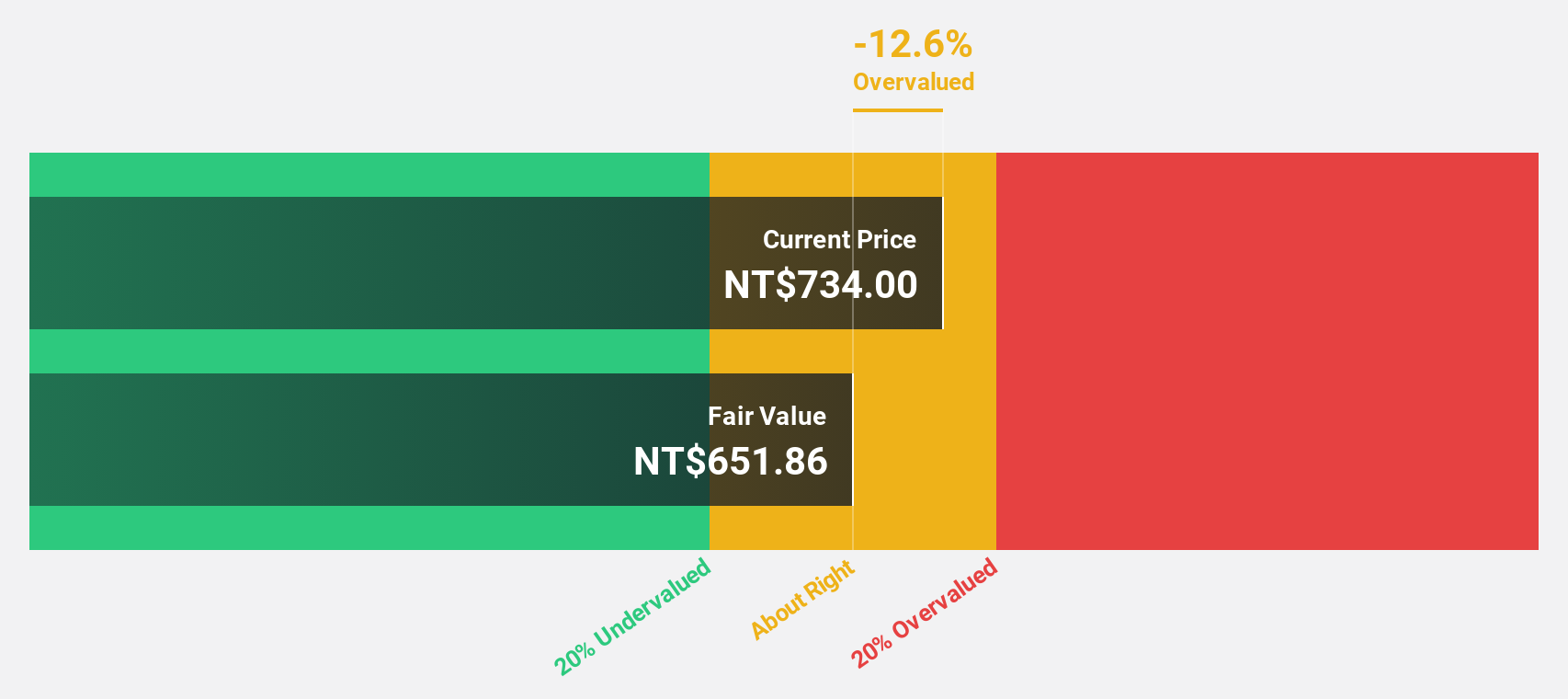

Estimated Discount To Fair Value: 18.2%

Asia Vital Components is trading at NT$1160, below its fair value estimate of NT$1418.03, indicating potential undervaluation based on cash flows. The company's earnings grew by 79.7% over the past year and are forecast to grow 27.4% annually, outpacing the TW market's growth rate of 18.2%. Despite recent share price volatility, revenue is expected to increase significantly at 24.9% per year, supported by a high projected return on equity of 42%.

- Our earnings growth report unveils the potential for significant increases in Asia Vital Components' future results.

- Delve into the full analysis health report here for a deeper understanding of Asia Vital Components.

Seize The Opportunity

- Navigate through the entire inventory of 523 Undervalued Global Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives