- Israel

- /

- Medical Equipment

- /

- TASE:EMTC-M

Islamic Arab Insurance (Salama) PJSC And 2 More Middle Eastern Penny Stocks With Strong Fundamentals

Reviewed by Simply Wall St

Amidst fluctuating oil prices, most Gulf markets have recently experienced a downturn, with indices in Saudi Arabia and Dubai seeing notable declines. However, for investors seeking opportunities beyond the well-trodden paths of large-cap stocks, penny stocks present an intriguing prospect. Despite being considered niche investments today, these smaller or newer companies can still offer significant value when backed by strong financial health. In this article, we explore three Middle Eastern penny stocks that combine robust fundamentals with potential long-term growth prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.394 | ₪14.79M | ✅ 0 ⚠️ 5 View Analysis > |

| Maharah for Human Resources (SASE:1831) | SAR4.79 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.64 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.13 | AED2.26B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.84 | AED12.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.859 | AED526.14M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.817 | ₪209.42M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Islamic Arab Insurance (Salama) PJSC (DFM:SALAMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Islamic Arab Insurance Co. (Salama) PJSC, along with its subsidiaries, offers a variety of general, family, health, and auto takaful solutions across Africa and Asia with a market cap of AED388.48 million.

Operations: The company's revenue is primarily derived from General Takaful at AED802.4 million and Family Takaful at AED230.75 million.

Market Cap: AED388.48M

Islamic Arab Insurance (Salama) PJSC has recently transitioned to profitability, reporting a net income of AED 6.67 million for Q2 2025, up from AED 0.685 million the previous year. Despite this positive shift, the company's return on equity remains low at 3.5%, and its short-term assets of AED934.7 million do not cover long-term liabilities of AED2.3 billion, indicating potential financial challenges ahead. The board's average tenure is only two years, suggesting limited experience in guiding the company through these complexities. Salama's stable weekly volatility and debt-free status provide some stability amidst these concerns.

- Jump into the full analysis health report here for a deeper understanding of Islamic Arab Insurance (Salama) PJSC.

- Gain insights into Islamic Arab Insurance (Salama) PJSC's historical outcomes by reviewing our past performance report.

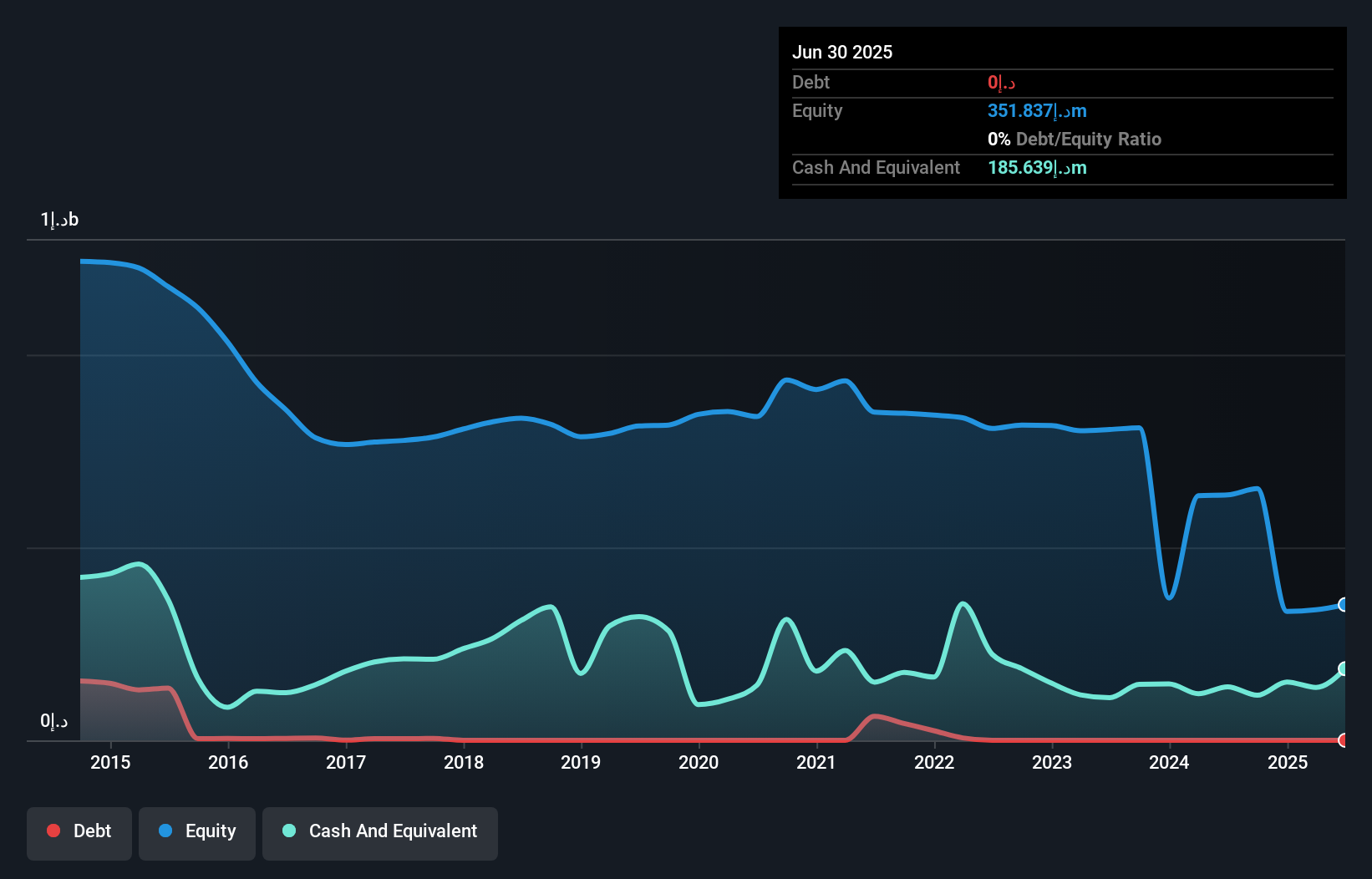

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company involved in the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪19.96 million.

Operations: Elbit Medical Technologies Ltd does not report specific revenue segments.

Market Cap: ₪19.96M

Elbit Medical Technologies Ltd, with a market cap of ₪19.96 million, is pre-revenue and has experienced declining earnings over the past five years. The company recently reported a net loss of US$0.115 million for the half-year ended June 30, 2025, down from a net income of US$0.436 million the previous year. Despite becoming profitable in recent periods due to one-off gains, its return on equity remains low at 3.5%. Elbit Medical has no debt and maintains healthy short-term asset coverage over liabilities but faces high share price volatility and limited revenue generation capabilities under US$1 million annually.

- Get an in-depth perspective on Elbit Medical Technologies' performance by reading our balance sheet health report here.

- Understand Elbit Medical Technologies' track record by examining our performance history report.

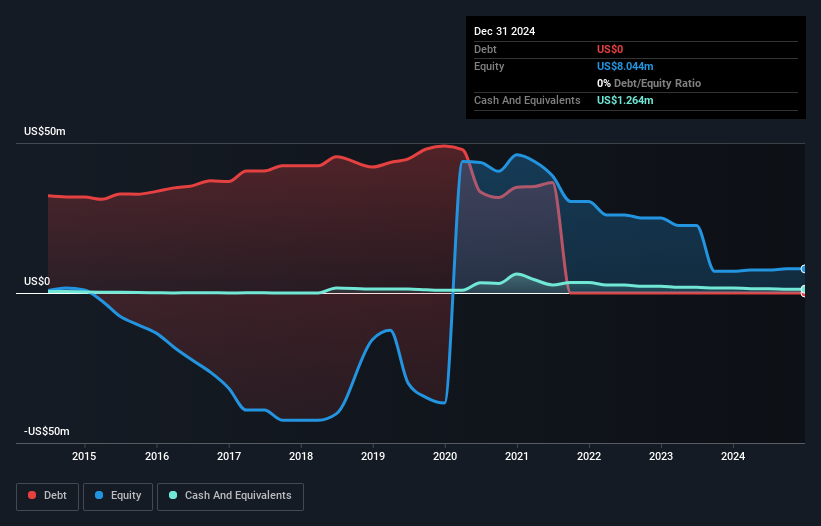

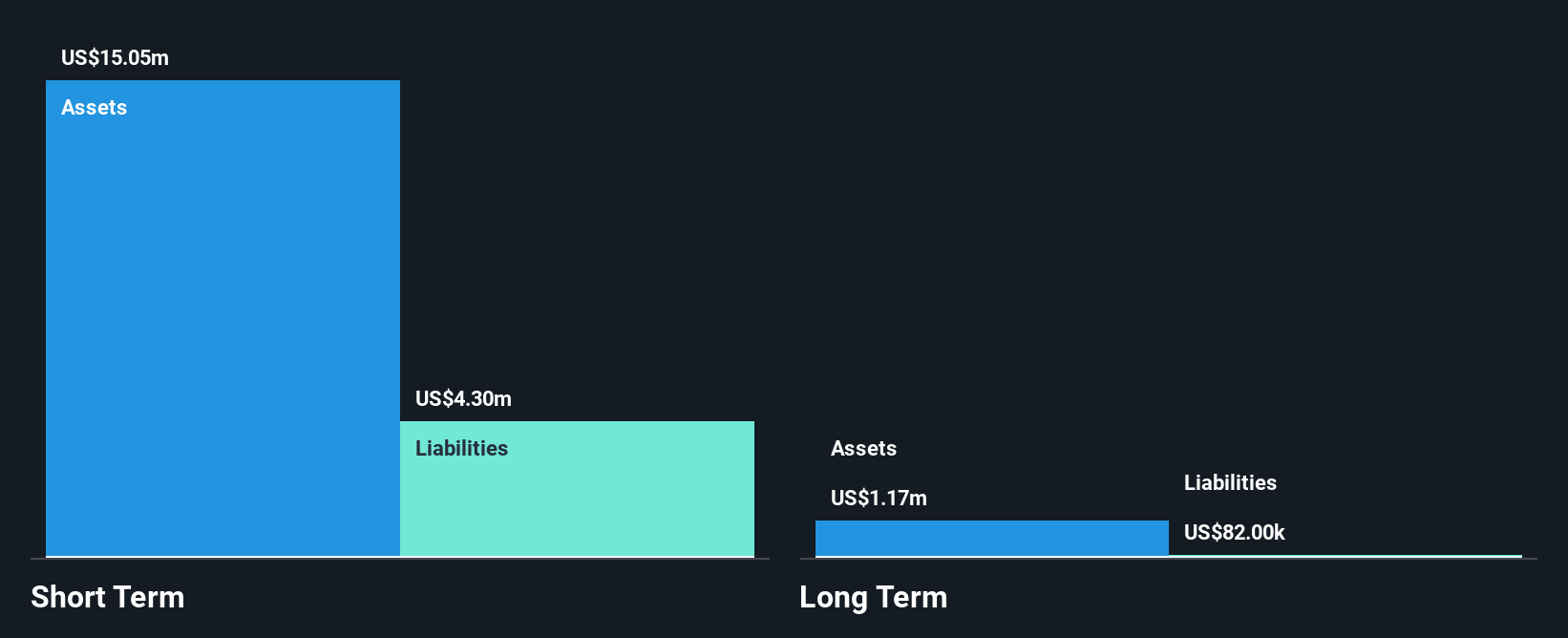

Gencell (TASE:GNCL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GenCell Ltd. develops and produces fuel cell-based energy systems, with a market cap of ₪30.18 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: ₪30.18M

GenCell Ltd., with a market cap of ₪30.18 million, reported sales of US$0.715 million for the half-year ended June 30, 2025, indicating it is pre-revenue. Despite its unprofitability and net loss of US$11.4 million, GenCell's short-term assets of $15.1M comfortably cover both short- and long-term liabilities. The company remains debt-free but faces high share price volatility and less than a year of cash runway under current free cash flow conditions. The management team is relatively experienced with an average tenure of 2.7 years, yet earnings have declined by 5.8% annually over the past five years.

- Click here to discover the nuances of Gencell with our detailed analytical financial health report.

- Assess Gencell's previous results with our detailed historical performance reports.

Key Takeaways

- Reveal the 76 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Interested In Other Possibilities? Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elbit Medical Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:EMTC-M

Elbit Medical Technologies

An investment holding company, engages in the research, development, production, and marketing of therapeutic medical systems in the United States, Europe, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)