- United Arab Emirates

- /

- Insurance

- /

- DFM:SALAMA

Islamic Arab Insurance Co. (Salama) PJSC's (DFM:SALAMA) 30% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

The Islamic Arab Insurance Co. (Salama) PJSC (DFM:SALAMA) share price has fared very poorly over the last month, falling by a substantial 30%. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

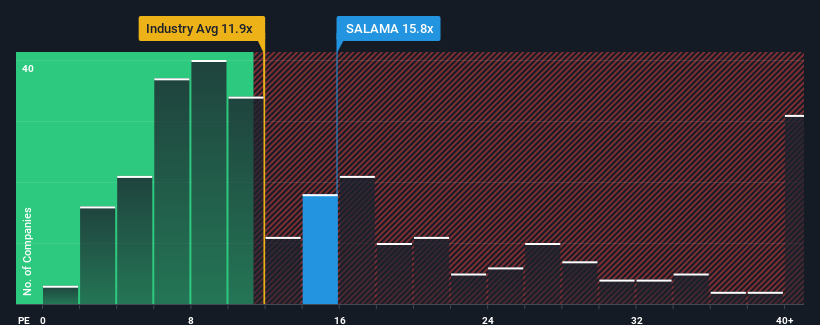

In spite of the heavy fall in price, there still wouldn't be many who think Islamic Arab Insurance (Salama) PJSC's price-to-earnings (or "P/E") ratio of 15.8x is worth a mention when the median P/E in the United Arab Emirates is similar at about 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's exceedingly strong of late, Islamic Arab Insurance (Salama) PJSC has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Islamic Arab Insurance (Salama) PJSC

Is There Some Growth For Islamic Arab Insurance (Salama) PJSC?

There's an inherent assumption that a company should be matching the market for P/E ratios like Islamic Arab Insurance (Salama) PJSC's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 129%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 84% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 1.5% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Islamic Arab Insurance (Salama) PJSC is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Islamic Arab Insurance (Salama) PJSC's plummeting stock price has brought its P/E right back to the rest of the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Islamic Arab Insurance (Salama) PJSC currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Islamic Arab Insurance (Salama) PJSC that you should be aware of.

If you're unsure about the strength of Islamic Arab Insurance (Salama) PJSC's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DFM:SALAMA

Islamic Arab Insurance (Salama) PJSC

Provides a range of general, family, health, and auto takaful solutions in Africa and Asia.

Excellent balance sheet and slightly overvalued.