- United Arab Emirates

- /

- Banks

- /

- ADX:ADIB

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a challenging start to 2025, with U.S. equities experiencing declines amid inflation concerns and political uncertainty, investors are closely watching economic indicators and policy updates. In this environment of fluctuating interest rates and market volatility, dividend stocks can offer a degree of stability through consistent income streams, making them an appealing option for those seeking to weather the current financial climate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.37% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 1995 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Abu Dhabi Islamic Bank PJSC (ADX:ADIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Islamic Bank PJSC offers banking, financing, and investing services both in the United Arab Emirates and internationally, with a market capitalization of AED55.57 billion.

Operations: Abu Dhabi Islamic Bank PJSC's revenue segments include Global Retail Banking at AED5.29 billion, Global Wholesale Banking at AED1.65 billion, Associates & Subsidiaries at AED1.40 billion, Private Banking at AED241.83 million, Treasury operations generating AED176.50 million, and Real Estate contributing AED168.80 million.

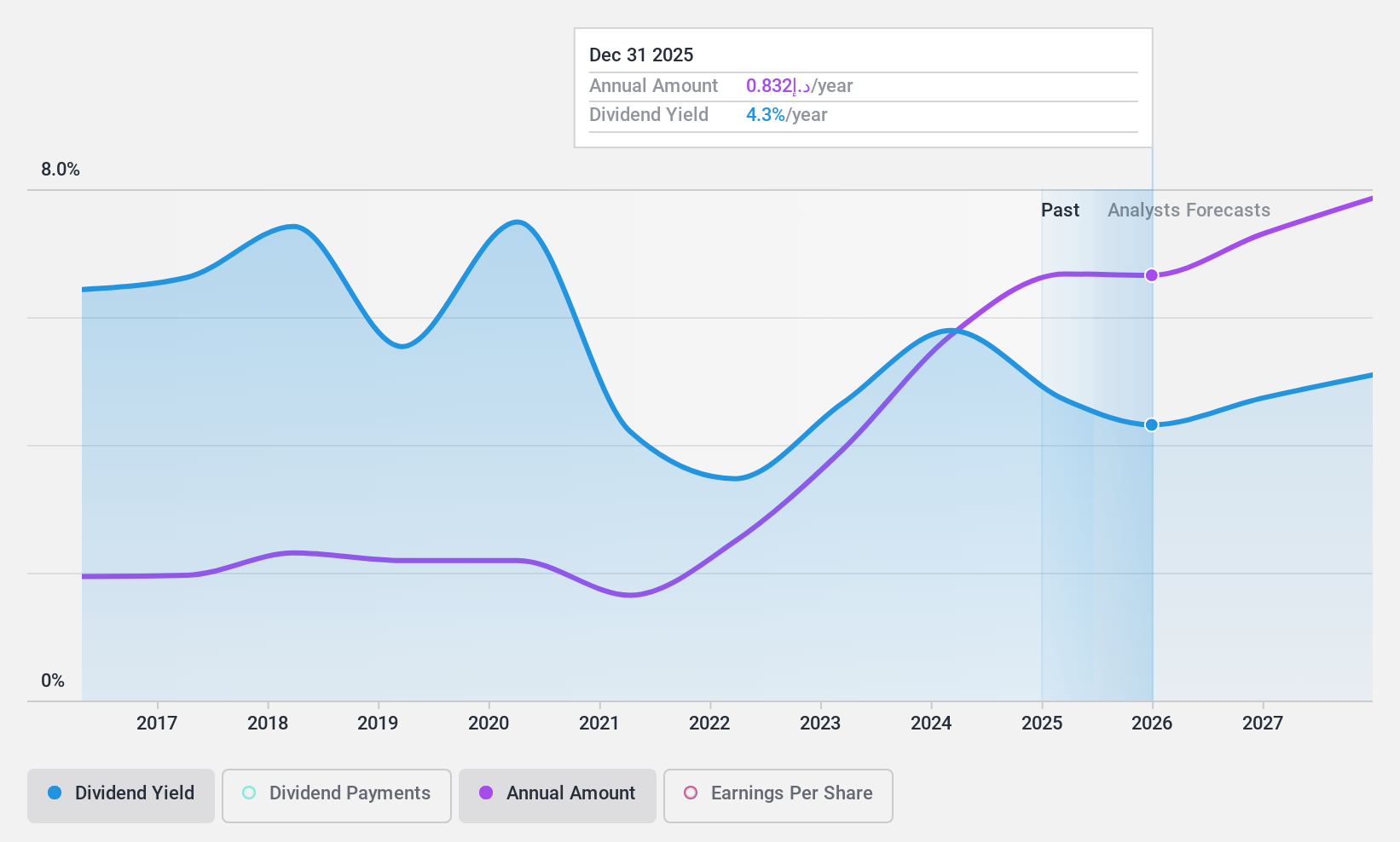

Dividend Yield: 4.7%

Abu Dhabi Islamic Bank PJSC offers a dividend yield of 4.67%, which is below the top quartile in the AE market. Despite a volatile dividend history over the past decade, payouts are well-covered by earnings with a current payout ratio of 47.6%. Earnings have grown significantly at 26.5% annually over five years, supporting future dividend sustainability. However, concerns include high non-performing loans (3.9%) and low allowance for bad loans (74%). Recent earnings show strong growth, with net income rising to AED 1.54 billion in Q3 2024 from AED 1.35 billion year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Abu Dhabi Islamic Bank PJSC.

- According our valuation report, there's an indication that Abu Dhabi Islamic Bank PJSC's share price might be on the expensive side.

SCB X (SET:SCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCB X Public Company Limited serves as a holding company for The Siam Commercial Bank Public Company Limited, offering a range of financial products and services, with a market cap of THB410.79 billion.

Operations: SCB X Public Company Limited generates revenue from Banking Services (THB144.35 billion), Platforms & Digital Assets (THB2.06 billion), and Consumer & Digital Financial Services (THB29.01 billion).

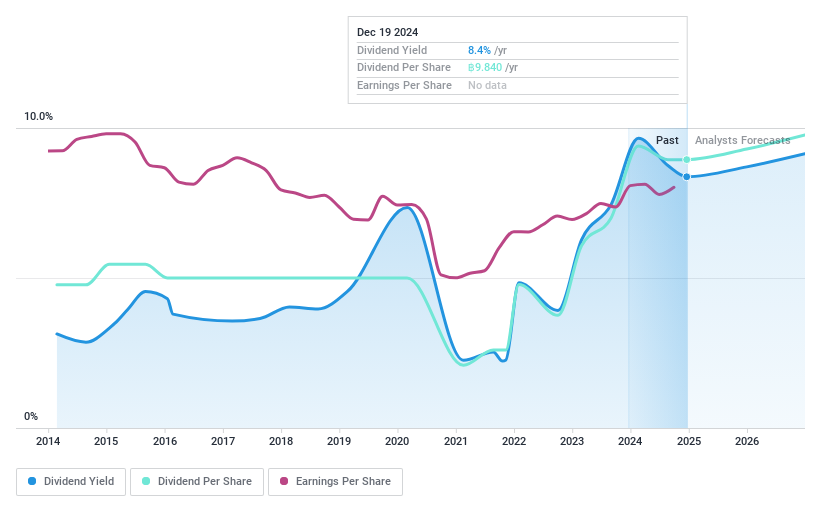

Dividend Yield: 8.1%

SCB X offers a high dividend yield of 8.07%, ranking in the top 25% of Thai market payers, yet its dividend history has been volatile over the past decade. Current dividends are covered by earnings with a payout ratio of 76.7%, and this coverage is expected to remain stable in three years at 77.4%. Despite recent earnings growth, SCB faces challenges with a high level of non-performing loans at 3.9%.

- Click here to discover the nuances of SCB X with our detailed analytical dividend report.

- Our expertly prepared valuation report SCB X implies its share price may be too high.

Warabeya Nichiyo Holdings (TSE:2918)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Warabeya Nichiyo Holdings Co., Ltd. operates in the manufacture and sale of food products for convenience stores both in Japan and internationally, with a market cap of ¥36.02 billion.

Operations: Warabeya Nichiyo Holdings Co., Ltd.'s revenue is primarily derived from its Food-Related Segment, which accounts for ¥196.73 billion, followed by its Logistics Business at ¥18.51 billion and Food Materials Businesses contributing ¥11.86 billion.

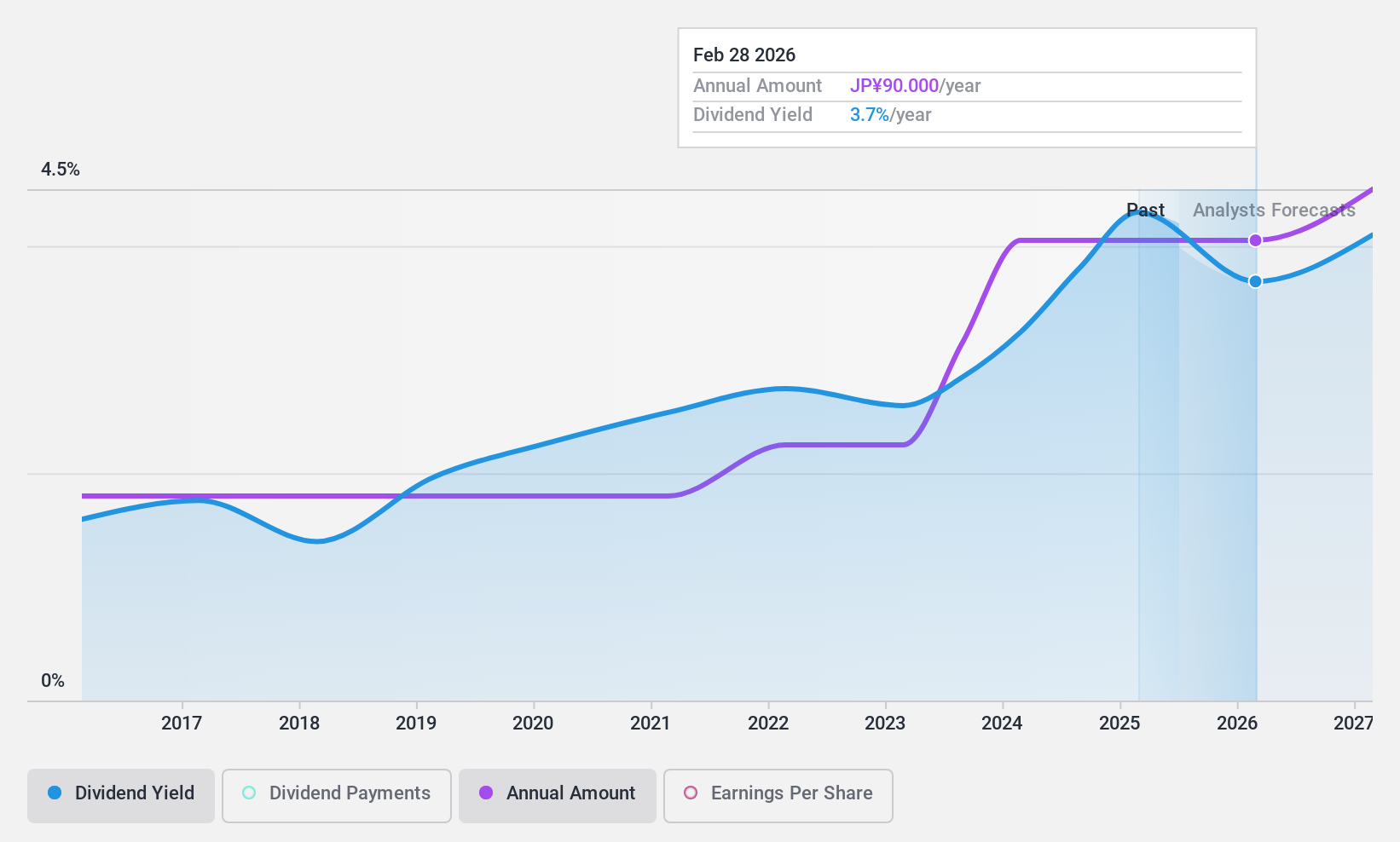

Dividend Yield: 4.4%

Warabeya Nichiyo Holdings offers a dividend yield of 4.39%, placing it in the top 25% of Japanese market payers. The company's dividends have been stable and growing over the past decade, but they are not covered by free cash flows, raising sustainability concerns. Despite this, a low payout ratio of 35.4% indicates coverage by earnings. Trading at a good value with an 8.1x P/E ratio compared to the market's 13.3x enhances its appeal for dividend investors seeking reliability and growth potential in earnings.

- Delve into the full analysis dividend report here for a deeper understanding of Warabeya Nichiyo Holdings.

- According our valuation report, there's an indication that Warabeya Nichiyo Holdings' share price might be on the cheaper side.

Key Takeaways

- Dive into all 1995 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:ADIB

Abu Dhabi Islamic Bank PJSC

Provides banking, financing, and investing services in the United Arab Emirates and internationally.

Adequate balance sheet average dividend payer.