Middle East's Hidden Stock Gems Include Drake and Scull International P.J.S.C

Reviewed by Simply Wall St

In recent times, most Gulf markets have shown resilience, closing higher despite global tariff tensions, with indices like Dubai's hitting multi-year highs. This promising environment underscores the potential for discovering hidden stock gems in the Middle East, where companies like Drake and Scull International P.J.S.C. are gaining attention for their unique market positions amidst these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Drake and Scull International P.J.S.C (DFM:DSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Drake and Scull International P.J.S.C. operates in the construction sector across various countries including the United Arab Emirates, Saudi Arabia, and others, with a market capitalization of approximately AED932.39 million.

Operations: Drake and Scull International P.J.S.C. generates revenue primarily from its wastewater treatment and water sludge segment, amounting to AED103.30 million.

Drake and Scull International (DSI) has shown a notable turnaround, reporting AED 2.45 million in net income for Q1 2025, compared to a net loss of AED 42.59 million the previous year, indicating significant profitability improvement. The company's price-to-earnings ratio is an attractive 0.2x against the AE market's 12.9x, suggesting potential undervaluation. Despite having more cash than total debt, DSI's earnings quality is impacted by a large one-off gain of AED3.8 billion over the past year. While free cash flow remains negative, positive shareholder equity marks progress from five years ago when it was negative.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY21.20 billion.

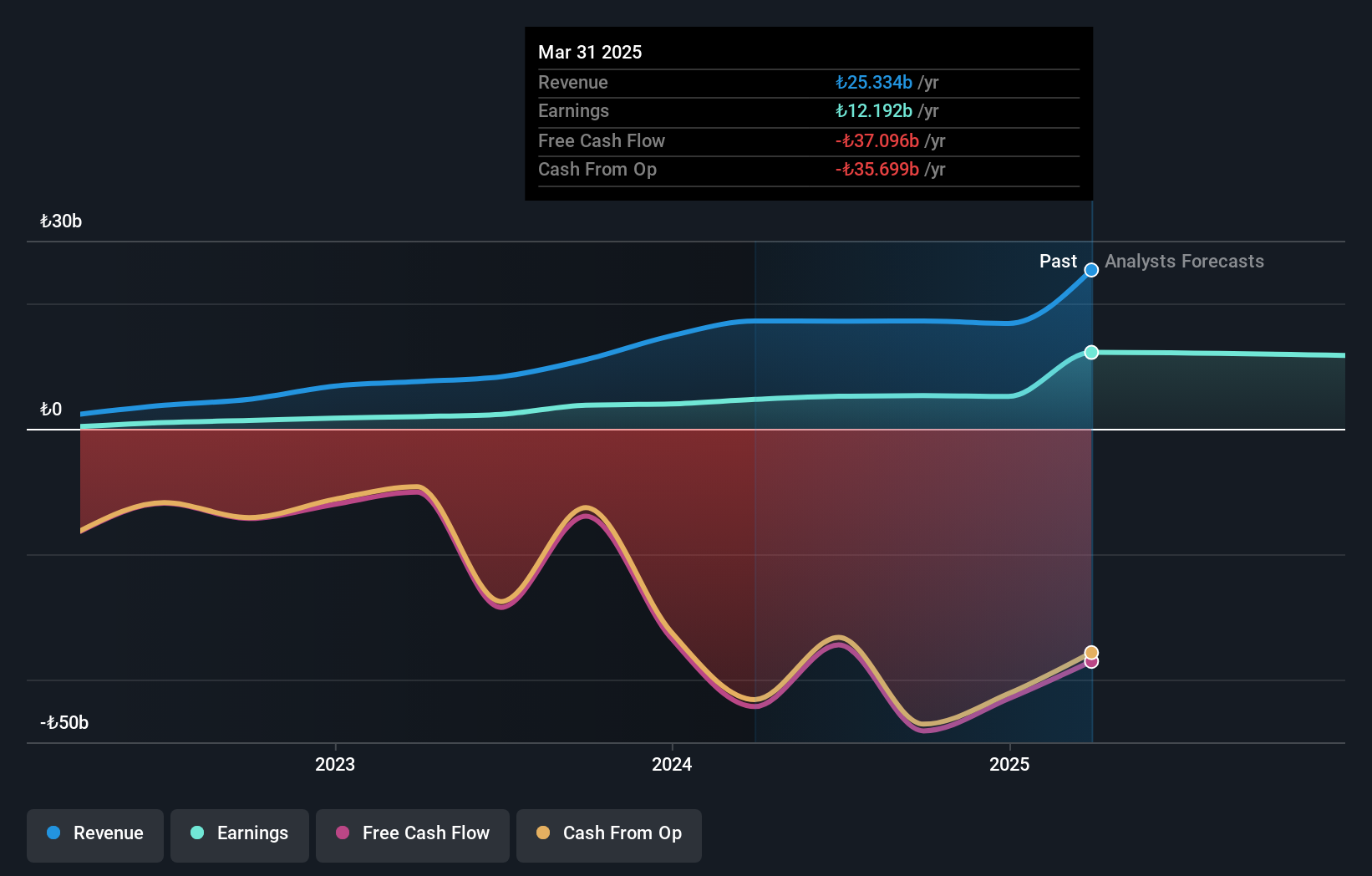

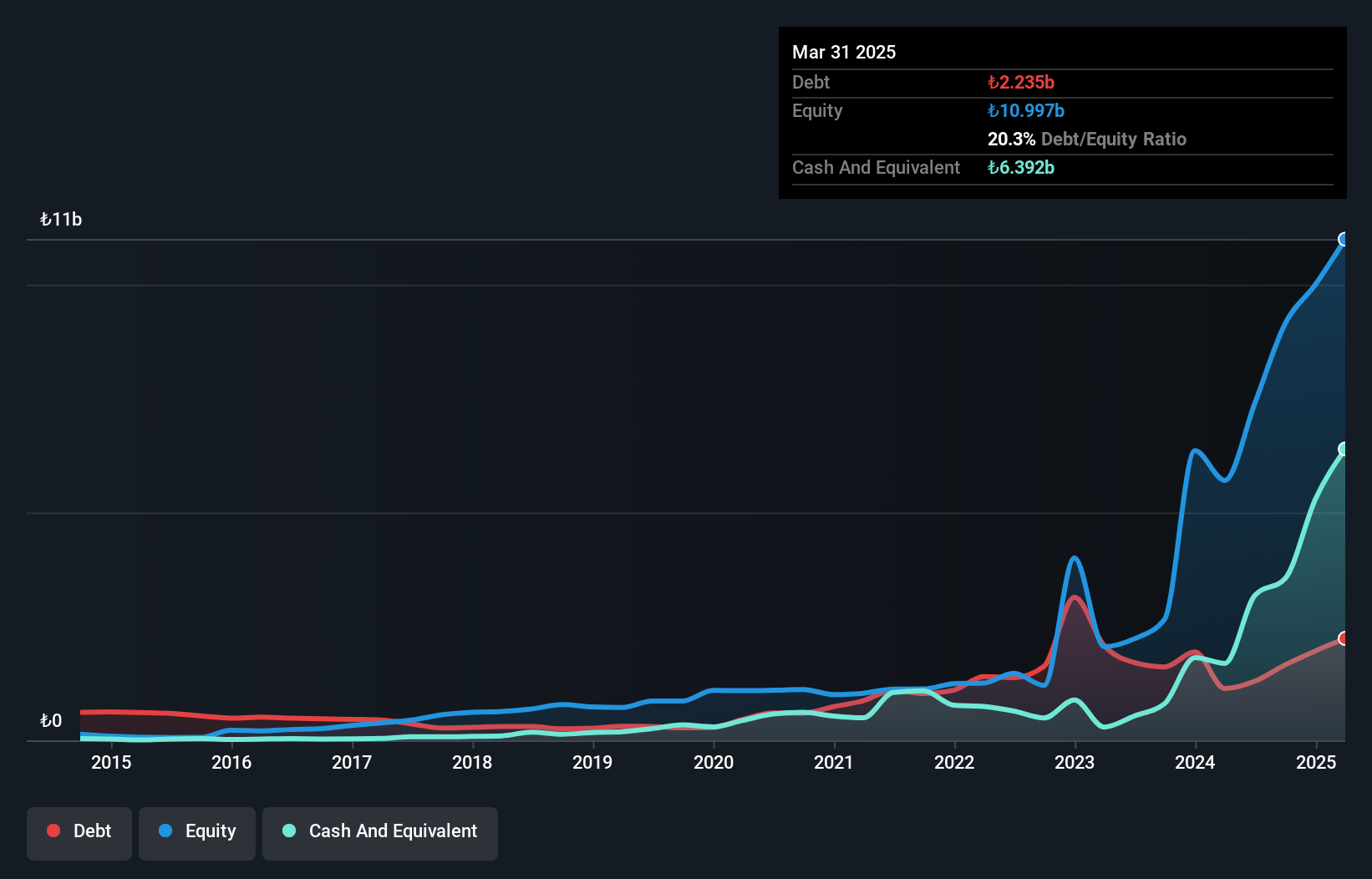

Operations: Albaraka Türk Katilim Bankasi A.S. generates revenue primarily from its Commercial and Corporate segment, contributing TRY32.66 billion, followed by Treasury at TRY21.81 billion and Individual banking at TRY7.04 billion. The bank's business model focuses on these key segments to drive its financial performance in Turkey's banking sector.

Albaraka Türk Katilim Bankasi stands out with its robust financial health, boasting total assets of TRY352.5 billion and equity of TRY20.4 billion. The bank's earnings surged 159.8% over the past year, far outpacing the industry average of 0.8%. With a bad loans ratio at an appropriate 1.4% and a sufficient allowance for these loans at 163%, it shows prudent risk management. Additionally, 65% of its liabilities are sourced from low-risk customer deposits, reinforcing stability. Its price-to-earnings ratio sits attractively low at 1.7x compared to the TR market's 18x, suggesting potential undervaluation in current market conditions.

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi (IBSE:BANVT)

Simply Wall St Value Rating: ★★★★★★

Overview: Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi is a Turkish food company with a market capitalization of TRY21.02 billion.

Operations: Banvit generates revenue primarily from its food processing segment, amounting to TRY30.49 billion. The company's financial performance is reflected in its market capitalization of TRY21.02 billion.

Banvit, a notable player in the food industry, showcases some intriguing financial dynamics. Its earnings surged by 27% over the past year, outpacing the sector's -6.8% performance. The company enjoys robust debt management with cash exceeding total debt and interest payments comfortably covered by EBIT at ten times over. Despite these strengths, Banvit faces challenges such as a net loss of TRY 14.16 million in Q1 2025 compared to a significant profit last year and negative free cash flow trends persisting over recent years. Nonetheless, its price-to-earnings ratio of 7.9x suggests potential value relative to the broader market's 18x benchmark.

Seize The Opportunity

- Unlock our comprehensive list of 222 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BANVT

Banvit Bandirma Vitaminli Yem Sanayii Anonim Sirketi

Operates as a food company in Turkey.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion