- United Arab Emirates

- /

- Banks

- /

- DFM:EMIRATESNBD

Middle Eastern Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As the Middle Eastern markets navigate a period of volatility, with Saudi Arabia experiencing its worst weekly performance in over a month and Dubai's index seeing slight gains, investors are closely monitoring the impact of fluctuating oil prices and geopolitical developments. In such an environment, dividend stocks can offer stability and income potential, making them an attractive option for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.35% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.44% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.35% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.00% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.95% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.75% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.63% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.86% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.34% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.97% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market cap of AED4.48 billion.

Operations: The revenue segments for National Bank of Umm Al-Qaiwain (PSC) include Treasury and Investments at AED400.90 million and Retail and Corporate Banking at AED327.74 million.

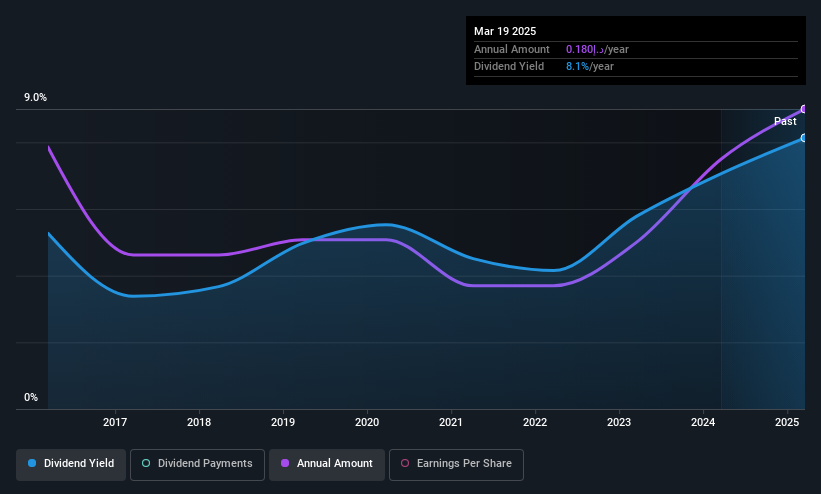

Dividend Yield: 8%

National Bank of Umm Al-Qaiwain (PSC) offers a dividend yield of 8.04%, placing it in the top 25% within the AE market. Despite a reasonable payout ratio of 69.8%, its dividend history is marked by volatility and unreliability over the past decade, with unstable growth patterns. The bank's high level of bad loans at 3.7% and low allowance for them could pose risks to future payouts, though recent earnings showed an increase in net income to AED 185.79 million for Q1 2025 from AED 175.74 million last year, indicating some financial resilience amidst these challenges.

- Get an in-depth perspective on National Bank of Umm Al-Qaiwain (PSC)'s performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of National Bank of Umm Al-Qaiwain (PSC) shares in the market.

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers corporate, institutional, retail, treasury, and Islamic banking services and has a market capitalization of AED143.39 billion.

Operations: Emirates NBD Bank PJSC's revenue is derived from Retail Banking and Wealth Management (AED16.01 billion), Corporate and Institutional Banking (AED10.73 billion), Deniz Bank (AED10.69 billion), and Global Markets and Treasury (AED2.74 billion).

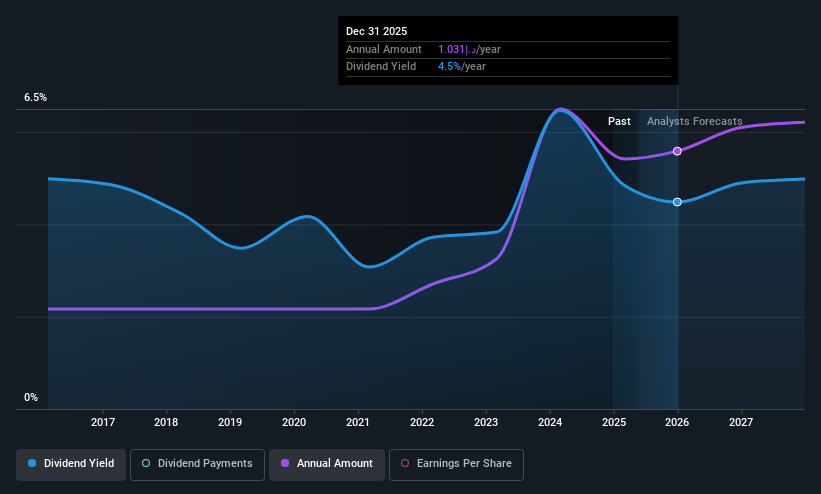

Dividend Yield: 4.4%

Emirates NBD Bank PJSC offers a stable dividend yield of 4.41%, though below the top 25% in the AE market. Its dividends are well-covered by earnings, with a low payout ratio of 28.8%, ensuring sustainability. Despite a high level of non-performing loans at 3%, its price-to-earnings ratio of 6.5x suggests good value compared to peers, and dividend payments have been reliable and growing over the past decade amidst consistent earnings growth.

- Dive into the specifics of Emirates NBD Bank PJSC here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Emirates NBD Bank PJSC is priced lower than what may be justified by its financials.

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company operates in the implementation, establishment, maintenance, operation, installation, and management of telecommunication networks in Saudi Arabia and Algeria with a market cap of SAR411 million.

Operations: Saudi Networkers Services Company generates revenue primarily from its Computer Services segment, totaling SAR571.06 million.

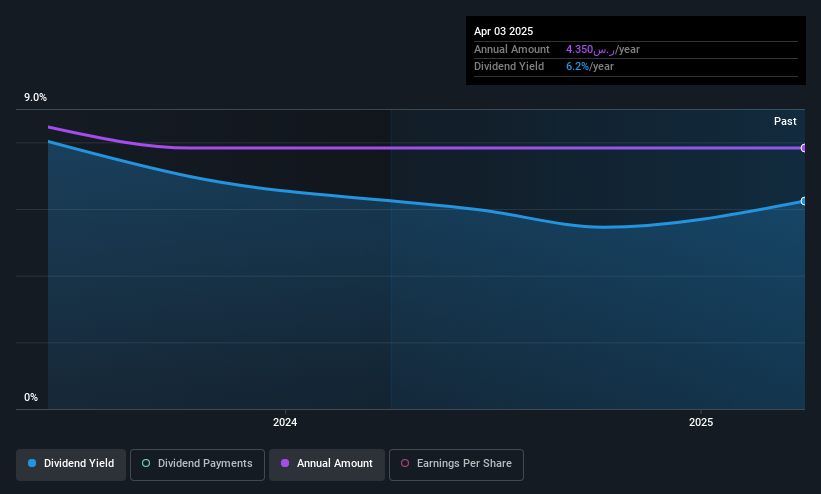

Dividend Yield: 6.4%

Saudi Networkers Services offers a compelling dividend yield in the top 25% of the Saudi market, supported by a sustainable payout ratio of 73.2%. Despite only three years of dividend history, payments have been stable and well-covered by cash flows with a low cash payout ratio of 47.3%. Recent executive changes may introduce some uncertainty; however, its valuation at 63% below estimated fair value could present an attractive opportunity for investors seeking dividends.

- Take a closer look at Saudi Networkers Services' potential here in our dividend report.

- According our valuation report, there's an indication that Saudi Networkers Services' share price might be on the cheaper side.

Turning Ideas Into Actions

- Gain an insight into the universe of 74 Top Middle Eastern Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates NBD Bank PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMIRATESNBD

Emirates NBD Bank PJSC

Provides corporate, institutional, retail, treasury, and Islamic banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives