Could Hewlett Packard Enterprise Company (NYSE:HPE) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

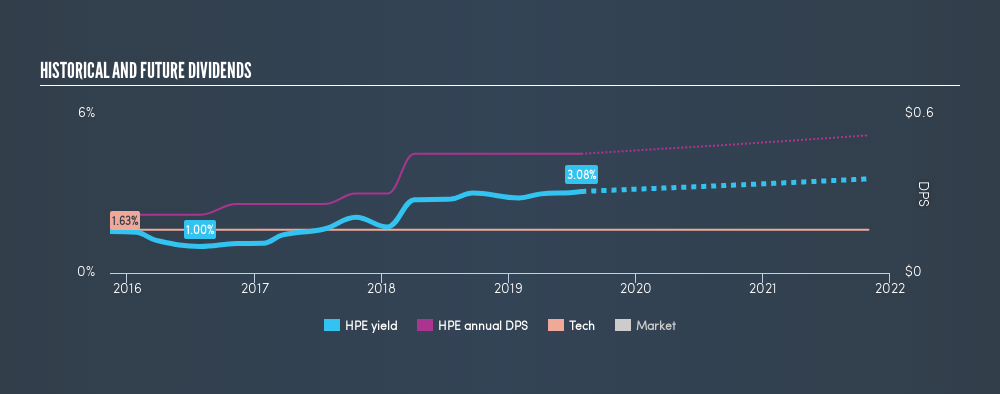

In this case, Hewlett Packard Enterprise likely looks attractive to dividend investors, given its 3.1% dividend yield and four-year payment history. We'd agree the yield does look enticing. The company also bought back stock equivalent to around 17% of market capitalisation this year. Some simple analysis can reduce the risk of holding Hewlett Packard Enterprise for its dividend, and we'll focus on the most important aspects below.

Explore this interactive chart for our latest analysis on Hewlett Packard Enterprise!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 234% of Hewlett Packard Enterprise's profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Hewlett Packard Enterprise paid out 78% of its cash flow last year. This may be sustainable but it does not leave much of a buffer for unexpected circumstances. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Hewlett Packard Enterprise fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Is Hewlett Packard Enterprise's Balance Sheet Risky?

As Hewlett Packard Enterprise's dividend was not well covered by earnings, we need to check its balance sheet for signs of financial distress. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Hewlett Packard Enterprise has net debt of 1.67 times its EBITDA, which we think is not too troublesome.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. Net interest cover of 8.85 times its interest expense appears reasonable for Hewlett Packard Enterprise, although we're conscious that even high interest cover doesn't make a company bulletproof.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the data, we can see that Hewlett Packard Enterprise has been paying a dividend for the past four years. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past four-year period, the first annual payment was US$0.22 in 2015, compared to US$0.45 last year. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Hewlett Packard Enterprise's EPS have fallen by approximately 30% per year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Hewlett Packard Enterprise's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Hewlett Packard Enterprise's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're not keen on the fact that Hewlett Packard Enterprise paid out such a high percentage of its income, although its cashflow is in better shape. Second, the company has not been able to generate earnings growth, and its history of dividend payments too short for us to thoroughly evaluate the dividend's consistency across an economic cycle. Using these criteria, Hewlett Packard Enterprise looks quite suboptimal from a dividend investment perspective.

Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from costs or inflation. See if the 22 analysts are forecasting a turnaround in our free collection of analyst estimates here.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:HPE

Hewlett Packard Enterprise

Develops intelligent solutions in the United States, the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Probably the best stock I've seen all year.

Hims & Hers Health aims for three dimensional revenue expansion

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion