- India

- /

- Diversified Financial

- /

- NSEI:IFCI

What Type Of Returns Would IFCI's(NSE:IFCI) Shareholders Have Earned If They Purchased Their SharesThree Years Ago?

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of IFCI Limited (NSE:IFCI), who have seen the share price tank a massive 72% over a three year period. That would certainly shake our confidence in the decision to own the stock. Unhappily, the share price slid 2.2% in the last week.

See our latest analysis for IFCI

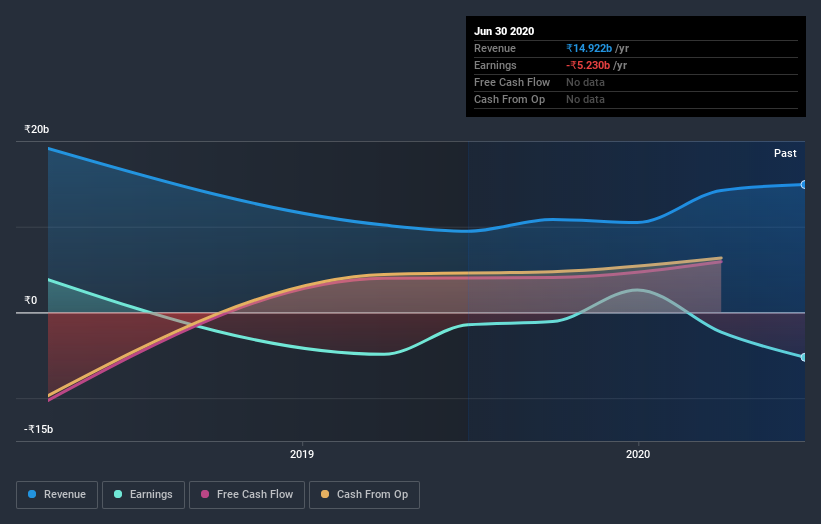

Given that IFCI didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in IFCI had a tough year, with a total loss of 9.5%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for IFCI you should be aware of, and 2 of them are a bit unpleasant.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading IFCI or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:IFCI

IFCI

Provides non-banking financial services to the public sector in India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives