- United States

- /

- Transportation

- /

- OTCPK:TSPH

Undervalued Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences gains amid trade news with China and a surge in oil futures, investors are keeping a close eye on emerging opportunities. Penny stocks, despite their somewhat outdated label, remain an intriguing area for those interested in smaller or newer companies that might offer untapped potential. These stocks can provide growth opportunities at lower price points when supported by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.89 | $394.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.77 | $654.61M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.38 | $261.26M | ✅ 4 ⚠️ 2 View Analysis > |

| GoodRx Holdings (GDRX) | $3.77 | $1.35B | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.975 | $56.12M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.22 | $53.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.94 | $24.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9611 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.31 | $78.39M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 366 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Smart Share Global (EM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Smart Share Global Limited is a consumer tech company offering mobile device charging services through both online and offline networks in the People's Republic of China, with a market cap of approximately $332.23 million.

Operations: The company's revenue is derived from two main segments: Mobile Device Charging, which generates CN¥1.41 billion, and Pv Business, contributing CN¥479.85 million.

Market Cap: $332.23M

Smart Share Global, with a market cap of US$332.23 million, operates in China's consumer tech sector and remains unprofitable despite reducing losses by a significant rate over the past five years. The company is debt-free, marking an improvement from five years ago when its debt-to-equity ratio was 39.2%. Its seasoned management team averages 6.8 years of tenure, and the board is considered experienced as well. Short-term assets of CN¥3.9 billion comfortably cover both short- and long-term liabilities, indicating solid financial positioning despite ongoing profitability challenges in its mobile device charging segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Smart Share Global.

- Gain insights into Smart Share Global's past trends and performance with our report on the company's historical track record.

GoPro (GPRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoPro, Inc. is a company that offers cameras, mountable and wearable accessories, as well as subscription services across various regions including the Americas and Asia Pacific, with a market cap of approximately $348 million.

Operations: The company generates revenue primarily from its photographic equipment and supplies segment, which accounted for $746.73 million.

Market Cap: $348M

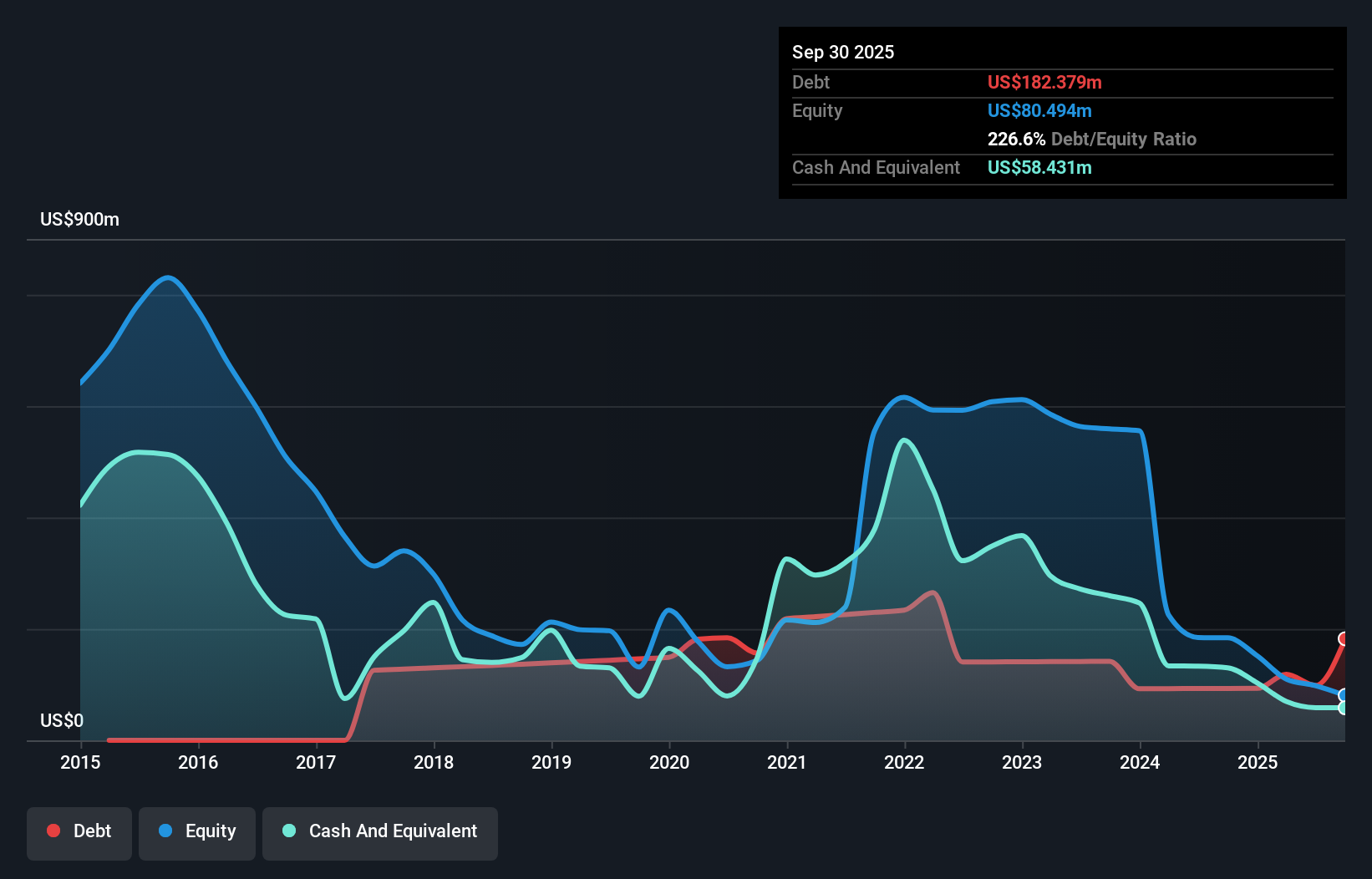

GoPro, Inc., with a market cap of approximately US$348 million, recently launched new products including the MAX2 360 camera and Fluid Pro AI gimbal, aiming to enhance its offerings in the action camera market. Despite these innovations, GoPro remains unprofitable with a negative return on equity of -110.84%, and its earnings have declined significantly over the past five years. The company's short-term assets do not cover its short-term liabilities, although it has taken steps to improve financial flexibility through debt restructuring and capital raising initiatives. Its seasoned management team averages seven years of tenure.

- Get an in-depth perspective on GoPro's performance by reading our balance sheet health report here.

- Gain insights into GoPro's outlook and expected performance with our report on the company's earnings estimates.

CreateAI Holdings (TSPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CreateAI Holdings Inc. is an artificial intelligence technology company specializing in video game and anime production and publishing, with a market cap of $108.66 million.

Operations: CreateAI Holdings Inc. has not reported any revenue segments.

Market Cap: $108.66M

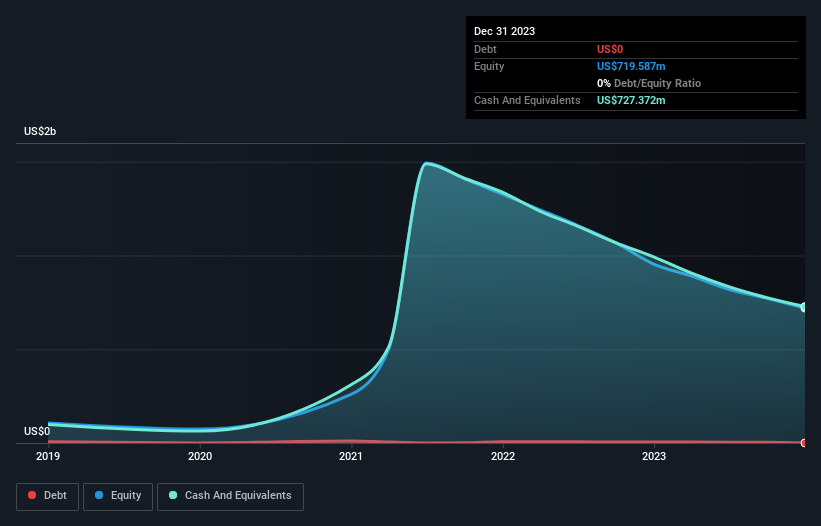

CreateAI Holdings Inc., with a market cap of US$108.66 million, is pre-revenue, reporting only US$0.013 million in sales for the recent quarter. Despite this, the company has made significant strides in AI technology for anime production with its Animon platform, which has gained acclaim since its launch in China. The recent debut of Animon Studio offers professional-grade tools to creators and studios, enhancing efficiency and creative control. Additionally, CreateAI's new motion capture center in Beijing supports high-precision content production for video games and animation, underscoring its commitment to digital innovation.

- Dive into the specifics of CreateAI Holdings here with our thorough balance sheet health report.

- Learn about CreateAI Holdings' historical performance here.

Next Steps

- Navigate through the entire inventory of 366 US Penny Stocks here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TSPH

CreateAI Holdings

An artificial intelligence technology, focuses on video game and anime production and publishing activities to digital entertainment content.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives