- United Kingdom

- /

- Basic Materials

- /

- AIM:SRC

UK's September 2025 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In recent weeks, the UK stock market has faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China and declining commodity prices impacting major companies. As these global economic pressures weigh on London markets, investors may find potential opportunities in stocks that are trading below their estimated value. Identifying undervalued stocks often involves looking for companies with strong fundamentals that may be temporarily overlooked by the market amidst broader economic concerns.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TBC Bank Group (LSE:TBCG) | £45.50 | £89.78 | 49.3% |

| SigmaRoc (AIM:SRC) | £1.244 | £2.41 | 48.5% |

| PageGroup (LSE:PAGE) | £2.282 | £4.45 | 48.7% |

| Moonpig Group (LSE:MOON) | £2.03 | £4.01 | 49.4% |

| LSL Property Services (LSE:LSL) | £2.88 | £5.60 | 48.5% |

| Gym Group (LSE:GYM) | £1.476 | £2.90 | 49.2% |

| Gooch & Housego (AIM:GHH) | £5.62 | £10.85 | 48.2% |

| Essentra (LSE:ESNT) | £0.978 | £1.95 | 49.7% |

| Burberry Group (LSE:BRBY) | £10.72 | £20.94 | 48.8% |

| AstraZeneca (LSE:AZN) | £114.14 | £222.61 | 48.7% |

Let's explore several standout options from the results in the screener.

SigmaRoc (AIM:SRC)

Overview: SigmaRoc plc, with a market cap of £1.39 billion, operates through its subsidiaries to invest in and acquire projects within the quarried materials sector.

Operations: The company's revenue primarily comes from the production and sale of construction material products and services, amounting to £1.02 billion.

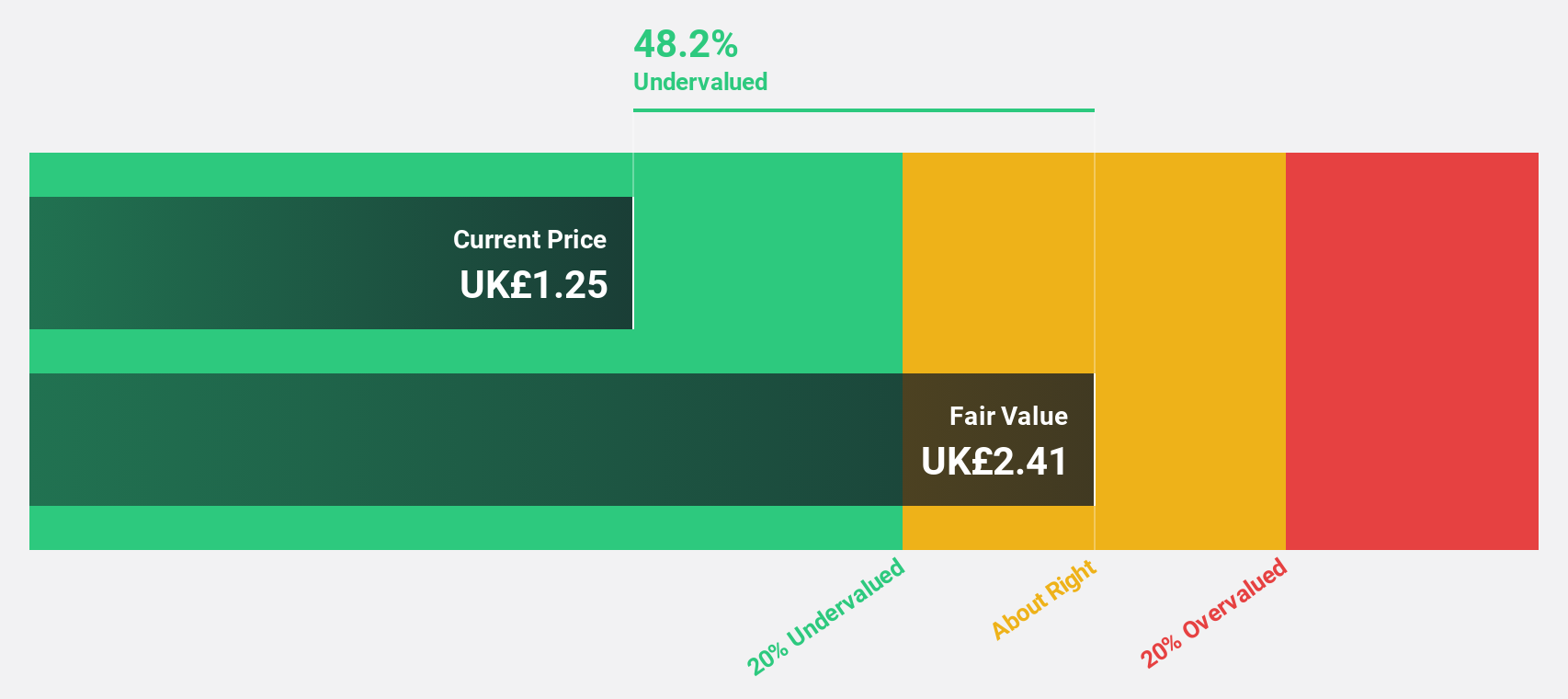

Estimated Discount To Fair Value: 48.5%

SigmaRoc is trading at £1.24, significantly below its estimated fair value of £2.41, indicating it's undervalued based on cash flows. Recent earnings show a substantial increase in net income to £24.32 million from £3.25 million year-on-year, despite lower return on equity forecasts (13.2%). While revenue growth is modest at 4.9% annually, profit growth is expected to be robust at 31%, outpacing the UK market's average of 13.8%.

- Our growth report here indicates SigmaRoc may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of SigmaRoc.

AO World (LSE:AO.)

Overview: AO World plc, along with its subsidiaries, operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market capitalization of approximately £537.63 million.

Operations: The company's revenue is primarily derived from its online retailing of domestic appliances and ancillary services, amounting to £1.14 billion.

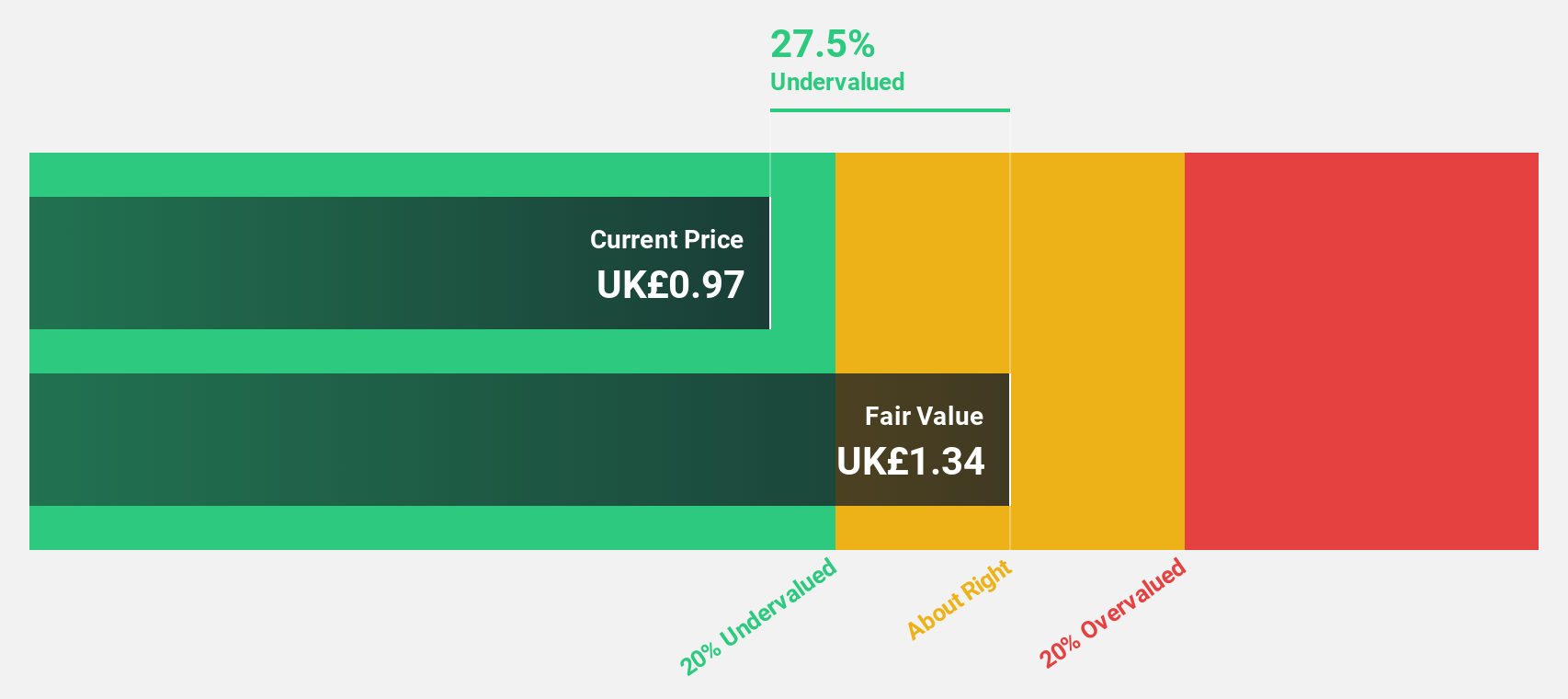

Estimated Discount To Fair Value: 27.3%

AO World is trading at £0.95, below its estimated fair value of £1.31, highlighting its undervaluation based on cash flows. Although earnings are forecast to grow significantly at 35.9% annually, profit margins have decreased to 0.9% from last year's 2.4%. Revenue growth is expected to outpace the UK market at 8.2% per year but remains slower than desired benchmarks. Recent board changes include Sophie Tomkins' appointment as an Independent Non-Executive Director, enhancing AO's governance structure.

- According our earnings growth report, there's an indication that AO World might be ready to expand.

- Navigate through the intricacies of AO World with our comprehensive financial health report here.

TBC Bank Group (LSE:TBCG)

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to both corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market capitalization of £2.52 billion.

Operations: The company's revenue is primarily generated from Georgian Financial Services, contributing GEL 2.38 billion, and Uzbekistan Operations, adding GEL 408.17 million.

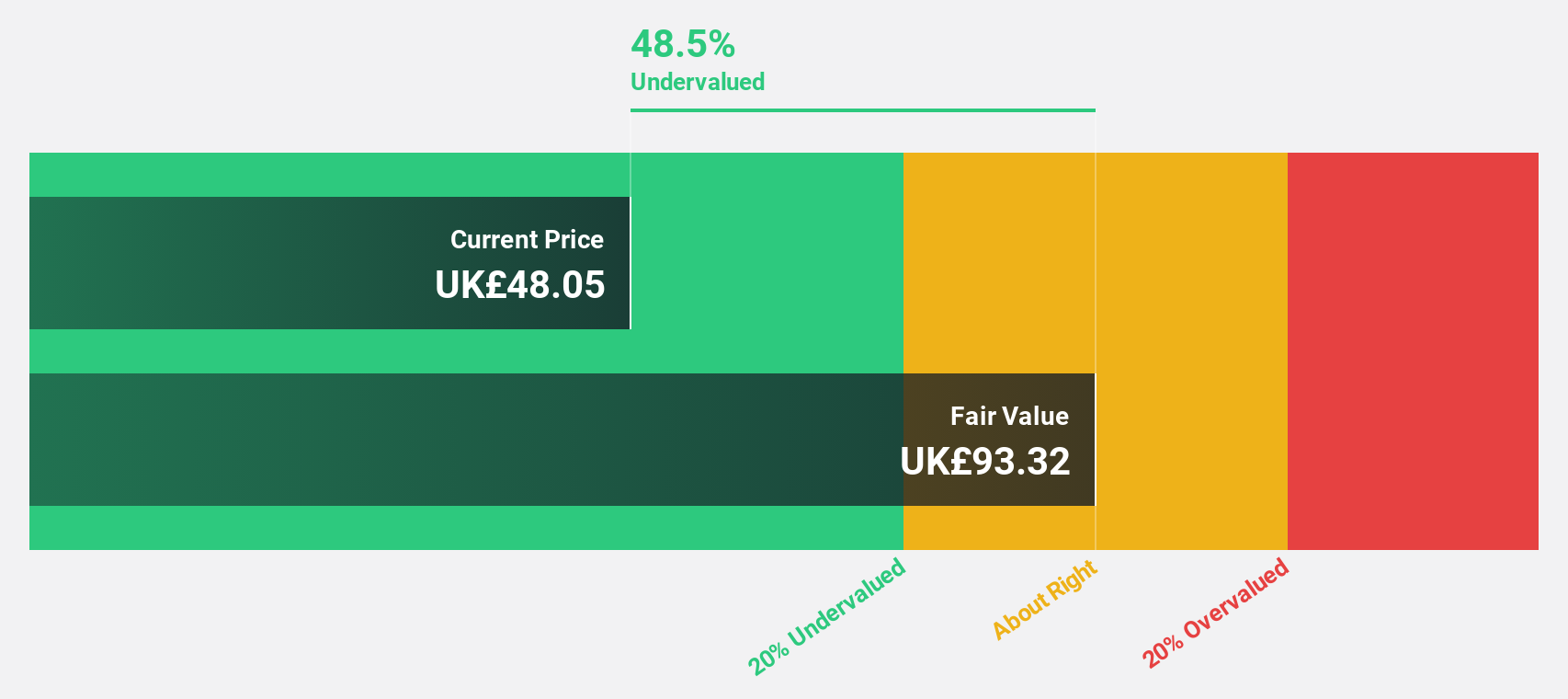

Estimated Discount To Fair Value: 49.3%

TBC Bank Group is trading at £45.5, significantly below its estimated fair value of £89.78, suggesting an undervaluation based on cash flows. Recent earnings reports show net interest income and net income growth, while the company announced a GEL 75 million share buyback program to return excess capital to shareholders. Despite a high level of bad loans at 2.5%, revenue and earnings are forecast to grow faster than the UK market, enhancing its investment appeal.

- Our comprehensive growth report raises the possibility that TBC Bank Group is poised for substantial financial growth.

- Get an in-depth perspective on TBC Bank Group's balance sheet by reading our health report here.

Make It Happen

- Get an in-depth perspective on all 55 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SRC

SigmaRoc

Through its subsidiaries, invests in and/or acquires projects in the quarried materials sector.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives