- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

UK Value Stocks: Crest Nicholson Holdings And 2 Other Companies That May Be Trading Below Their Estimated Worth

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. In this environment, investors may be particularly interested in identifying stocks that are potentially undervalued, as these could offer opportunities for growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £5.97 | £11.87 | 49.7% |

| Topps Tiles (LSE:TPT) | £0.38 | £0.7 | 45.5% |

| TBC Bank Group (LSE:TBCG) | £49.60 | £96.96 | 48.8% |

| Moonpig Group (LSE:MOON) | £2.125 | £4.01 | 47% |

| Marlowe (AIM:MRL) | £4.37 | £8.36 | 47.7% |

| LSL Property Services (LSE:LSL) | £3.06 | £5.91 | 48.2% |

| Informa (LSE:INF) | £8.342 | £16.06 | 48% |

| Hostelworld Group (LSE:HSW) | £1.29 | £2.57 | 49.9% |

| Burberry Group (LSE:BRBY) | £12.355 | £23.83 | 48.1% |

| 1Spatial (AIM:SPA) | £0.44 | £0.81 | 46% |

Below we spotlight a couple of our favorites from our exclusive screener.

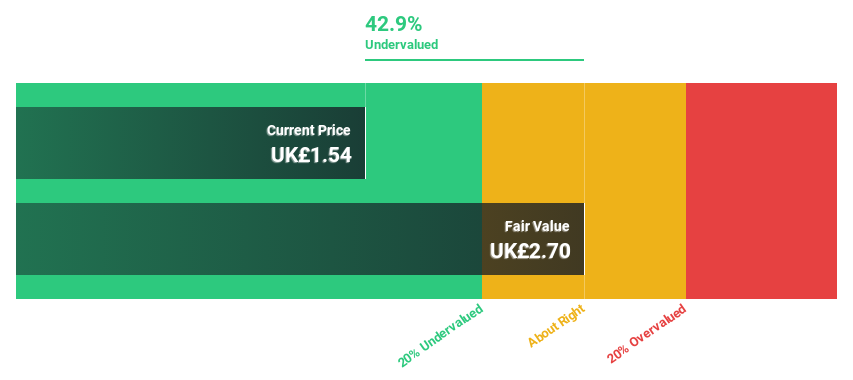

Crest Nicholson Holdings (LSE:CRST)

Overview: Crest Nicholson Holdings plc is a UK-based company specializing in the construction of residential homes, with a market cap of £482.95 million.

Operations: The company generates revenue of £610.20 million from its home building activities in the residential and commercial sectors within the United Kingdom.

Estimated Discount To Fair Value: 19.7%

Crest Nicholson Holdings is trading at £1.88, below its estimated fair value of £2.35, suggesting it may offer good value based on discounted cash flow analysis. Despite a slower revenue growth forecast of 7.5% annually, earnings are expected to grow significantly at 73.89% per year, with profitability anticipated within three years—above average market growth. Recent half-year results showed a turnaround with net income of £6.7 million compared to a loss last year and an interim dividend declared by the board.

- Insights from our recent growth report point to a promising forecast for Crest Nicholson Holdings' business outlook.

- Unlock comprehensive insights into our analysis of Crest Nicholson Holdings stock in this financial health report.

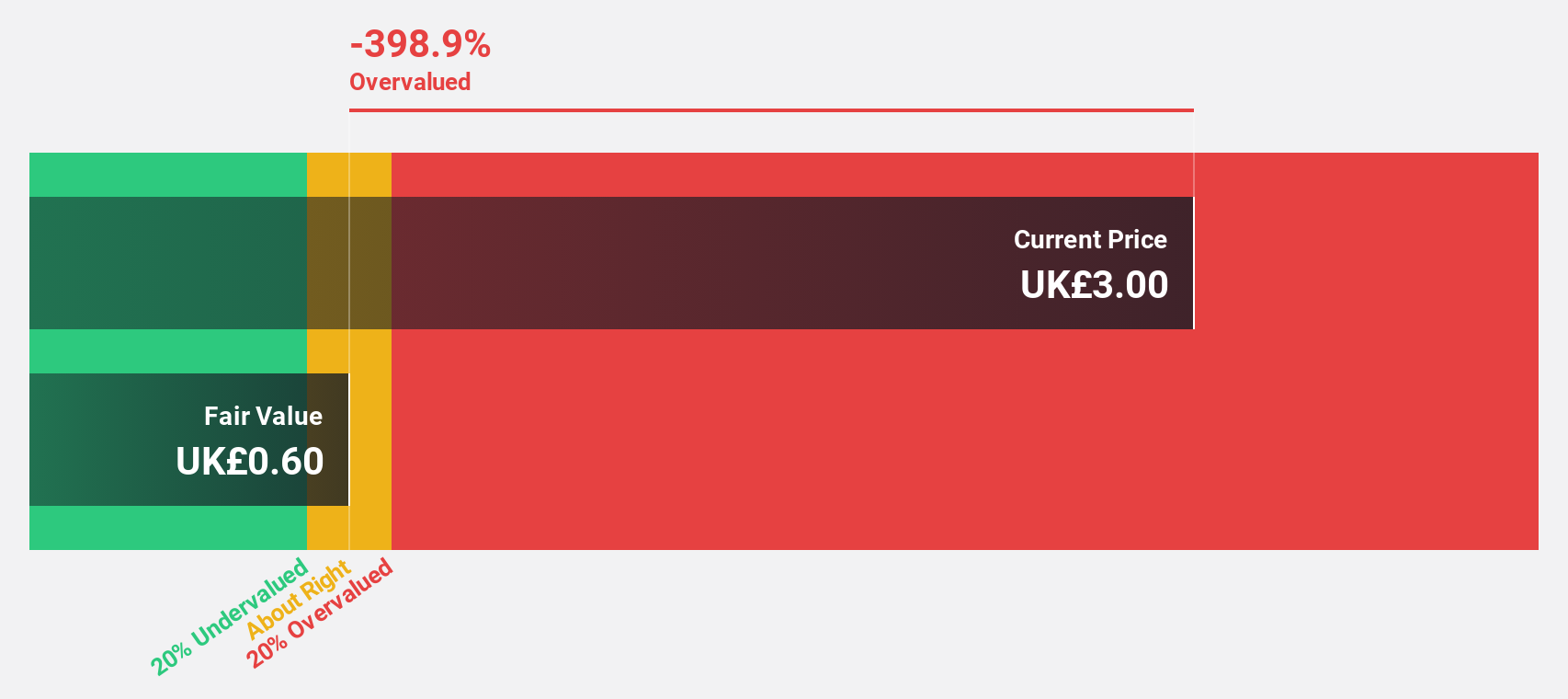

LSL Property Services (LSE:LSL)

Overview: LSL Property Services plc, with a market cap of £315.07 million, provides business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders in the United Kingdom.

Operations: LSL Property Services generates revenue through its Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million) segments in the United Kingdom.

Estimated Discount To Fair Value: 48.2%

LSL Property Services is currently priced at £3.06, substantially below its fair value estimate of £5.91, indicating potential undervaluation based on discounted cash flow analysis. Despite a modest revenue growth forecast of 6.7% annually, earnings are projected to increase by 16.46% per year, outpacing the UK market's growth rate. The company's recent dividend affirmation and buyback plan extension may further support investor confidence amidst an unstable dividend history and executive changes.

- According our earnings growth report, there's an indication that LSL Property Services might be ready to expand.

- Navigate through the intricacies of LSL Property Services with our comprehensive financial health report here.

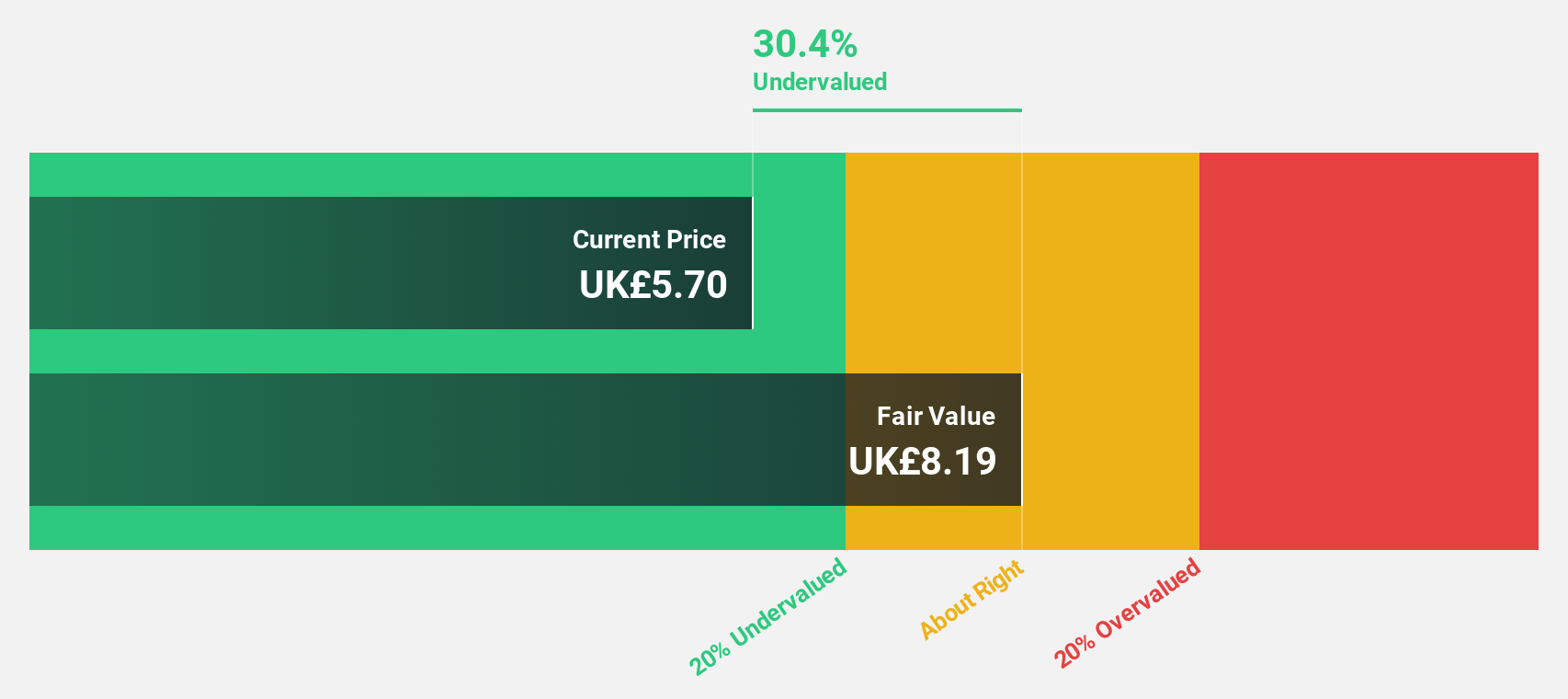

Vp (LSE:VP.)

Overview: Vp plc offers equipment rental and associated services both in the United Kingdom and internationally, with a market cap of £225.18 million.

Operations: The company generates revenue from its operations in the United Kingdom, amounting to £325.49 million, and internationally, contributing £62.34 million.

Estimated Discount To Fair Value: 30.6%

Vp plc is trading at £5.7, significantly below its estimated fair value of £8.22, highlighting potential undervaluation based on discounted cash flow analysis. Despite a high debt level and a dividend yield of 6.93% not covered by earnings or free cash flows, the company has returned to profitability with net income of £14.45 million for the year ending March 31, 2025. Earnings are forecast to grow substantially at 23.55% annually, outpacing the UK market's growth rate.

- The growth report we've compiled suggests that Vp's future prospects could be on the up.

- Take a closer look at Vp's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 57 hidden gems among our Undervalued UK Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agent franchisees, and valuation services to lenders in the United Kingdom.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion