- United Kingdom

- /

- Oil and Gas

- /

- LSE:GKP

UK Penny Stocks Under £500M Market Cap To Watch

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced a downturn, with the FTSE 100 index closing lower following weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market fluctuations, there remains potential in exploring smaller or newer companies that are often categorized as penny stocks. While the term may seem outdated, these stocks can still offer significant value and stability for investors who focus on those with strong financial foundations and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.435 | £498.13M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.17 | £336.88M | ✅ 4 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.85 | £1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.44 | £47.61M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.886 | £327.62M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.17 | £326.55M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.725 | £133.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.825 | £11.36M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.10 | £65.3M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc focuses on designing, developing, and commercializing medical devices for asthma diagnosis, monitoring, and management globally with a market cap of £283.94 million.

Operations: The company generates revenue primarily from its NIOX® segment, which reported £41.8 million.

Market Cap: £283.94M

NIOX Group Plc, with a market cap of £283.94 million, has seen recent volatility in its share price and significant insider selling. Despite this, the company remains debt-free and has stable short-term assets exceeding both its short- and long-term liabilities. Recent earnings showed a decrease in net income to £3.7 million from £10.7 million the previous year, with profit margins dropping to 8.1%. The cancellation of a proposed acquisition by Keensight Capital highlights uncertainties in its strategic direction amid macroeconomic challenges. Nonetheless, NIOX continues to generate revenue primarily through its NIOX® segment (£41.8 million).

- Click to explore a detailed breakdown of our findings in NIOX Group's financial health report.

- Explore NIOX Group's analyst forecasts in our growth report.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Polar Capital Holdings plc is a publicly owned investment manager with a market cap of £457.44 million.

Operations: Polar Capital Holdings plc has not reported any specific revenue segments.

Market Cap: £457.44M

Polar Capital Holdings plc, with a market cap of £457.44 million, has demonstrated financial stability with short-term assets of £209.7 million surpassing both its short- and long-term liabilities. Despite recent negative earnings growth and declining profit margins from 20.6% to 15.6%, the company remains debt-free, ensuring no concerns over interest payments or debt coverage by cash flow. The firm trades at an attractive valuation, approximately 15.1% below estimated fair value, although its dividend yield of 9.69% is not well covered by earnings alone. Recent leadership changes may influence future strategic direction as Iain Evans prepares to assume the CEO role in September 2025.

- Get an in-depth perspective on Polar Capital Holdings' performance by reading our balance sheet health report here.

- Gain insights into Polar Capital Holdings' outlook and expected performance with our report on the company's earnings estimates.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq with a market cap of £366.57 million.

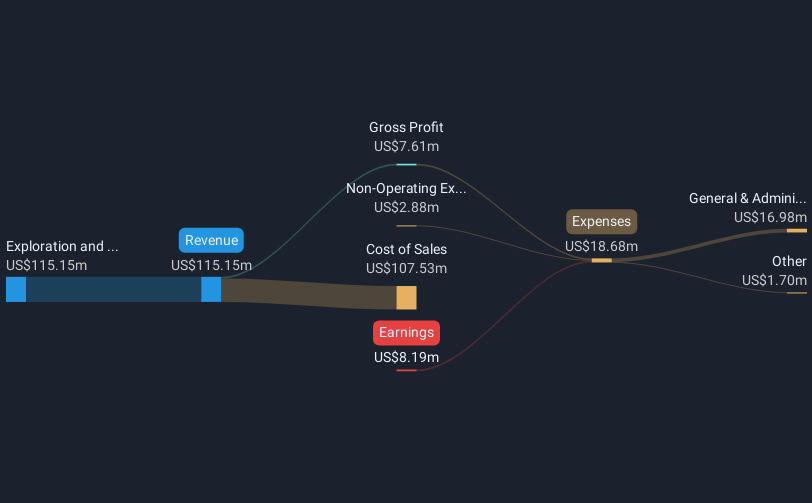

Operations: The company generates revenue of $151.21 million from its oil and gas exploration and production activities in the Kurdistan Region of Iraq.

Market Cap: £366.57M

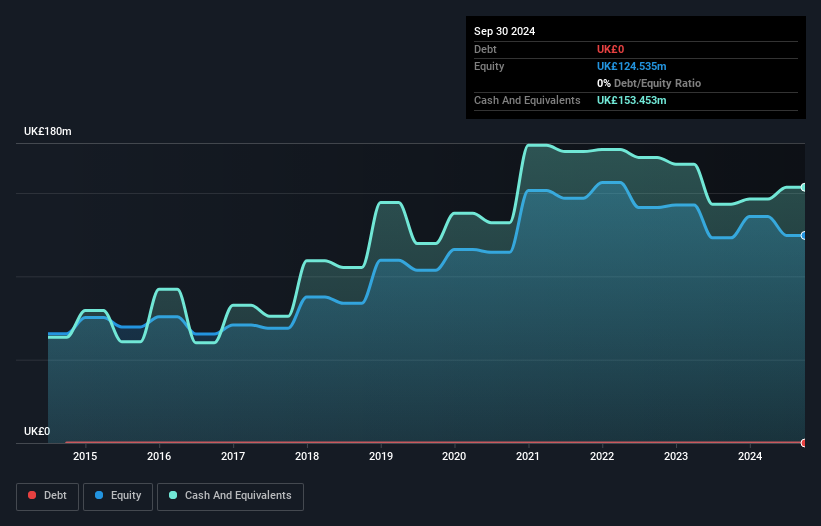

Gulf Keystone Petroleum Limited, with a market cap of £366.57 million, operates without debt, enhancing its financial flexibility. The company's short-term assets of $139 million exceed both short- and long-term liabilities, indicating solid liquidity management. Recently becoming profitable, Gulf Keystone's earnings have grown by 4.7% annually over the past five years and are forecasted to increase significantly in the future. However, its 9.93% dividend yield is not well supported by current earnings. The management team is experienced with an average tenure of 3.8 years, though the board lacks similar experience at just 1.9 years on average.

- Dive into the specifics of Gulf Keystone Petroleum here with our thorough balance sheet health report.

- Assess Gulf Keystone Petroleum's future earnings estimates with our detailed growth reports.

Next Steps

- Jump into our full catalog of 295 UK Penny Stocks here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GKP

Gulf Keystone Petroleum

Engages in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives