- United Kingdom

- /

- Retail Distributors

- /

- AIM:SUP

UK Penny Stocks To Consider In October 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors may find opportunities in penny stocks, which, although an older term, remain relevant for those seeking smaller or newer companies with potential for growth. These stocks can offer a blend of value and resilience that larger firms might not provide, making them interesting options for investors looking to explore under-the-radar opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.645 | £520.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.25 | £181.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.115 | £15.34M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.545 | $316.82M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.51 | £257.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.465 | £70.76M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.08 | £172.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.745 | £10.26M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.38 | £72.51M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

IQE (AIM:IQE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IQE plc, along with its subsidiaries, develops, manufactures, and sells advanced semiconductor materials and has a market capitalization of approximately £67.45 million.

Operations: The company's revenue is derived from three segments: CMOS++ (£0.45 million), Wireless (£47.11 million), and Photonics, including Infra-Red (£49.70 million).

Market Cap: £67.45M

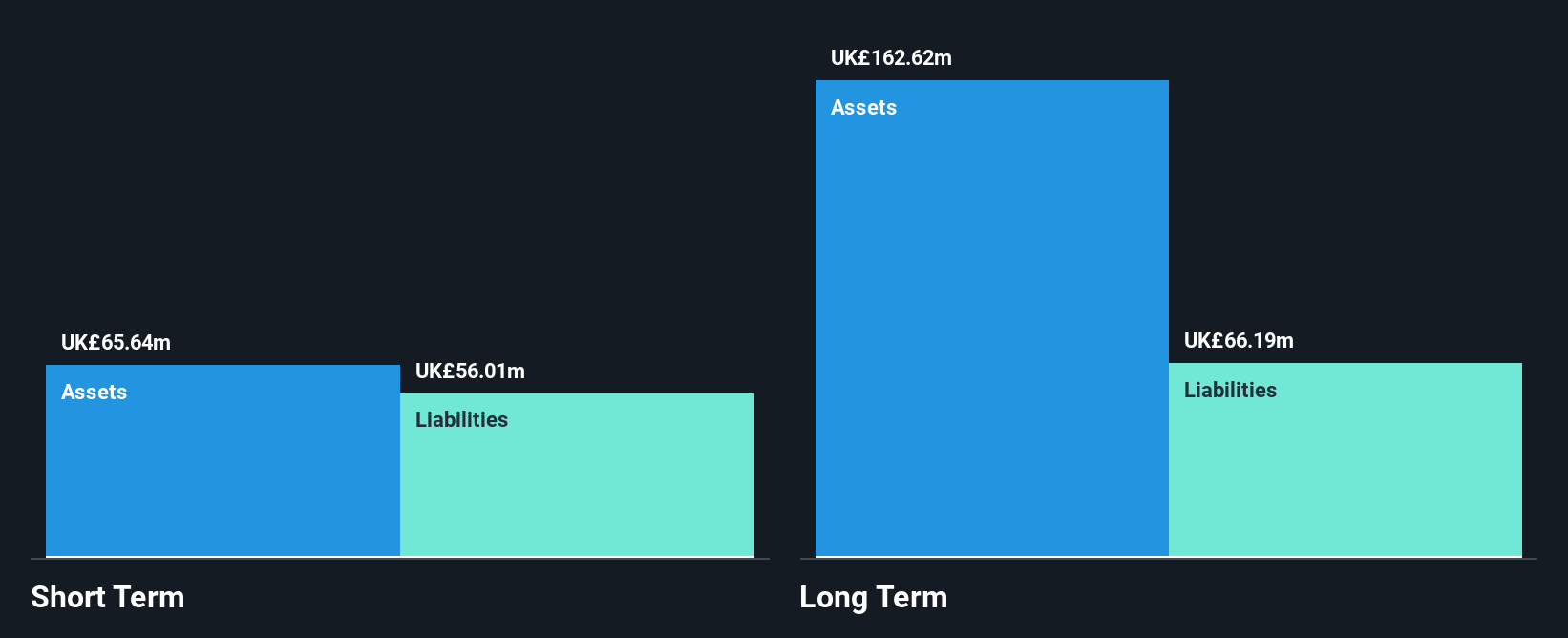

IQE plc, with a market cap of £67.45 million, has faced challenges as evidenced by its recent earnings report showing a net loss of £26.04 million for the first half of 2025, compared to a loss of £15.07 million the previous year. Despite revenue forecasts between £90-100 million for 2025, its financial health is strained with short-term assets barely covering long-term liabilities and an increased debt-to-equity ratio over five years. The company's share price remains highly volatile, though it benefits from a seasoned management team and sufficient cash runway to potentially stabilize operations in the near term.

- Jump into the full analysis health report here for a deeper understanding of IQE.

- Gain insights into IQE's outlook and expected performance with our report on the company's earnings estimates.

Supreme (AIM:SUP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Supreme Plc is a company that owns, manufactures, and distributes fast-moving branded and discounted consumer goods across the UK, Ireland, the Netherlands, France, the rest of Europe, and internationally with a market cap of £199.44 million.

Operations: The company generates revenue through its diverse business lines, including £128.95 million from vaping, £53.37 million from electricals, and £48.76 million from drinks and wellness.

Market Cap: £199.44M

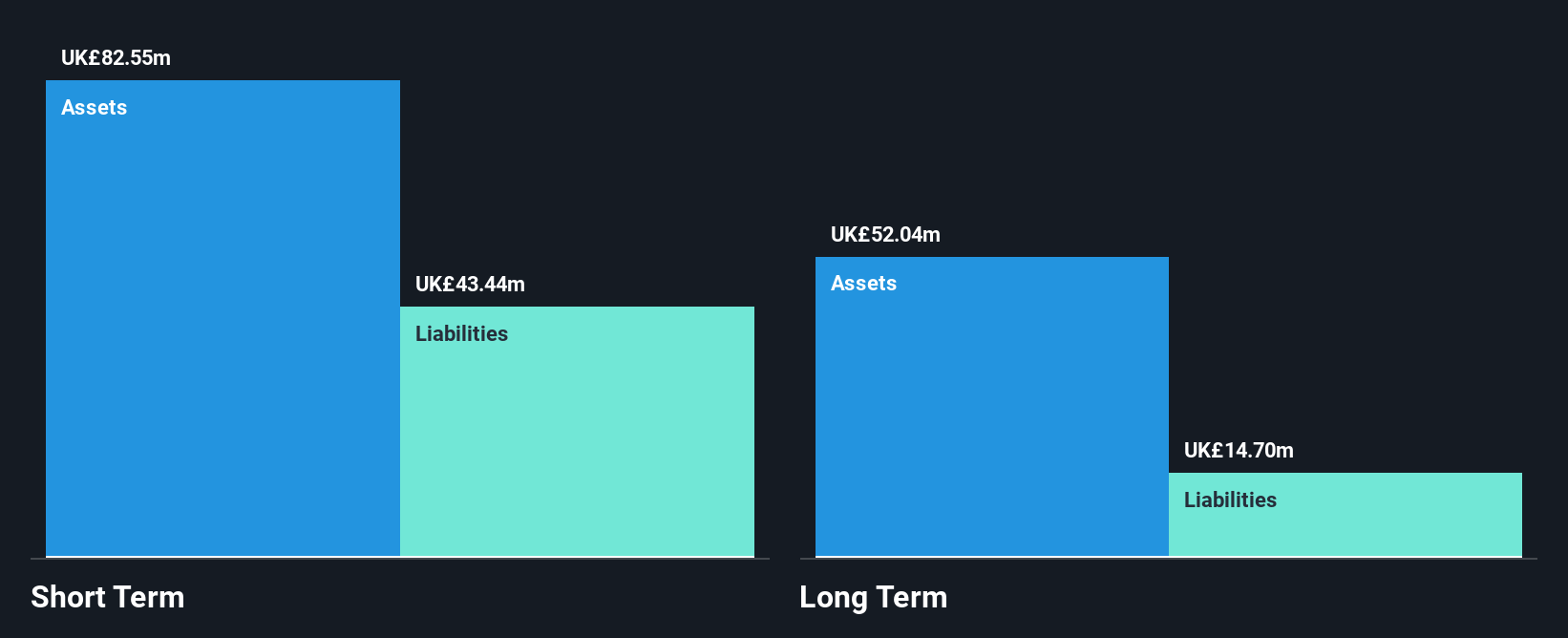

Supreme Plc, with a market cap of £199.44 million, demonstrates strong financial health and operational stability. The company generates significant revenue from diverse business lines, including vaping (£128.95M), electricals (£53.37M), and drinks and wellness (£48.76M). Its earnings have grown significantly by 21.8% per year over the past five years, though recent growth has slowed to 4.6%. Supreme's debt is well covered by operating cash flow at a very large rate of 1202.3%, and its short-term assets exceed both short- and long-term liabilities comfortably, indicating solid liquidity management amidst stable weekly volatility levels (4%).

- Take a closer look at Supreme's potential here in our financial health report.

- Gain insights into Supreme's future direction by reviewing our growth report.

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bloomsbury Publishing Plc is a global publisher offering academic, educational, and general fiction and non-fiction books for a diverse audience including children, educators, students, researchers, libraries, and professionals with a market cap of £398.14 million.

Operations: The company's revenue is primarily derived from its Consumer segment (£256 million), with additional contributions from the Non-Consumer segments, including Special Interest (£21.7 million) and Academic & Professional (£83.3 million).

Market Cap: £398.14M

Bloomsbury Publishing Plc, with a market cap of £398.14 million, has demonstrated financial resilience despite recent challenges. The company reported half-year sales of £159.5 million, down from £179.8 million the previous year, and net income decreased to £13.8 million from £16.6 million. While its earnings growth has been negative recently at -21.2%, Bloomsbury maintains high-quality earnings and robust liquidity with short-term assets exceeding liabilities significantly (£220.2M vs £136.4M). The company's debt is well-covered by operating cash flow, reflecting prudent financial management despite being dropped from key indices like FTSE 250 and FTSE 350 recently.

- Unlock comprehensive insights into our analysis of Bloomsbury Publishing stock in this financial health report.

- Evaluate Bloomsbury Publishing's prospects by accessing our earnings growth report.

Where To Now?

- Explore the 295 names from our UK Penny Stocks screener here.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SUP

Supreme

Owns, manufactures, and distributes fast-moving branded and discounted consumer goods in the United Kingdom, Ireland, the Netherlands, France, rest of Europe, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion