- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

UK Penny Stocks: ActiveOps Leads The Trio To Consider

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 index faltering due to weak trade data from China, highlighting global economic uncertainties. For investors seeking opportunities amid these conditions, penny stocks—despite their somewhat outdated name—remain a relevant area of interest. These smaller or newer companies can offer a combination of value and growth potential when supported by strong financials, making them intriguing options for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 3 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.82 | £1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.435 | £47.07M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.886 | £327.62M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.65 | £131.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.87 | £238.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.095 | £174.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.845 | £11.63M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.16 | £66.99M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ActiveOps (AIM:AOM)

Simply Wall St Financial Health Rating: ★★★★★★

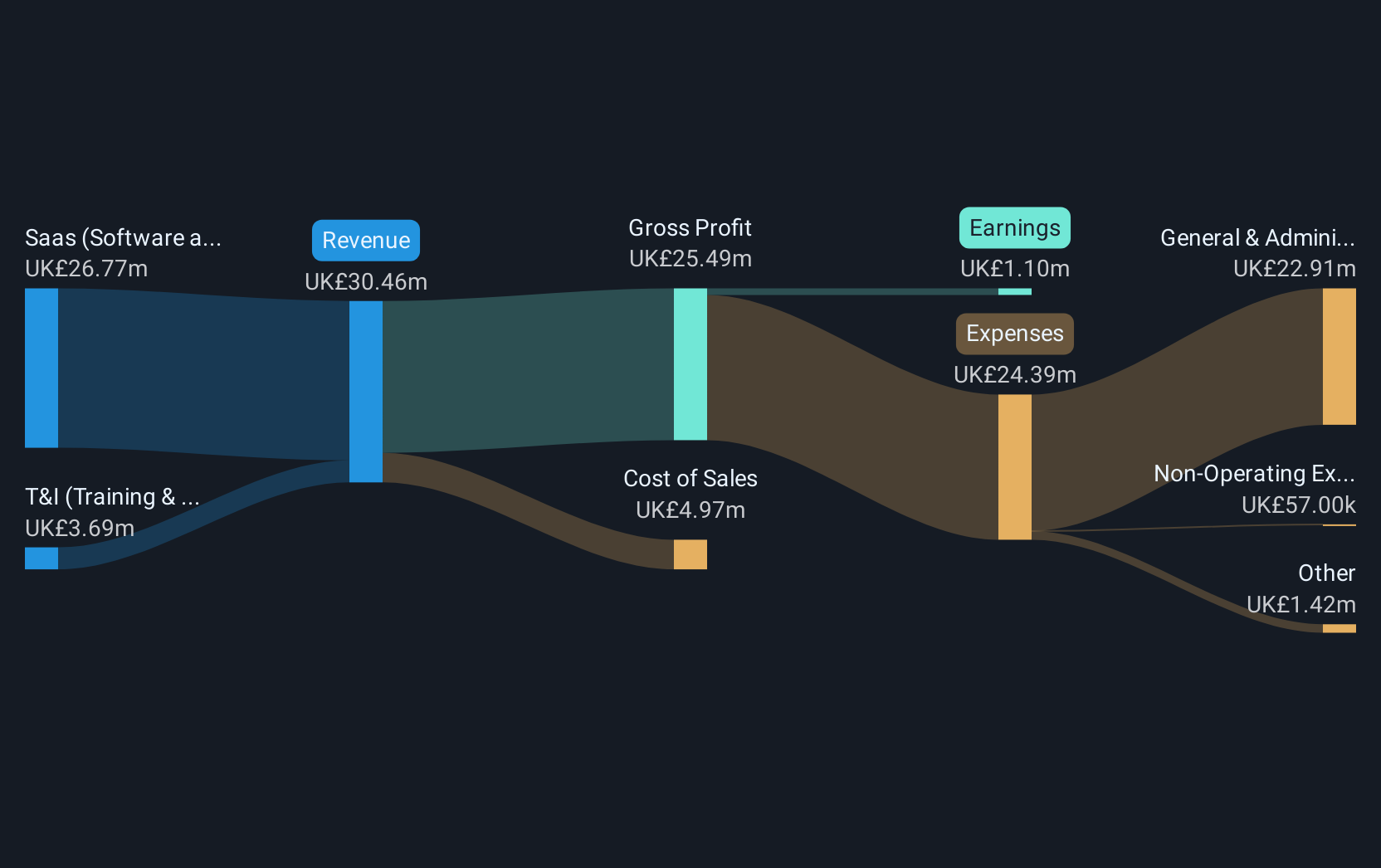

Overview: ActiveOps Plc provides hosted operations management software as a service solution across various industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific with a market cap of £104.19 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: £104.19M

ActiveOps has demonstrated strong financial health with short-term assets exceeding both short and long-term liabilities, and it remains debt-free. The company reported a net income of £1.1 million for the year ending March 31, 2025, showing growth from the previous year. Its earnings have been growing consistently, albeit at a slower pace than its five-year average. Analysts expect continued earnings growth of over 43% annually. Recent partnerships, such as becoming the Official Data Analytics Partner for The British & Irish Lions Tour to Australia in 2025, could enhance brand visibility and market reach.

- Click here and access our complete financial health analysis report to understand the dynamics of ActiveOps.

- Understand ActiveOps' earnings outlook by examining our growth report.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

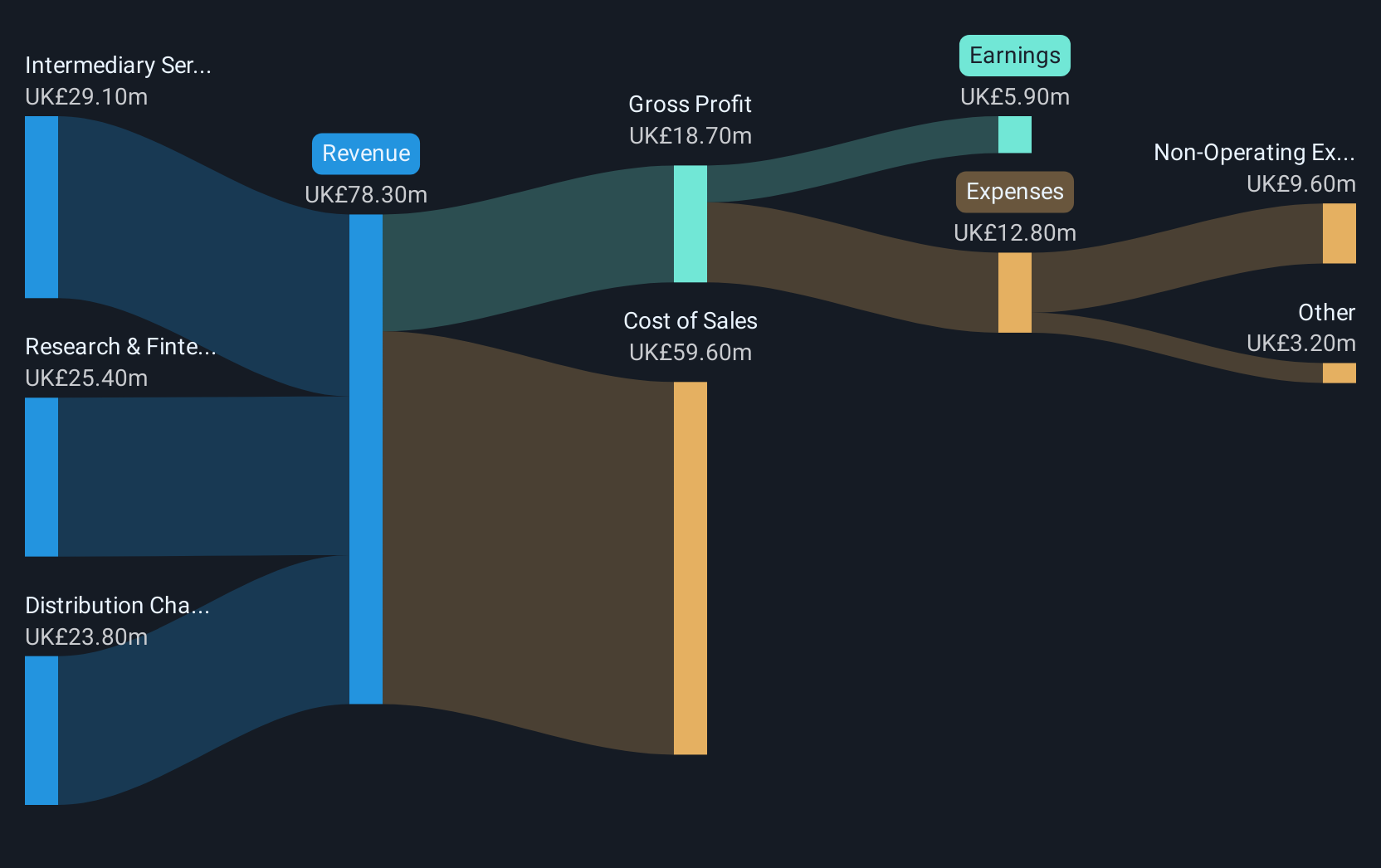

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £265.69 million.

Operations: Fintel generates its revenue through three primary segments: Research & Fintech (£25.4 million), Distribution Channels (£23.8 million), and Intermediary Services (£29.1 million).

Market Cap: £265.69M

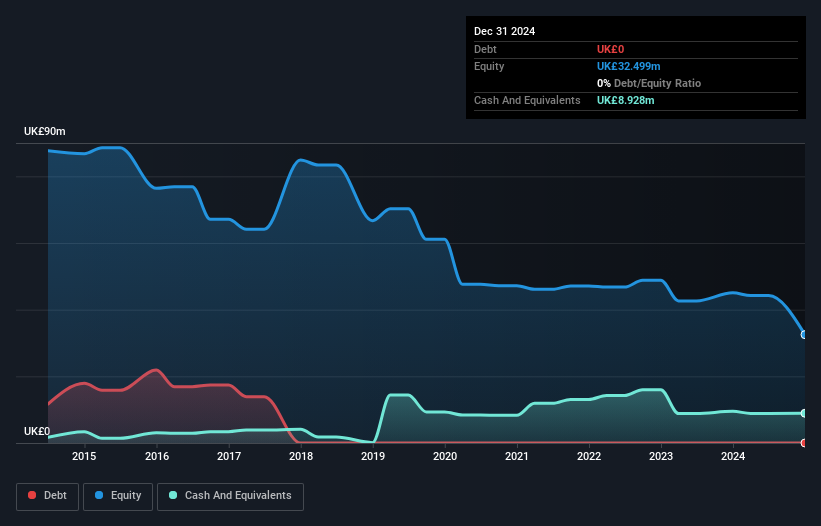

Fintel Plc, with a market cap of £265.69 million, has seen its debt-to-equity ratio improve significantly over the past five years, now at 29.4%, indicating effective debt management. However, short-term assets (£21.8M) fall short of covering both short and long-term liabilities (£27.6M and £39.5M respectively). Despite negative earnings growth last year (-16.9%) and declining profit margins (7.5% from 10.9%), analysts expect future earnings to grow by 30% annually. Recent board changes include the appointment of Ian Pickford as an independent non-executive director, potentially strengthening strategic direction in wealth management services.

- Dive into the specifics of Fintel here with our thorough balance sheet health report.

- Evaluate Fintel's prospects by accessing our earnings growth report.

Centaur Media (LSE:CAU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Centaur Media Plc provides business information, learning, and specialist consultancy services to professional and commercial markets globally, with a market cap of £48.63 million.

Operations: The company generates revenue from two main segments: Xeim, contributing £26.21 million, and The Lawyer, which accounts for £8.91 million.

Market Cap: £48.63M

Centaur Media Plc, with a market cap of £48.63 million, is currently unprofitable but has managed to reduce losses over the past five years. The company maintains a stable cash runway exceeding three years due to positive free cash flow growth. Despite trading at 21.7% below its estimated fair value, Centaur's short-term assets (£13.6M) are insufficient to cover its short-term liabilities (£15.9M). Recent M&A discussions involve the potential sale of MiniMBA for £19 million, which could impact future earnings and strategic positioning if concluded successfully. A dividend of 1.2 pence per share was recently affirmed despite coverage concerns.

- Get an in-depth perspective on Centaur Media's performance by reading our balance sheet health report here.

- Learn about Centaur Media's future growth trajectory here.

Make It Happen

- Click this link to deep-dive into the 295 companies within our UK Penny Stocks screener.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives