- United Kingdom

- /

- Metals and Mining

- /

- AIM:EMH

UK Penny Stocks: 3 Top Picks Under £60M Market Cap

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 and FTSE 250 indices have recently faced downward pressure, influenced by disappointing trade data from China, which has highlighted ongoing challenges in global economic recovery. Against this backdrop, investors may find value in exploring penny stocks—typically smaller or newer companies—that offer potential opportunities despite the term being somewhat outdated. By focusing on firms with solid financials and promising growth prospects, investors can uncover hidden value in these often-overlooked segments of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.585 | £513.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.69 | £298.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.705 | £217.14M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.258 | £137.52M | ✅ 3 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.834 | £308.39M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.85 | £293.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.215 | £193.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 2 ⚠️ 4 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.30 | £8.49M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

European Metals Holdings (AIM:EMH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: European Metals Holdings Limited is an exploration and development company operating in the Czech Republic with a market cap of £20.54 million.

Operations: European Metals Holdings Limited has not reported any revenue segments.

Market Cap: £20.54M

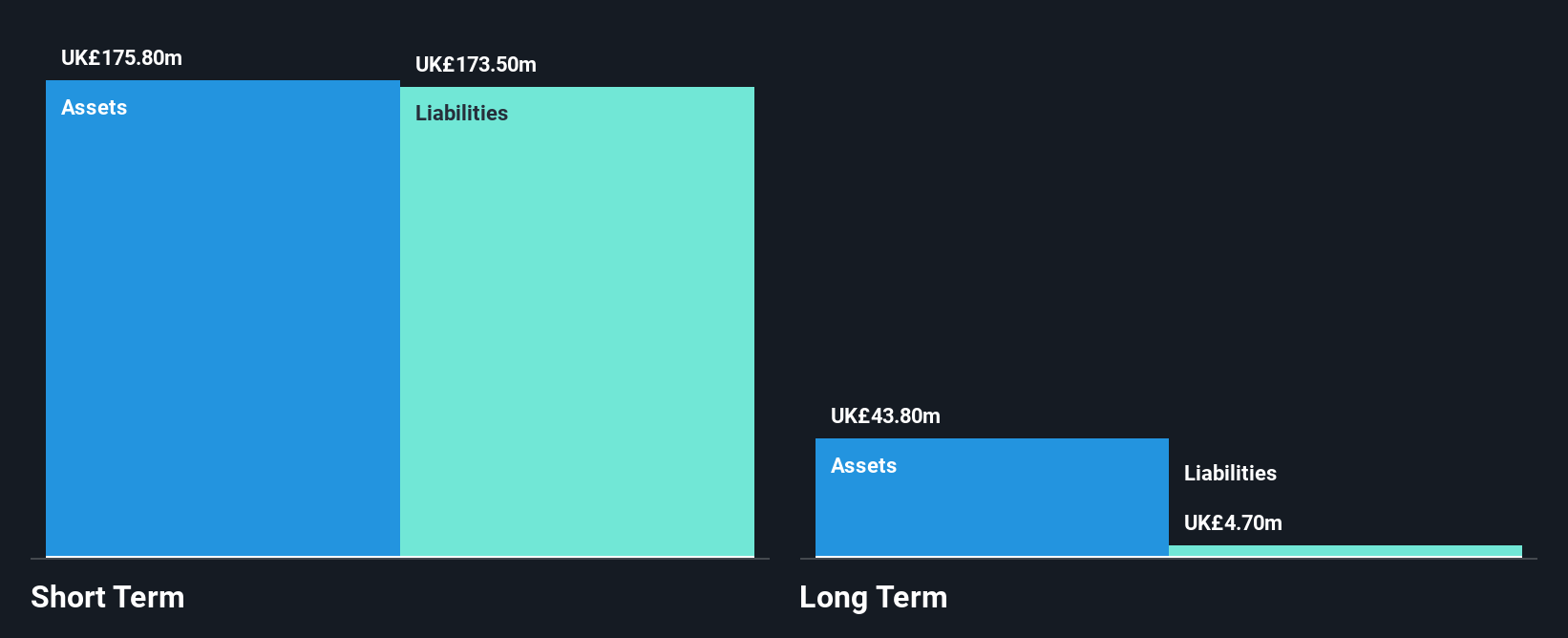

European Metals Holdings Limited, with a market cap of £20.54 million, is a pre-revenue exploration company operating in the Czech Republic. Despite its unprofitability, it has managed to reduce losses over the past five years and maintains a debt-free balance sheet. The company's short-term assets of A$4 million comfortably cover both its short and long-term liabilities. European Metals Holdings also benefits from an experienced board with an average tenure of 8.2 years and has not significantly diluted shareholders recently. Recent changes include appointing Ms. Sujana Karthik as Company Secretary, bringing extensive expertise in financial management and corporate governance to the team.

- Take a closer look at European Metals Holdings' potential here in our financial health report.

- Evaluate European Metals Holdings' historical performance by accessing our past performance report.

Manolete Partners (AIM:MANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Manolete Partners Plc is an insolvency litigation financing company operating in the United Kingdom with a market cap of £35.67 million.

Operations: The company's revenue segment consists of Unclassified Services, generating £30.48 million.

Market Cap: £35.67M

Manolete Partners Plc, with a market cap of £35.67 million, has demonstrated stable revenue growth, reporting £30.48 million in sales for the fiscal year ending March 2025. The company maintains a strong balance sheet with short-term assets of £50.2 million exceeding both its short and long-term liabilities, while cash surpasses total debt levels. Despite low return on equity at 2.2%, Manolete's interest payments are well covered by EBIT at 21.8 times coverage, indicating financial stability amidst negative earnings growth over the past year and declining net profit margins from 3.5% to 2.9%.

- Click here and access our complete financial health analysis report to understand the dynamics of Manolete Partners.

- Gain insights into Manolete Partners' outlook and expected performance with our report on the company's earnings estimates.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Staffline Group PLC, with a market cap of £52.44 million, offers recruitment and outsourced human resource services in the United Kingdom and the Republic of Ireland through its subsidiaries.

Operations: The company generates revenue through its Recruitment GB segment, which accounts for £929.3 million, and its Recruitment Ireland segment, contributing £102.6 million.

Market Cap: £52.44M

Staffline Group PLC, with a market cap of £52.44 million, has shown financial improvement by becoming profitable this year and reporting half-year sales of £485.8 million, up from £446.8 million the previous year. The company completed significant share buybacks totaling 11.6% for £4.84 million, indicating confidence in its stock value despite high volatility over the past three months. Staffline's debt management is robust with a satisfactory net debt to equity ratio of 16.5%, and its short-term assets comfortably cover long-term liabilities but not short-term ones entirely. A strategic partnership in logistics could enhance its market position further.

- Jump into the full analysis health report here for a deeper understanding of Staffline Group.

- Assess Staffline Group's future earnings estimates with our detailed growth reports.

Make It Happen

- Investigate our full lineup of 296 UK Penny Stocks right here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if European Metals Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EMH

European Metals Holdings

Operates as the exploration and development company in the Czech Republic.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives