- United States

- /

- Banks

- /

- NYSE:TFC

Truist Financial (NYSE:TFC) Unveils Truist Merchant Engage Platform For U.S. SMBs

Reviewed by Simply Wall St

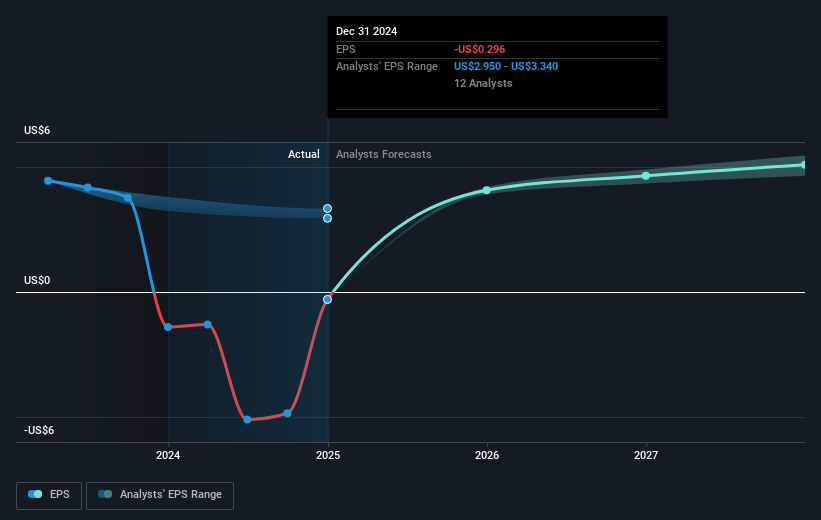

Truist Financial (NYSE:TFC) has launched Truist Merchant Engage, a new service platform for small and medium-sized businesses, which is indicative of the company's ongoing efforts to leverage technology for growth. Over the last quarter, Truist shares rose 29%, a move potentially influenced by this product expansion and improved earnings performance. The company reported increased net income and earnings per share alongside dividend affirmations and a substantial share buyback program. These positive company developments added weight to the stock’s favorable performance, contrasting with broader market uncertainties related to trade tensions and mixed results from other industries.

Truist Financial has 1 possible red flag we think you should know about.

Over the past five years, Truist Financial's total shareholder return, including dividends, was 59.78%. This longer-term performance provides context to its recent movements, where the company exceeded the broader US market's 12.5% gain over the past year yet fell short compared to the US Banks industry, which advanced 31.2% during the same period.

The introduction of Truist Merchant Engage and other initiatives have the potential to bolster revenue that is forecasted to grow 15% annually. Despite the company's current unprofitability, these moves suggest an optimism that earnings may grow by 54.39% annually, according to forecasts. This potential growth reflects the technological and strategic efforts aimed at expanding market presence, enhancing client engagement, and increasing operational efficiencies.

Currently, Truist's stock price is positioned at a discount to the consensus analyst price target of US$46.37. This leaves room for future appreciation, considering the estimated value disparities and the company's wider strategic shifts outlined in recent announcements. The company remains focused on leveraging technology and partnerships, potentially impacting both short-term and long-term performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives