- United States

- /

- Banks

- /

- NasdaqGM:TSBK

Top Three Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed signals, with inflation concerns tempering hopes for interest rate cuts, the S&P 500 continues to achieve record highs. In this environment, dividend stocks can offer investors a steady income stream and potential stability amid market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.48% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.69% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.14% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Employers Holdings (EIG) | 3.06% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.69% | ★★★★★☆ |

| Dillard's (DDS) | 5.21% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.51% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.77% | ★★★★★☆ |

| Archer-Daniels-Midland (ADM) | 3.44% | ★★★★★☆ |

Click here to see the full list of 133 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

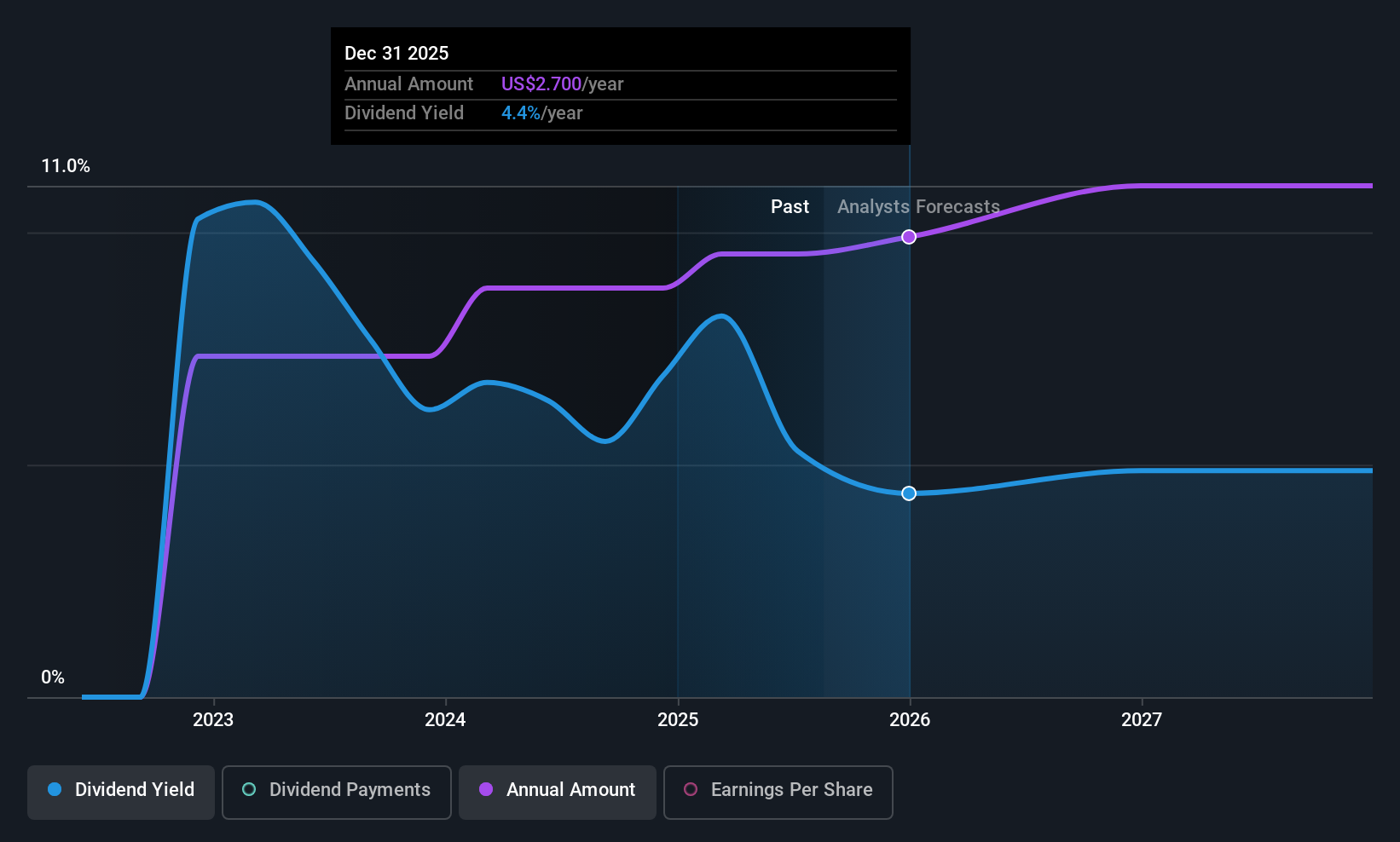

Euroseas (ESEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Euroseas Ltd. offers ocean-going transportation services globally and has a market cap of $395.59 million.

Operations: Euroseas Ltd. generates its revenue by providing ocean-going transportation services across the globe.

Dividend Yield: 4.6%

Euroseas has demonstrated a stable dividend profile, with consistent payments over the past three years. The company's dividends are well-covered by both earnings and cash flows, boasting a low payout ratio of 11.4%. Recent increases in quarterly dividends, such as the US$0.70 per share for Q2 2025, highlight growth potential. Despite recent declines in net income to US$29.86 million for Q2 2025, Euroseas maintains strong fleet utilization and charter coverage, supporting future cash flow stability crucial for dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Euroseas.

- Insights from our recent valuation report point to the potential undervaluation of Euroseas shares in the market.

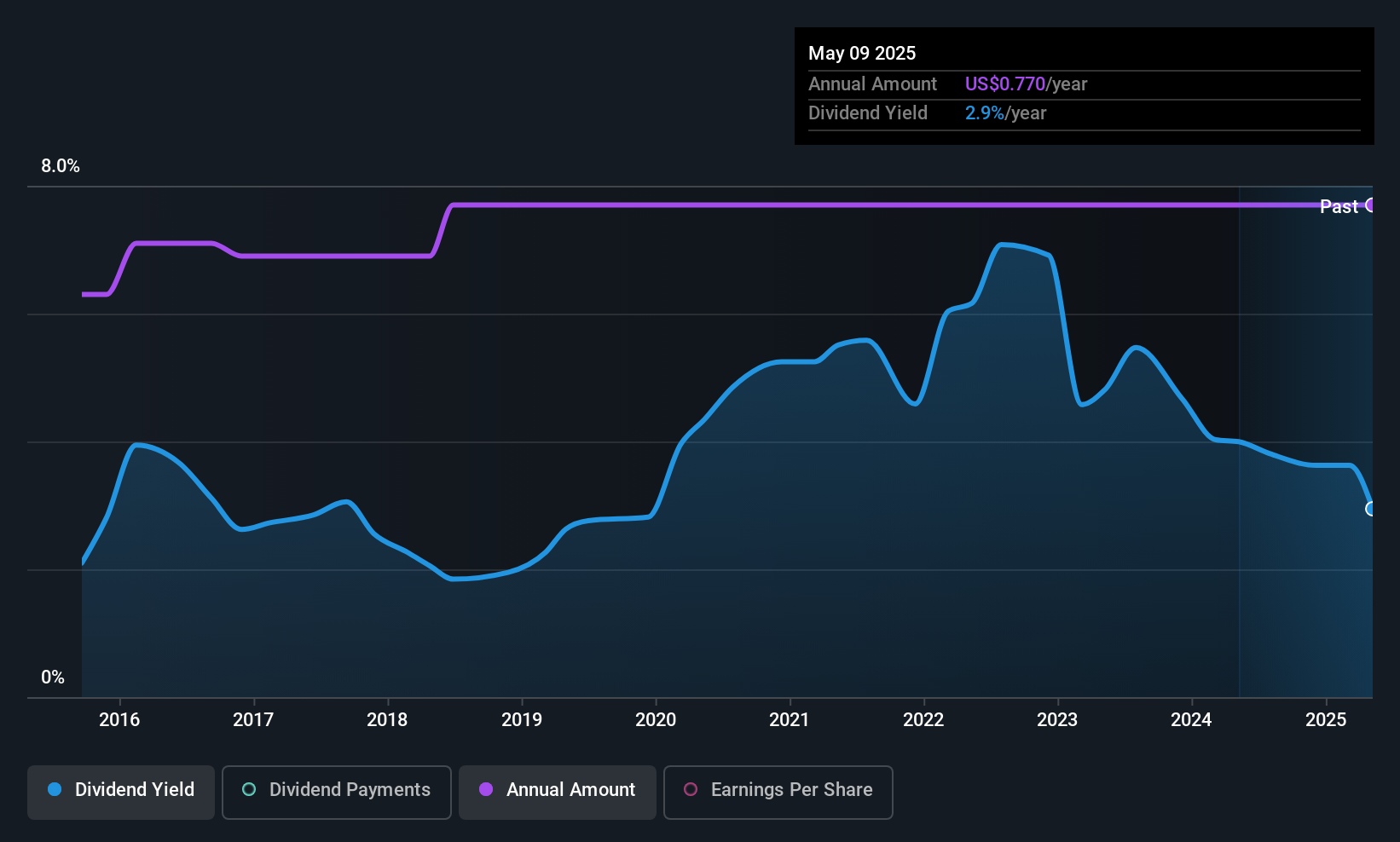

Timberland Bancorp (TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $264.08 million.

Operations: Timberland Bancorp, Inc. generates its revenue primarily from community banking services, amounting to $78.34 million.

Dividend Yield: 3.1%

Timberland Bancorp offers a stable dividend profile, with consistent growth over the past decade and a current payout of $0.26 per share. The dividend is well-supported by earnings due to a low payout ratio of 29.3%. Despite trading below estimated fair value, its dividend yield of 3.13% is modest compared to top-tier US payers. Recent financial results show net income growth, although significant insider selling raises concerns about future stability amidst ongoing share repurchase activities.

- Take a closer look at Timberland Bancorp's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Timberland Bancorp is trading behind its estimated value.

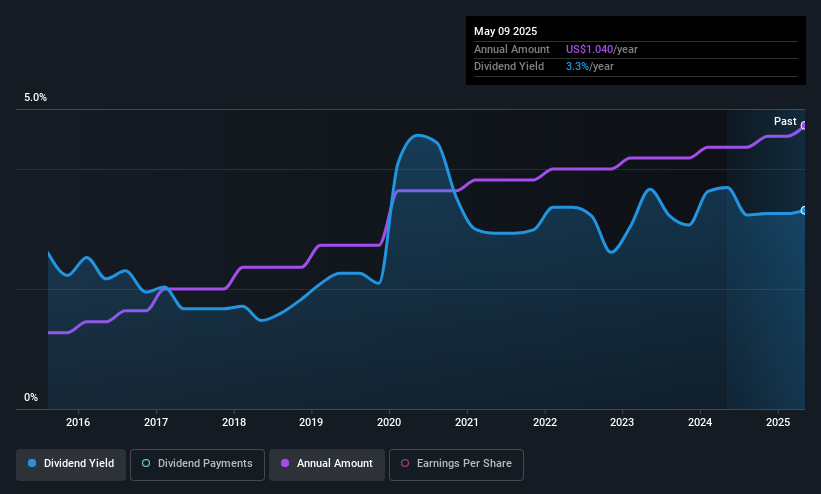

Universal Insurance Holdings (UVE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Insurance Holdings, Inc., with a market cap of $695.50 million, operates as an integrated insurance holding company in the United States through its subsidiaries.

Operations: Universal Insurance Holdings generates revenue primarily through its Property & Casualty insurance segment, which accounted for $1.57 billion.

Dividend Yield: 3.2%

Universal Insurance Holdings maintains a stable dividend profile, offering a 3.16% yield with consistent growth over the past decade. Its dividends are well-covered by earnings and cash flows, evidenced by low payout ratios of 27.2% and 8.1%, respectively. Despite recent insider selling, the company continues share buybacks and reported solid financials for Q2 2025, with revenue at US$400.14 million and net income slightly lower than the previous year at US$35.09 million.

- Click to explore a detailed breakdown of our findings in Universal Insurance Holdings' dividend report.

- The valuation report we've compiled suggests that Universal Insurance Holdings' current price could be quite moderate.

Summing It All Up

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 130 more companies for you to explore.Click here to unveil our expertly curated list of 133 Top US Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Timberland Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TSBK

Timberland Bancorp

Operates as the bank holding company for Timberland Bank that provides various community banking services in Washington.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives