- Poland

- /

- Hospitality

- /

- WSE:RBW

Top European Dividend Stocks For July 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed stock index performances and ongoing trade discussions with the U.S., investors are keeping a close eye on economic indicators such as inflation and industrial output. In this context, dividend stocks can offer stability and income potential, making them an attractive option for those looking to balance growth with steady returns in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.10% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.85% | ★★★★★★ |

| ERG (BIT:ERG) | 5.14% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 233 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

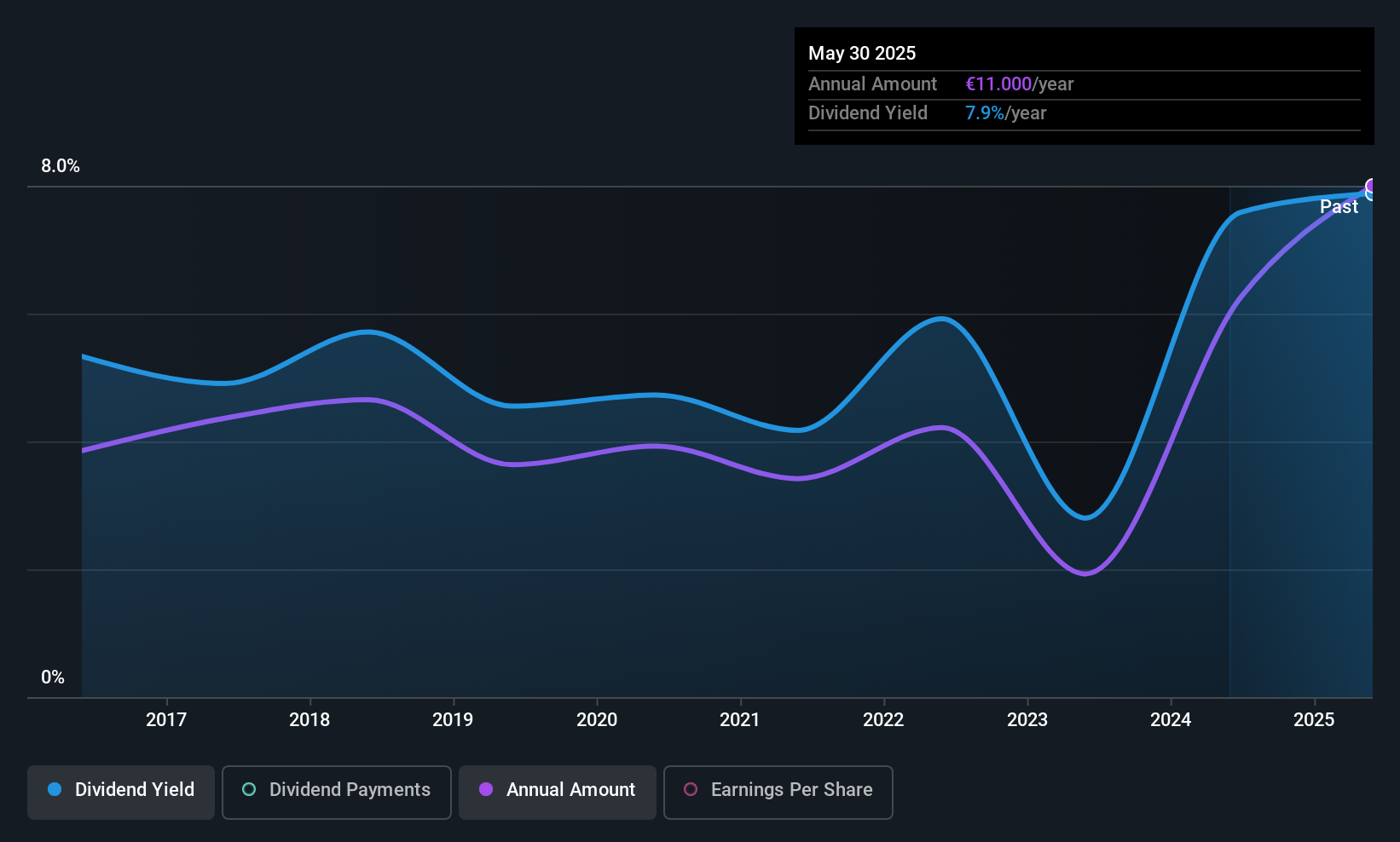

Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Les Docks des Pétroles d'Ambès -SA operates in the storage and shipping of petroleum products in France, with a market capitalization of €87.04 million.

Operations: Les Docks des Pétroles d'Ambès -SA generates revenue primarily from its pipelines segment, amounting to €22 million.

Dividend Yield: 5.7%

Les Docks des Pétroles d'Ambès -SA offers a high and reliable dividend yield of 5.73%, positioning it in the top 25% of French dividend payers. Over the past decade, its dividends have been stable and growing, with coverage from both earnings (81.3%) and cash flows (57.2%). Despite large one-off items affecting recent financial results, earnings grew by 42.8% last year, supporting its sustainable payout strategy amidst trading at a significant discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Les Docks des Pétroles d'Ambès -SA stock in this dividend report.

- In light of our recent valuation report, it seems possible that Les Docks des Pétroles d'Ambès -SA is trading behind its estimated value.

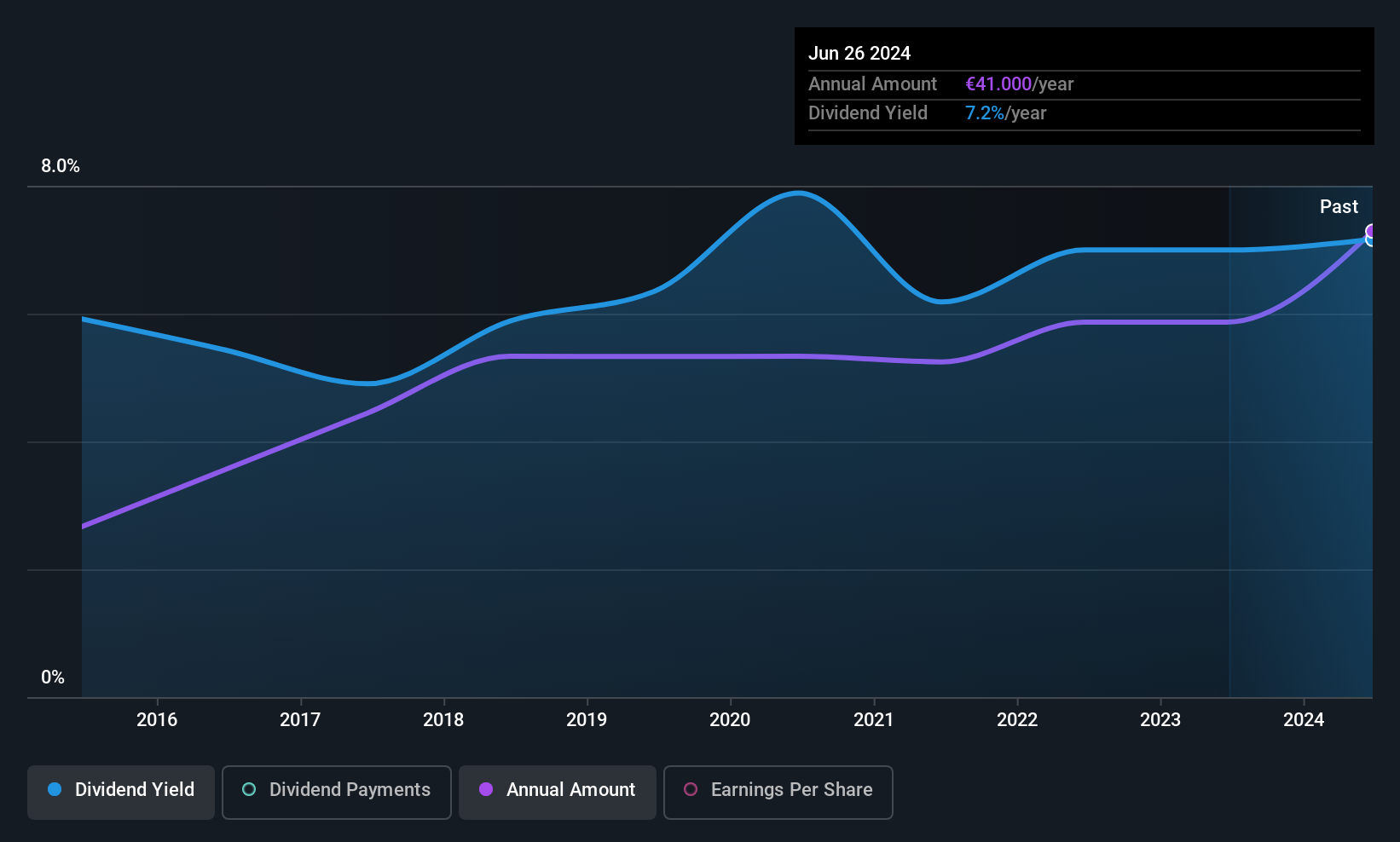

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of approximately €1.04 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and marketing of electricity and gas (€1.12 billion) and the consumption of electricity and gas (€311.39 million).

Dividend Yield: 7.6%

Électricite de Strasbourg Société Anonyme offers a dividend yield of 7.59%, ranking in the top 25% of French dividend payers. Despite past volatility and an unstable track record, dividends are currently covered by earnings (payout ratio: 52.4%) and cash flows (cash payout ratio: 71%). The company trades at a significant discount to its estimated fair value, while recent earnings growth of 61.1% may support future dividend stability despite historical unreliability.

- Delve into the full analysis dividend report here for a deeper understanding of Électricite de Strasbourg Société Anonyme.

- Insights from our recent valuation report point to the potential undervaluation of Électricite de Strasbourg Société Anonyme shares in the market.

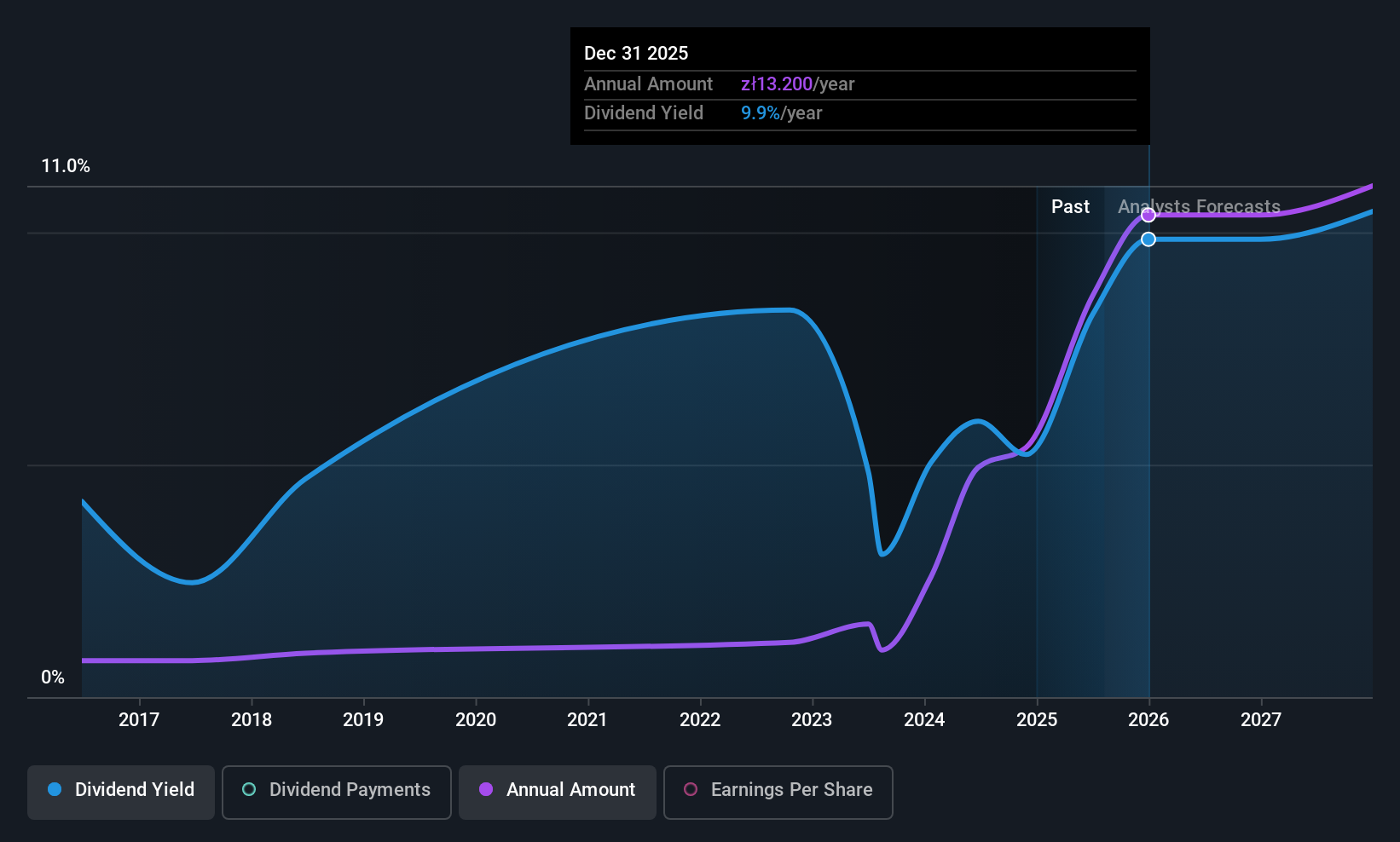

Rainbow Tours (WSE:RBW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rainbow Tours S.A. is a tour operator based in Poland that provides travel services across several countries including the Czech Republic, Greece, Spain, Turkey, Slovakia, and Lithuania with a market capitalization of PLN1.92 billion.

Operations: Rainbow Tours S.A.'s revenue primarily stems from its Tour Operator Activities in Poland, which generated PLN4.14 billion, and its Foreign Tour Operator Activities, which contributed PLN161.84 million.

Dividend Yield: 8.3%

Rainbow Tours offers a dividend yield of 8.33%, placing it among the top 25% of Polish dividend payers. Despite a history of volatility, current dividends are supported by earnings (payout ratio: 52.9%) and cash flows (cash payout ratio: 53.3%). The company's recent earnings growth, with net income rising to PLN 59.53 million in Q1 2025 from PLN 39.03 million the previous year, suggests potential for improved stability despite past unreliability.

- Get an in-depth perspective on Rainbow Tours' performance by reading our dividend report here.

- Our valuation report here indicates Rainbow Tours may be undervalued.

Next Steps

- Delve into our full catalog of 233 Top European Dividend Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:RBW

Rainbow Tours

Operates as a tour operator in Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, Lithuania, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives