- United States

- /

- Specialized REITs

- /

- NYSE:VICI

Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the U.S. markets experience a strong start to the week, with major indices climbing over 1%, investors are keenly watching for corporate earnings and economic data that could influence Federal Reserve decisions on interest rates. In this environment of heightened market activity, dividend stocks remain an attractive option for those seeking steady income and potential growth, as they can offer stability amid broader market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.13% | ★★★★★☆ |

| Rayonier (RYN) | 11.76% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.71% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.28% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.04% | ★★★★★★ |

| Ennis (EBF) | 5.82% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.83% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.68% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.78% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.53% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

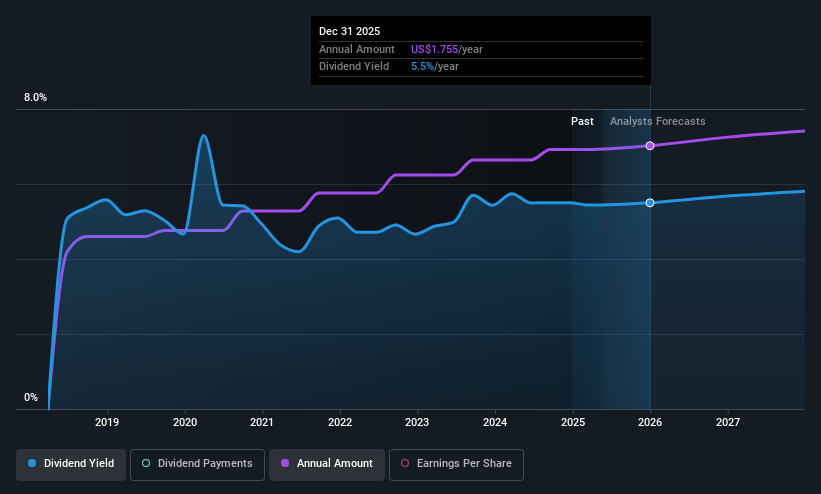

Coca-Cola FEMSA. de (KOF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V. is a franchise bottler that produces, markets, sells, and distributes Coca-Cola trademark beverages across several Latin American countries, with a market cap of approximately $17.68 billion.

Operations: Coca-Cola FEMSA's revenue from Non-Alcoholic Beverages amounts to MX$288.81 billion.

Dividend Yield: 4.8%

Coca-Cola FEMSA's dividend payments have been reliable and stable over the past decade, consistently growing without volatility. Despite a high cash payout ratio of 233.5%, dividends are covered by earnings with a reasonable payout ratio of 65.6%. However, they are not well-covered by free cash flows, raising sustainability concerns. Recently, the company announced a quarterly dividend increase to US$0.9005 per share payable on October 27, 2025, highlighting its commitment to returning value to shareholders.

- Take a closer look at Coca-Cola FEMSA. de's potential here in our dividend report.

- Our expertly prepared valuation report Coca-Cola FEMSA. de implies its share price may be lower than expected.

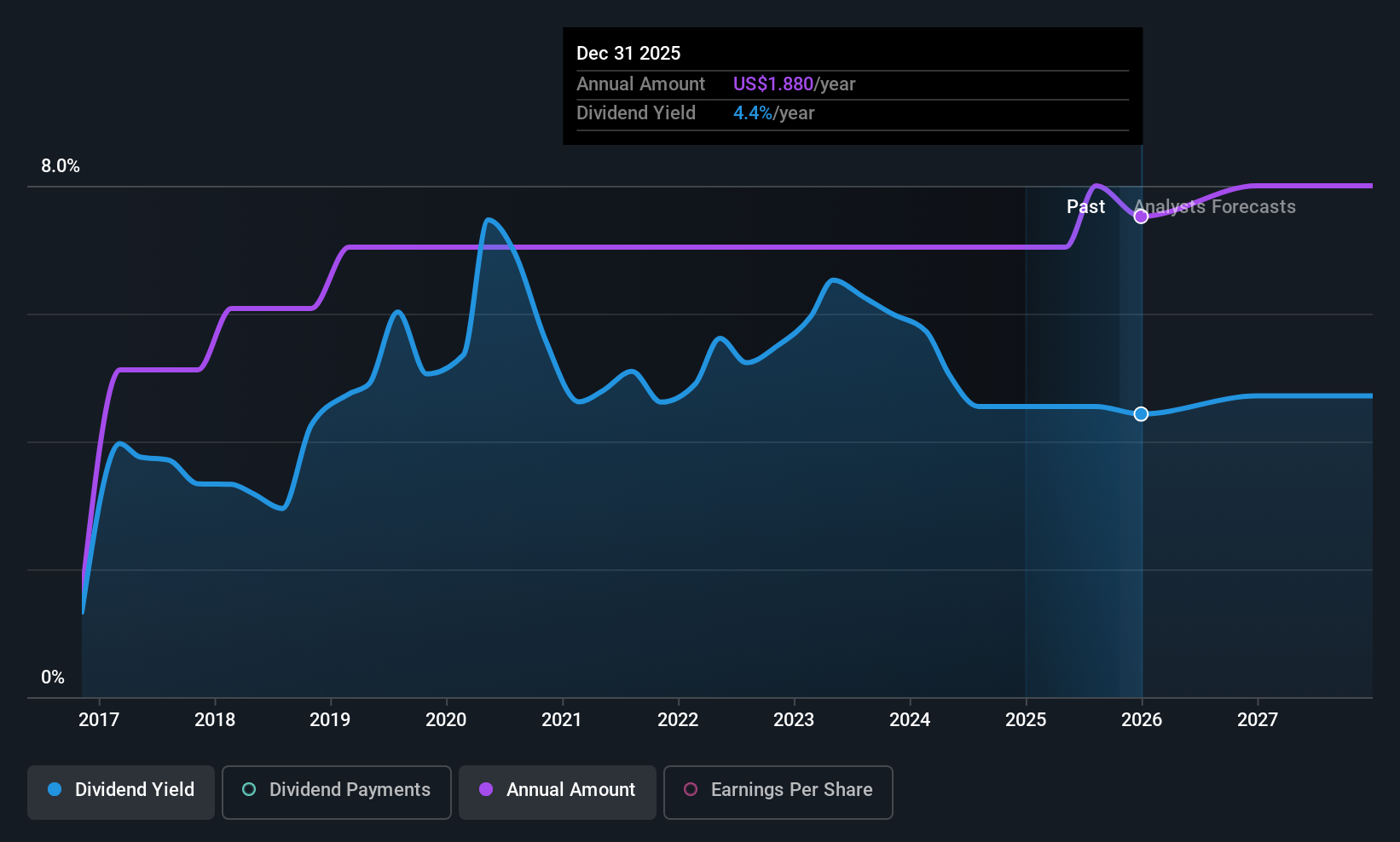

Bank of N.T. Butterfield & Son (NTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Bank of N.T. Butterfield & Son Limited offers community, commercial, and private banking services to individuals and small to medium-sized businesses, with a market cap of $1.73 billion.

Operations: The Bank of N.T. Butterfield & Son Limited generates revenue primarily from its banking segment, which amounted to $588.90 million.

Dividend Yield: 4.8%

The Bank of N.T. Butterfield & Son's dividend payments have grown steadily, with a recent increase to US$0.50 per share, reflecting a 14% rise. Despite only nine years of dividend history, the payout ratio remains low at 34.6%, indicating strong coverage by earnings and suggesting sustainability. Recent executive changes aim to bolster risk management and client relations, while strategic buybacks enhance shareholder value amid stable financial performance and competitive dividend yield in the U.S. market.

- Delve into the full analysis dividend report here for a deeper understanding of Bank of N.T. Butterfield & Son.

- Upon reviewing our latest valuation report, Bank of N.T. Butterfield & Son's share price might be too pessimistic.

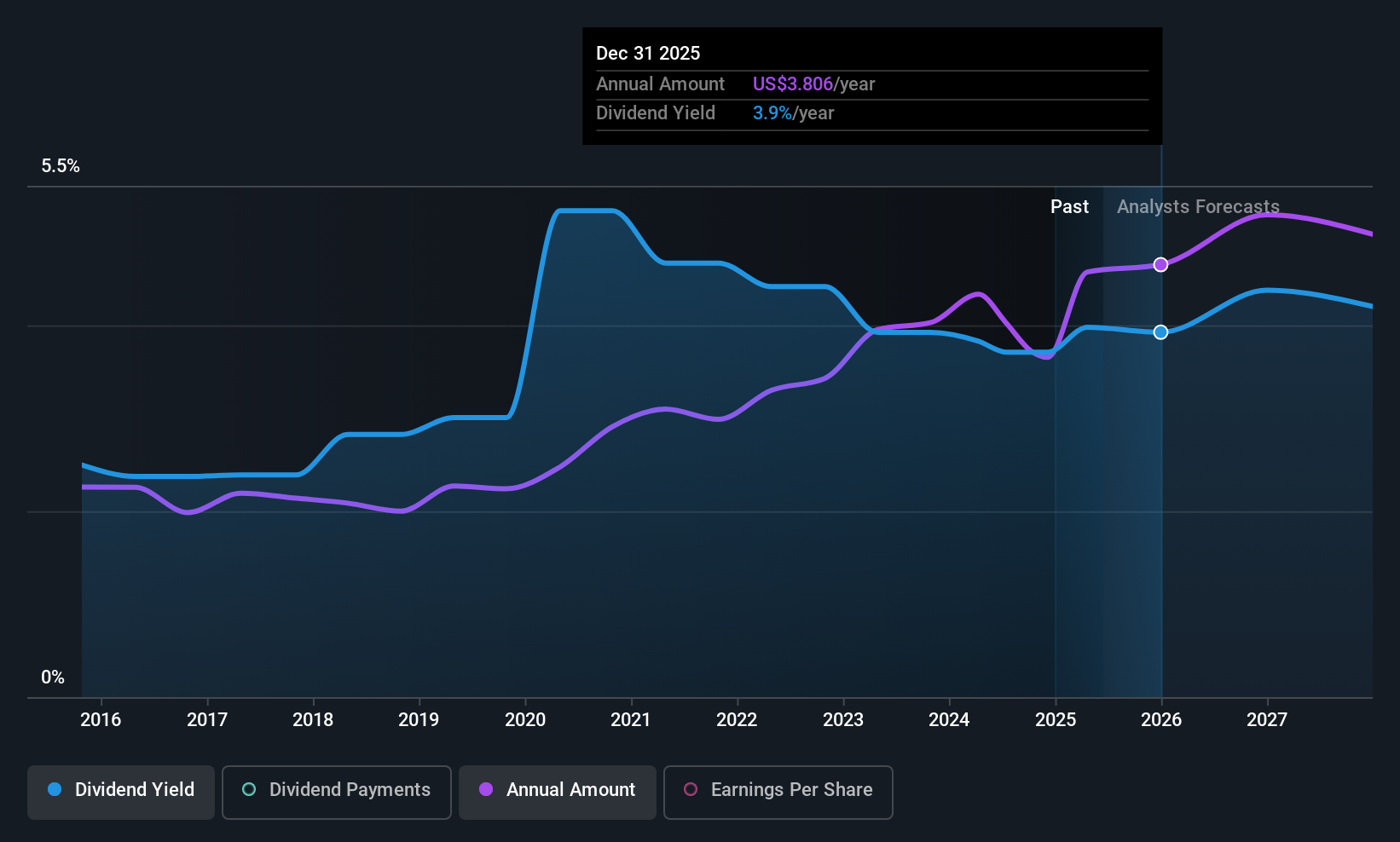

VICI Properties (VICI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VICI Properties Inc. is an S&P 500 experiential real estate investment trust with a market cap of $33.28 billion, owning a large portfolio of gaming, hospitality, wellness, entertainment and leisure destinations including iconic venues like Caesars Palace Las Vegas and the Venetian Resort Las Vegas.

Operations: VICI Properties Inc. generates revenue primarily through its real property and real estate lending activities, totaling $3.93 billion.

Dividend Yield: 5.5%

VICI Properties recently announced a 4% dividend increase to US$0.45 per share, highlighting its commitment to returning value to shareholders. The dividend is well-supported by earnings and cash flows, with payout ratios of 65.4% and 75.1%, respectively. Although the company has only a seven-year history of dividends, its payments have been stable and are among the top tier in the U.S., offering good relative value despite some concerns about debt coverage by operating cash flow.

- Navigate through the intricacies of VICI Properties with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of VICI Properties shares in the market.

Next Steps

- Click through to start exploring the rest of the 134 Top US Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VICI

VICI Properties

An S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality, wellness, entertainment and leisure destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives