- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Top Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.4%, contributing to a 12% increase over the past year, with earnings forecasted to grow by 15% annually. In this environment of growth and optimism, selecting dividend stocks that offer consistent income and potential for capital appreciation can be a strategic way to enhance an investment portfolio.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.07% | ★★★★★☆ |

| Universal (UVV) | 5.43% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.17% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.90% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.51% | ★★★★★★ |

| Credicorp (BAP) | 5.18% | ★★★★★☆ |

| CompX International (CIX) | 5.03% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.24% | ★★★★★★ |

| Chevron (CVX) | 4.98% | ★★★★★★ |

Click here to see the full list of 150 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

Hershey (HSY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Hershey Company, along with its subsidiaries, manufactures and sells confectionery products and pantry items both in the United States and internationally, with a market cap of $33.04 billion.

Operations: Hershey's revenue is primarily derived from its North America Confectionery segment at $8.71 billion, followed by North America Salty Snacks at $1.14 billion, and International operations contributing $905.10 million.

Dividend Yield: 3.4%

Hershey maintains a sustainable dividend payout with a 67.4% earnings coverage and 61% cash flow coverage, ensuring stability and reliability over the past decade. Despite trading below estimated fair value, its dividend yield of 3.39% is lower than the top US market payers. Recent board changes and product launches like HERSHEY'S Milk Chocolate with Caramel may support future growth, though Q1 earnings showed decreased sales and income compared to last year at US$2.81 billion and US$224.2 million respectively.

- Delve into the full analysis dividend report here for a deeper understanding of Hershey.

- Insights from our recent valuation report point to the potential undervaluation of Hershey shares in the market.

Merck (MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations spanning pharmaceuticals, vaccines, and animal health, and has a market cap of approximately $193.70 billion.

Operations: Merck & Co., Inc. generates revenue primarily through its Pharmaceutical segment, which accounts for $57.03 billion, and its Animal Health segment, contributing $5.95 billion.

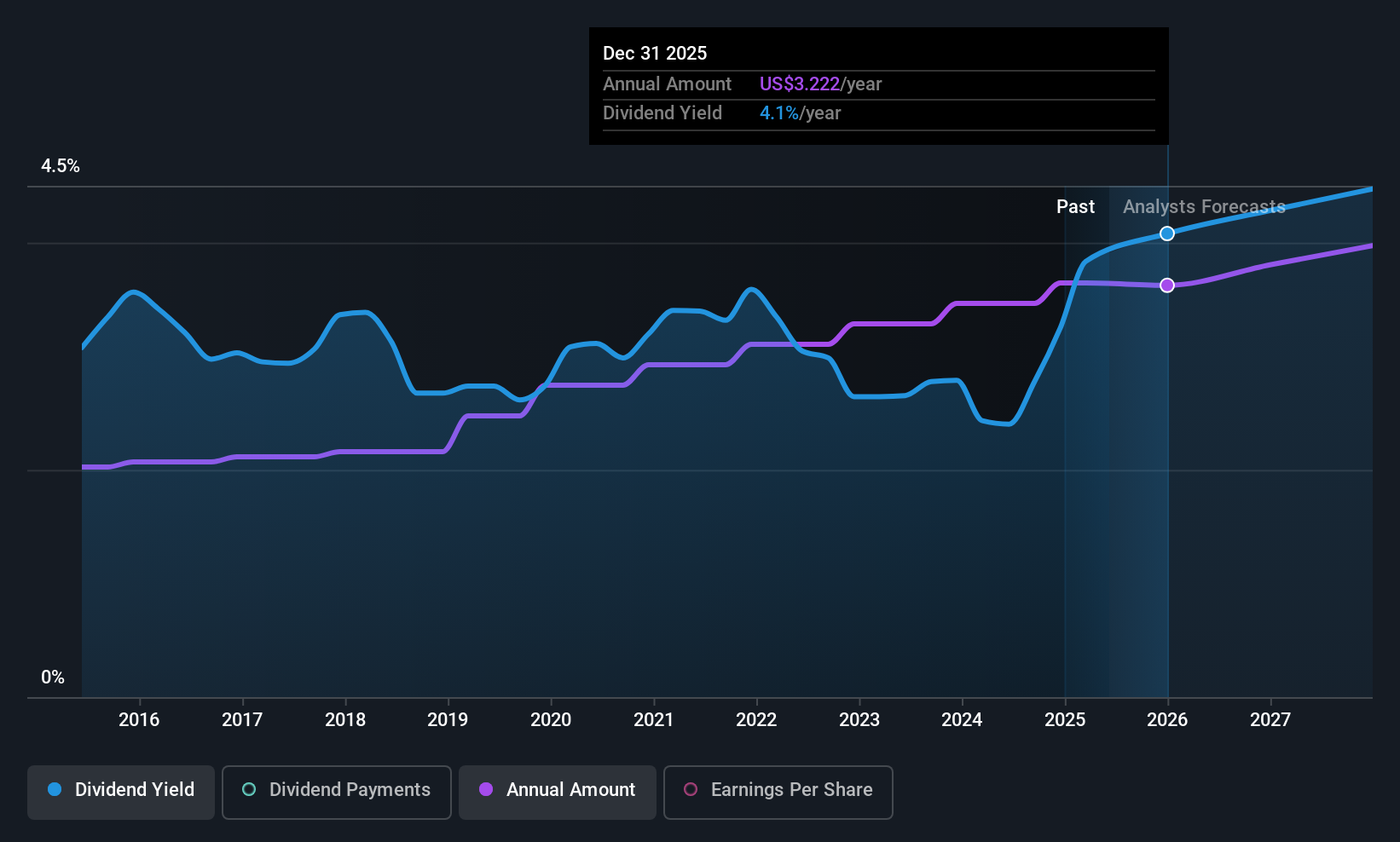

Dividend Yield: 4.1%

Merck's dividend is well-covered with a payout ratio of 45.3% and cash payout ratio of 47.7%, indicating sustainability and reliability over the past decade. Although its 4.14% yield is below top-tier US dividend payers, Merck trades at a significant discount to estimated fair value, suggesting potential for capital appreciation. Recent M&A discussions to acquire MoonLake Immunotherapeutics for over US$3 billion highlight efforts to bolster Merck's drug pipeline as Keytruda approaches patent expiration.

- Click here and access our complete dividend analysis report to understand the dynamics of Merck.

- According our valuation report, there's an indication that Merck's share price might be on the cheaper side.

Teekay Tankers (TNK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. offers marine transportation services to the oil industry both in Bermuda and internationally, with a market cap of approximately $1.53 billion.

Operations: Teekay Tankers Ltd. generates its revenue primarily from its Tankers segment, which accounts for $970.44 million, and its Marine Services and Other segment, contributing $122.25 million.

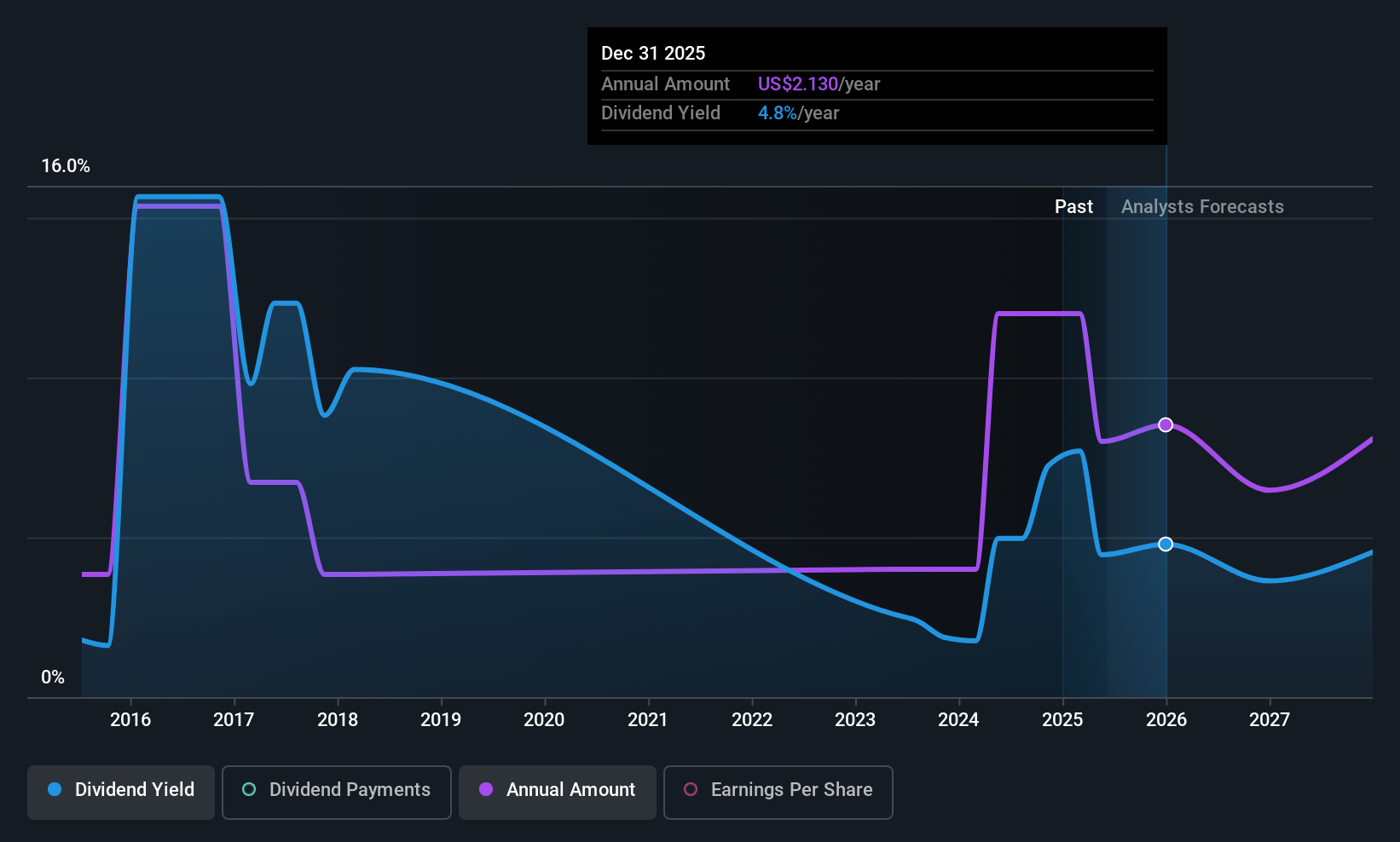

Dividend Yield: 4.4%

Teekay Tankers' dividend is supported by a low payout ratio of 31.3% and cash payout ratio of 21.5%, yet its history shows volatility with inconsistent growth over the past decade. Despite trading at 85.8% below estimated fair value, recent revenue and net income declines highlight challenges, though a special US$1.00 per share dividend was announced alongside a regular US$0.25 per share quarterly dividend, reflecting mixed signals for income-focused investors.

- Take a closer look at Teekay Tankers' potential here in our dividend report.

- Our valuation report here indicates Teekay Tankers may be undervalued.

Summing It All Up

- Click here to access our complete index of 150 Top US Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives