- United States

- /

- Oil and Gas

- /

- NYSE:MUR

Top Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

The United States market has shown positive momentum with a 2.9% increase over the last week and a 14% rise over the past year, while earnings are anticipated to grow by 15% annually. In such an environment, identifying dividend stocks that offer consistent payouts and potential for growth can be an effective strategy for investors seeking steady income and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.79% | ★★★★★☆ |

| Universal (UVV) | 5.71% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.72% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.21% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.26% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 5.77% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.88% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.74% | ★★★★★☆ |

| Chevron (CVX) | 4.70% | ★★★★★★ |

Click here to see the full list of 140 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

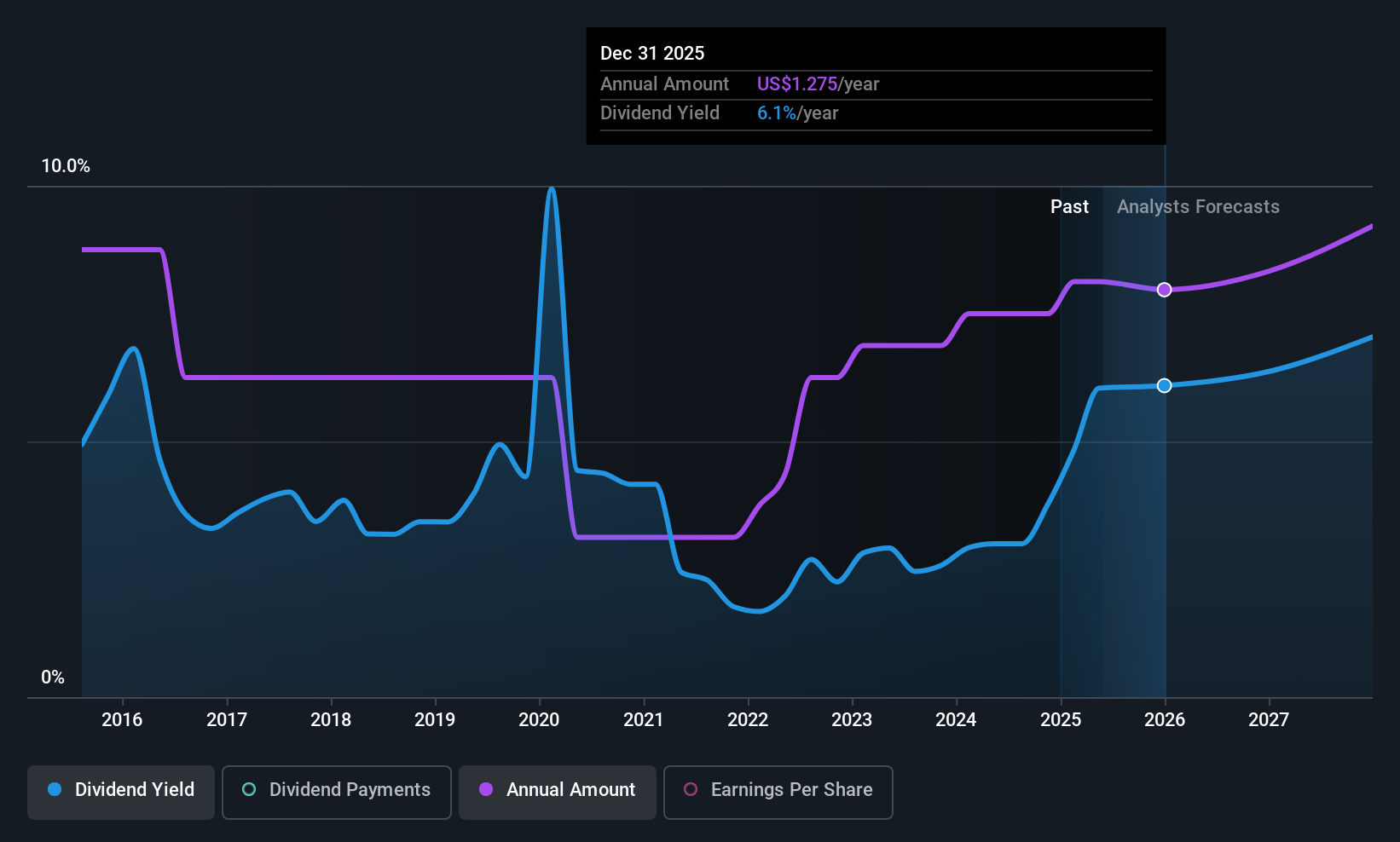

Lifetime Brands (LCUT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lifetime Brands, Inc. designs, sources, and sells branded kitchenware and tableware products for home use both in the United States and internationally, with a market cap of $114.31 million.

Operations: Lifetime Brands generates revenue primarily from its U.S. operations, including retail direct, amounting to $625.23 million, and international sales totaling $55.56 million.

Dividend Yield: 3.4%

Lifetime Brands recently declared a quarterly dividend of US$0.0425 per share, maintaining stable and reliable payouts over the past decade. However, despite a low cash payout ratio suggesting dividends are covered by cash flows, the company is unprofitable with dividends not covered by earnings. Recent removal from multiple Russell indices may impact investor perception. Trading at 38.9% below estimated fair value suggests potential for value investors, but dividend sustainability remains uncertain.

- Click to explore a detailed breakdown of our findings in Lifetime Brands' dividend report.

- Our valuation report unveils the possibility Lifetime Brands' shares may be trading at a discount.

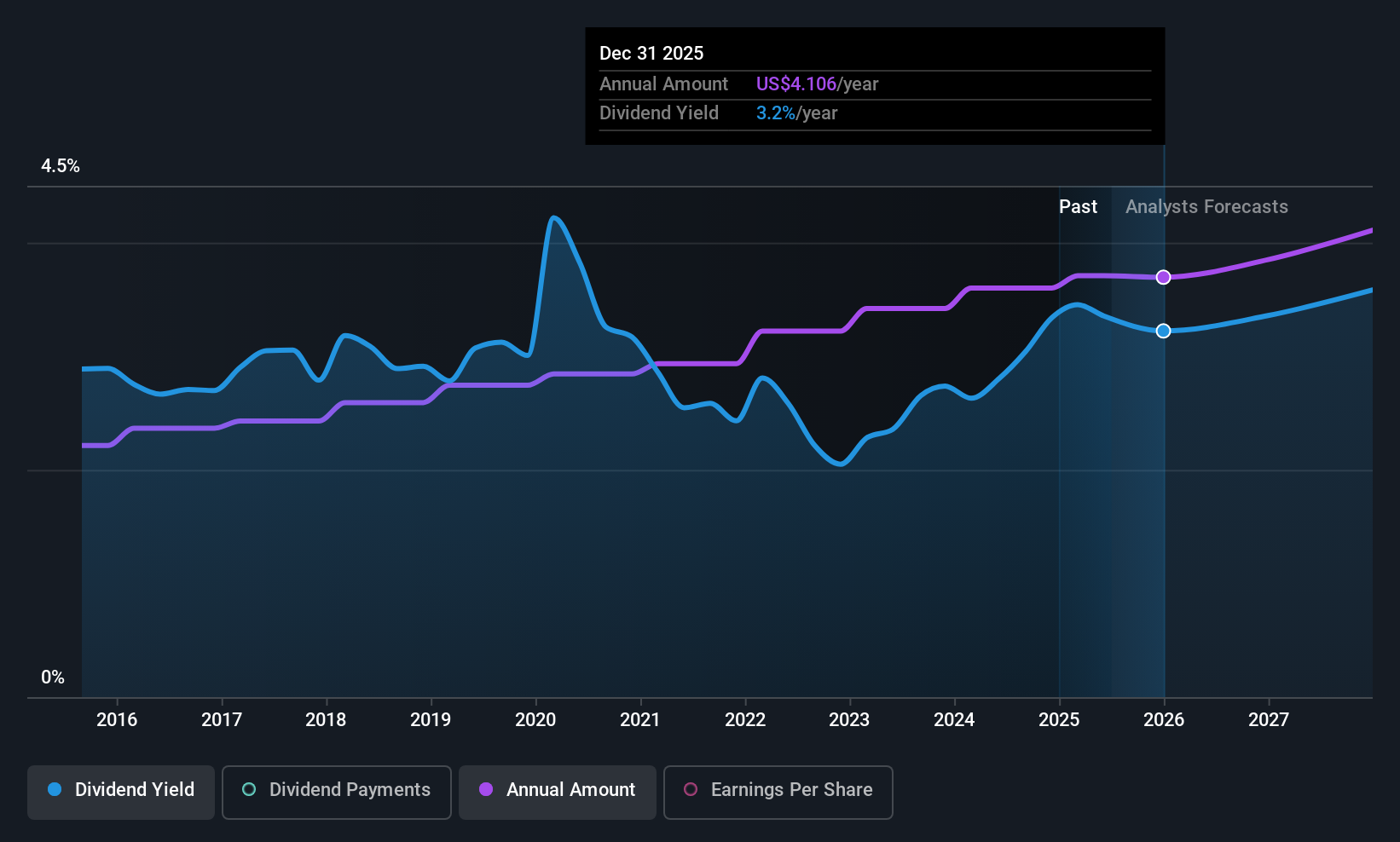

Genuine Parts (GPC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genuine Parts Company distributes automotive and industrial replacement parts and has a market cap of approximately $16.84 billion.

Operations: Genuine Parts Company's revenue is derived from two main segments: Automotive, generating $14.86 billion, and Industrial (including Electrical/Electronic Materials), contributing $8.71 billion.

Dividend Yield: 3.3%

Genuine Parts maintains stable and reliable dividends, recently declaring a quarterly payout of US$1.03 per share. Despite consistent dividend growth over the past decade, the current 3.29% yield is below top-tier levels in the U.S., and high cash payout ratios indicate dividends are not well covered by free cash flows. Recent leadership changes include Alain Masse's promotion to President, North America Automotive, which may influence strategic direction amidst modest sales growth expectations for 2025.

- Click here to discover the nuances of Genuine Parts with our detailed analytical dividend report.

- Our valuation report unveils the possibility Genuine Parts' shares may be trading at a premium.

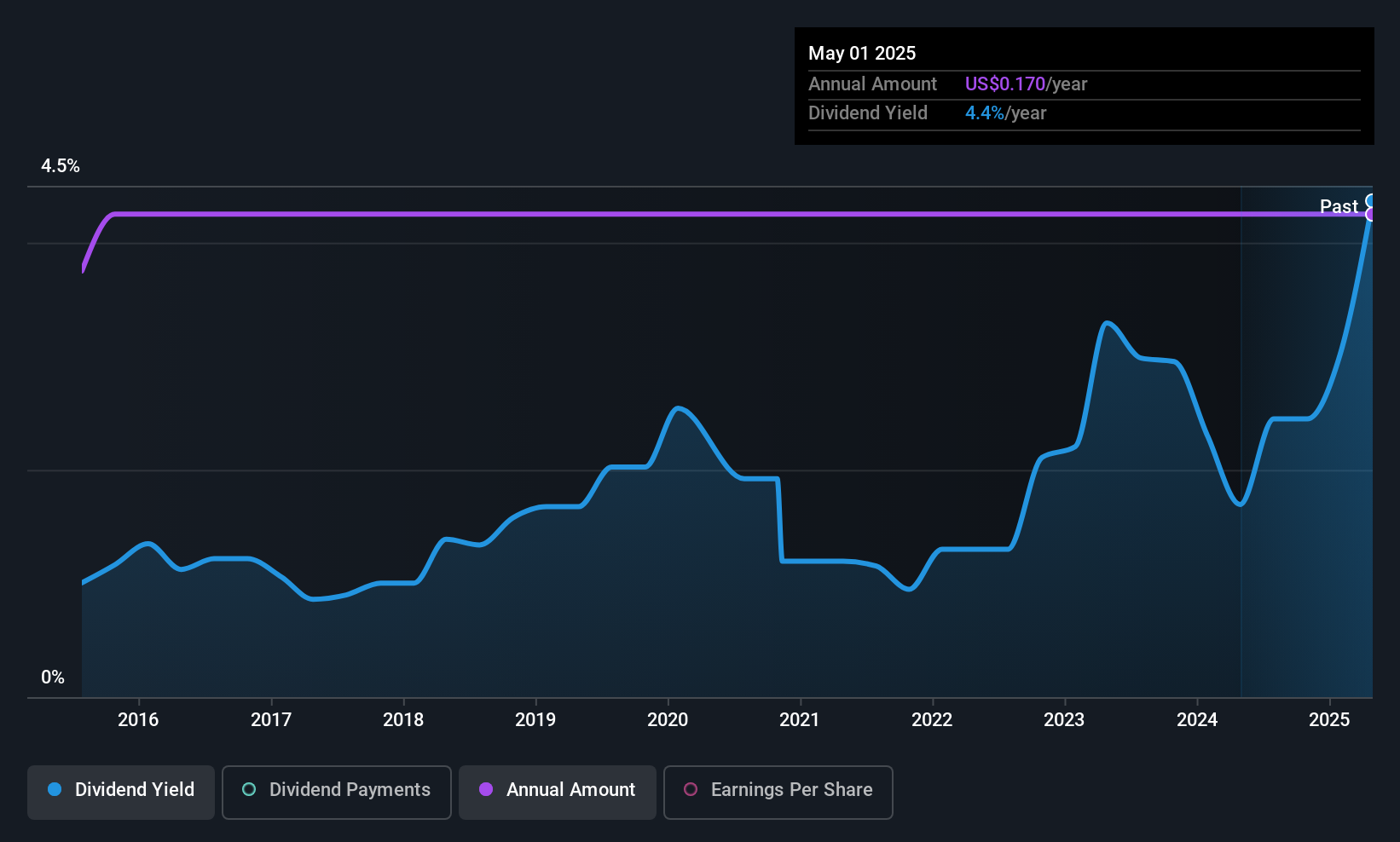

Murphy Oil (MUR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Murphy Oil Corporation, along with its subsidiaries, is engaged in the exploration and production of oil and gas in the United States, Canada, and internationally, with a market cap of approximately $3.21 billion.

Operations: Murphy Oil Corporation's revenue primarily comes from its exploration and production activities, with $2.35 billion generated in the United States and $537 million in Canada.

Dividend Yield: 5.5%

Murphy Oil's dividend yield of 5.46% places it among the top 25% in the U.S., though its dividend track record has been volatile over the past decade. Despite this, dividends are well covered by both earnings, with a payout ratio of 46.1%, and cash flows at 30.8%. Recent financials show a decrease in revenue to US$665.71 million for Q1 2025, but production guidance remains strong for the year ahead.

- Delve into the full analysis dividend report here for a deeper understanding of Murphy Oil.

- Our valuation report here indicates Murphy Oil may be undervalued.

Seize The Opportunity

- Discover the full array of 140 Top US Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives