- Philippines

- /

- Food and Staples Retail

- /

- PSE:COSCO

Top Asian Dividend Stocks To Consider In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious central bank policies and fluctuating economic indicators, the Asian markets have shown resilience with notable gains in key indices like Japan's Nikkei 225 and China's CSI 300. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to balance growth with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.18% | ★★★★★★ |

| NCD (TSE:4783) | 4.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.91% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.94% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| Daicel (TSE:4202) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.49% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1056 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

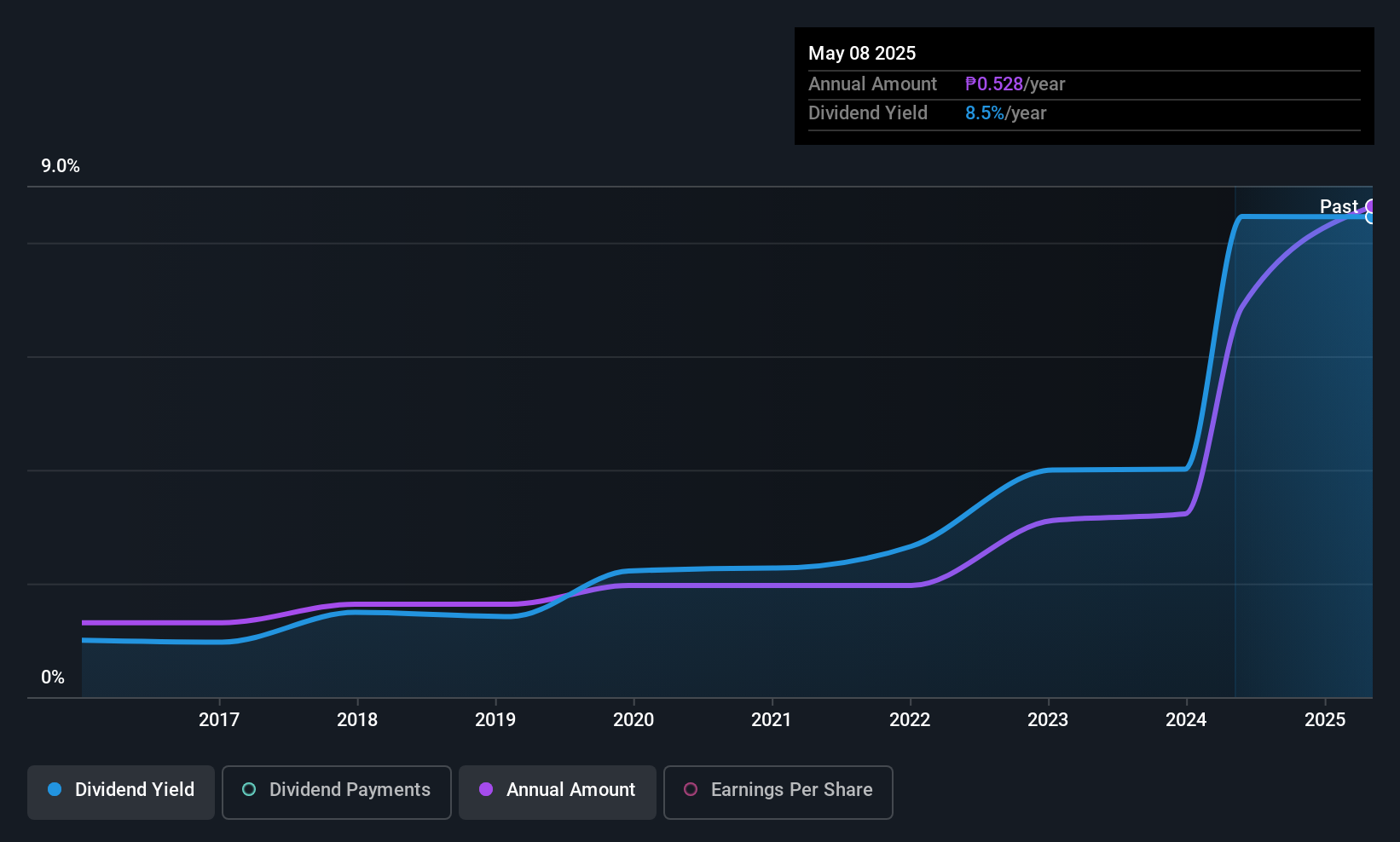

Cosco Capital (PSE:COSCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosco Capital, Inc. operates in the Philippines through its subsidiaries in retail, real estate, liquor distribution, oil and mineral exploration, and specialty retail businesses with a market capitalization of ₱52.80 billion.

Operations: Cosco Capital, Inc.'s revenue is primarily derived from its grocery retail segment at ₱230.55 billion, followed by liquor distribution at ₱19.84 billion, real estate and property leasing at ₱2.06 billion, specialty retail at ₱2.13 billion, and energy and minerals at ₱628.68 million.

Dividend Yield: 7.0%

Cosco Capital's dividend yield of 7.03% ranks in the top 25% of Philippine market payers, supported by a low payout ratio of 18.5% and cash payout ratio of 14.9%, indicating strong coverage by earnings and cash flows. Despite a history of volatility, dividends have grown over the past decade. Recent earnings for H1 2025 show increased sales at PHP119.54 billion and net income at PHP7.61 billion, reflecting robust financial performance amidst competitive valuation metrics.

- Click here to discover the nuances of Cosco Capital with our detailed analytical dividend report.

- According our valuation report, there's an indication that Cosco Capital's share price might be on the cheaper side.

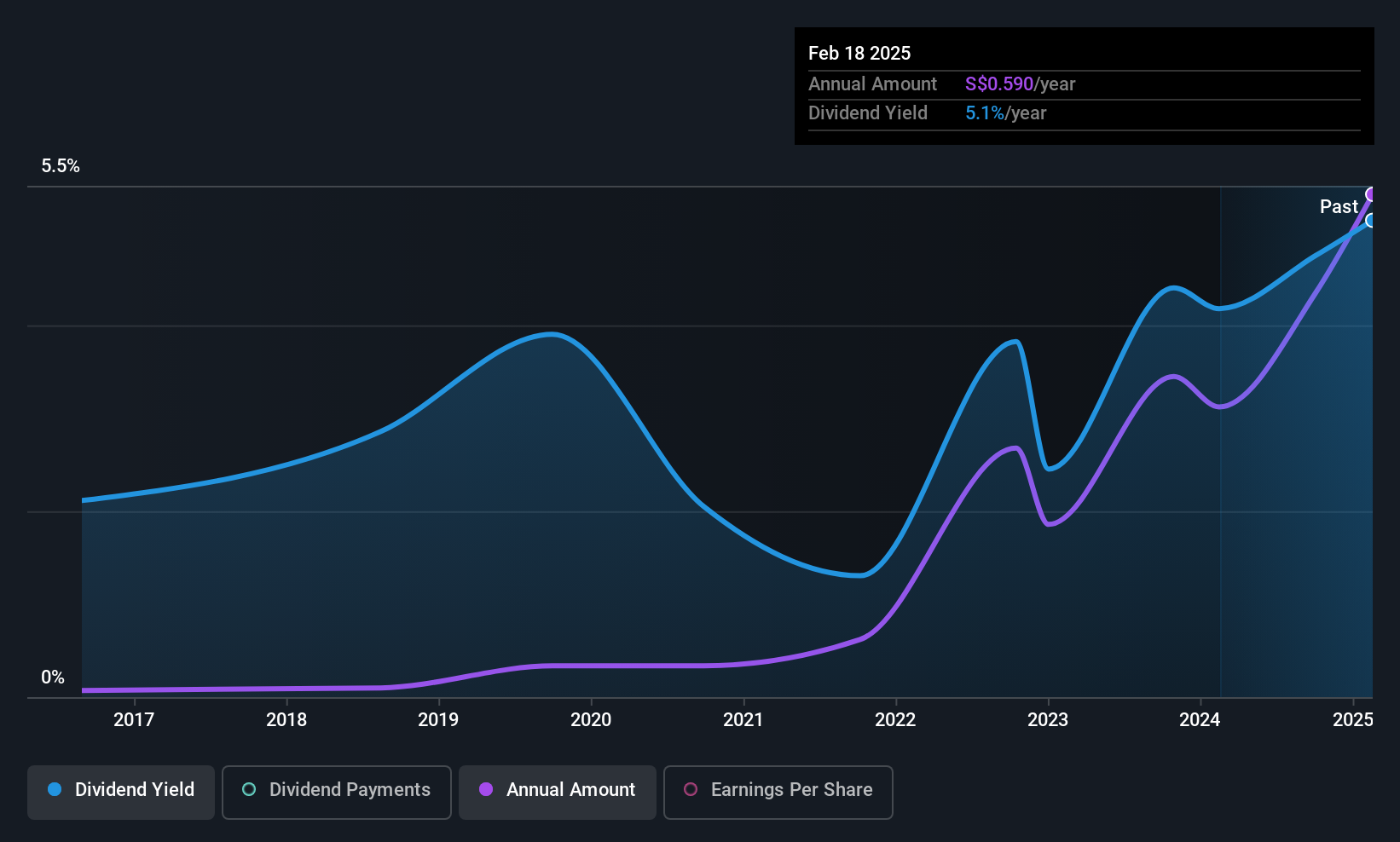

Azeus Systems Holdings (SGX:BBW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azeus Systems Holdings Ltd. is an investment holding company that offers IT products and services across various regions including Asia, Europe, Australia, the Americas, the Middle East, and Africa with a market cap of SGD464.99 million.

Operations: Azeus Systems Holdings Ltd. generates revenue from two main segments: IT Services, contributing HK$82.96 million, and Azeus Products Sales, accounting for HK$391.84 million.

Dividend Yield: 5.9%

Azeus Systems Holdings' dividend yield of 5.89% is among the top 25% in Singapore, though its payout ratio of 98.8% suggests dividends are not well covered by earnings, despite coverage by cash flows. The company's dividends have been volatile over the past decade but have shown growth. Recently, Azeus approved a final dividend of HK$3.90 per share for FY2025, following a significant earnings increase of 96.4% last year.

- Take a closer look at Azeus Systems Holdings' potential here in our dividend report.

- Our expertly prepared valuation report Azeus Systems Holdings implies its share price may be lower than expected.

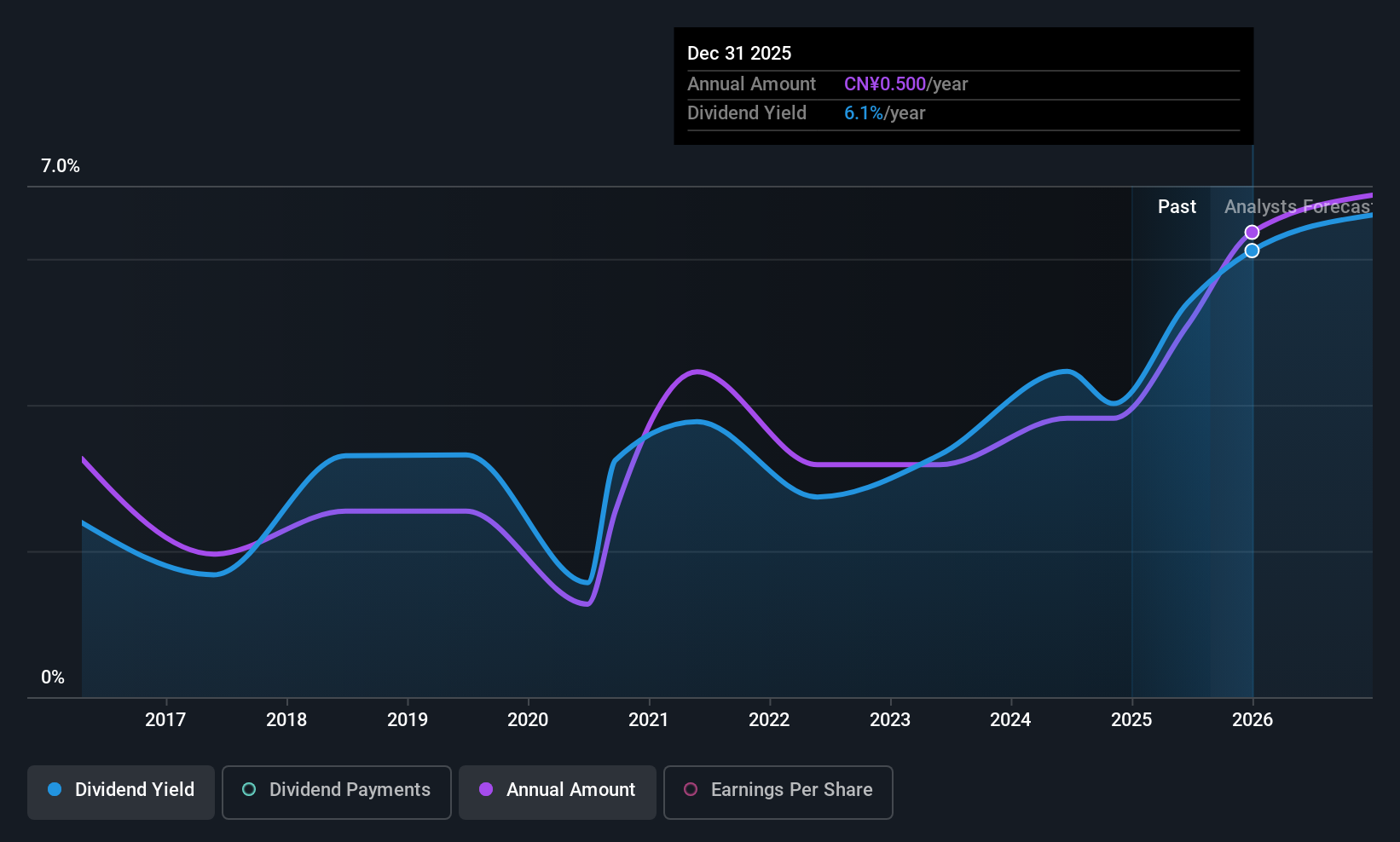

Jiangsu Guotai International Group (SZSE:002091)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangsu Guotai International Group Co., Ltd. (SZSE:002091) operates in the trading and distribution sector with a market cap of CN¥14.66 billion.

Operations: Jiangsu Guotai International Group Co., Ltd. (SZSE:002091) generates its revenue primarily from its trading and distribution activities.

Dividend Yield: 4.4%

Jiangsu Guotai International Group's dividend yield ranks in the top 25% in China, supported by a reasonable payout ratio of 56.3%, indicating coverage by earnings and cash flows. Despite a history of volatility, dividends have grown over the past decade. Recently, shareholders approved a proposal to redefine the dividend return plan for 2025-2027, suggesting potential changes in future payouts. The company reported increased revenue and net income for H1 2025 compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Guotai International Group.

- The valuation report we've compiled suggests that Jiangsu Guotai International Group's current price could be quite moderate.

Turning Ideas Into Actions

- Embark on your investment journey to our 1056 Top Asian Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:COSCO

Cosco Capital

Engages in retail, real estate, liquor distribution, oil and mineral exploration, and other specialty retail businesses in the Philippines.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives