- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Three Stocks Possibly Undervalued By Market Estimates In August 2025

Reviewed by Simply Wall St

As the United States market navigates a complex landscape of tariff concerns and economic uncertainties, major indices like the Dow Jones and S&P 500 have experienced fluctuations with recent rallies stalling. In this environment, identifying stocks that may be undervalued by market estimates can offer intriguing opportunities for investors looking to capitalize on potential discrepancies between a company's intrinsic value and its current trading price.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $9.35 | $18.45 | 49.3% |

| Roku (ROKU) | $85.83 | $169.44 | 49.3% |

| Pennant Group (PNTG) | $22.16 | $44.18 | 49.8% |

| NBT Bancorp (NBTB) | $40.99 | $80.33 | 49% |

| Hesai Group (HSAI) | $20.25 | $40.20 | 49.6% |

| Gold Royalty (GROY) | $2.82 | $5.57 | 49.4% |

| Globalstar (GSAT) | $24.25 | $47.68 | 49.1% |

| Freshpet (FRPT) | $69.99 | $138.47 | 49.5% |

| FB Financial (FBK) | $48.02 | $93.90 | 48.9% |

| BeOne Medicines (ONC) | $304.30 | $604.44 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

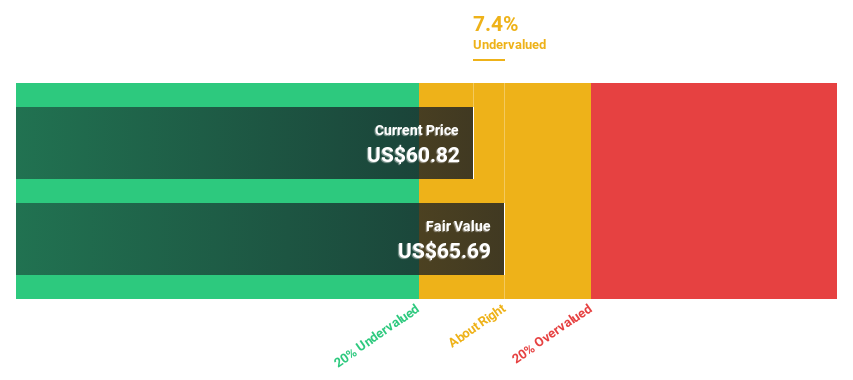

Pagaya Technologies (PGY)

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-driven technology to serve financial services, service providers, their customers, and asset investors across the United States, Israel, and the Cayman Islands with a market cap of $2.20 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating $1.08 billion.

Estimated Discount To Fair Value: 11.4%

Pagaya Technologies is trading at US$32.21, below its estimated fair value of US$36.37, indicating potential undervaluation based on cash flows. The company recently closed a US$500 million debt offering to refinance higher-cost loans, enhancing profitability and generating approximately US$40 million in annualized cash flow savings. Despite significant insider selling and high share price volatility, Pagaya's revenue growth outpaces the market average, with profitability expected within three years.

- The growth report we've compiled suggests that Pagaya Technologies' future prospects could be on the up.

- Click here to discover the nuances of Pagaya Technologies with our detailed financial health report.

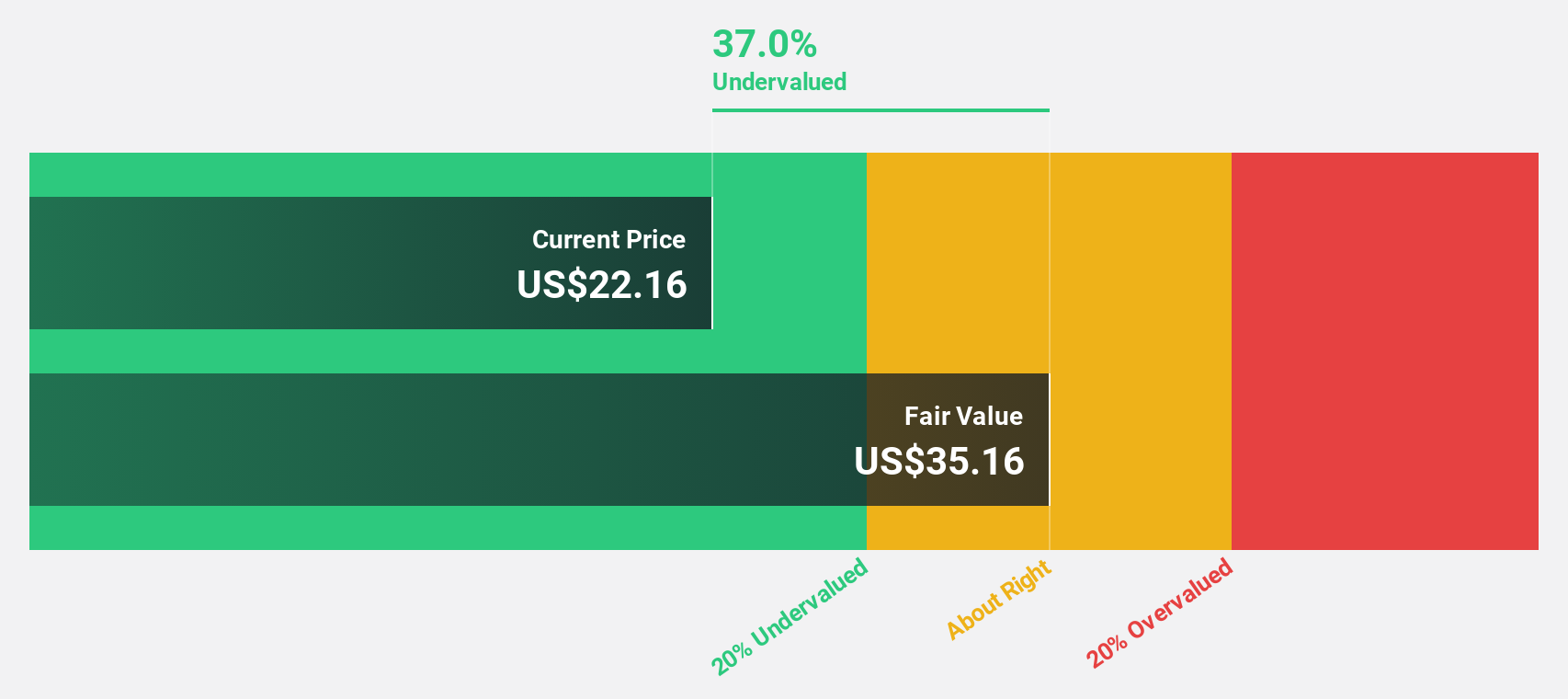

Hasbro (HAS)

Overview: Hasbro, Inc. is a toy and game company operating in various regions including the United States, Europe, and Asia, with a market cap of approximately $10.47 billion.

Operations: Hasbro's revenue is primarily derived from three segments: Consumer Products at $2.67 billion, Wizards of The Coast & Digital Gaming at $1.90 billion, and Entertainment at $131.40 million.

Estimated Discount To Fair Value: 17.4%

Hasbro is trading at US$76.89, below its estimated fair value of US$93.06, suggesting potential undervaluation based on cash flows. Despite reporting a net loss due to goodwill impairment and being dropped from several growth indices, Hasbro raised its earnings guidance for 2025 and maintains a quarterly dividend of US$0.70 per share. The company's strategic partnerships in gaming could enhance future revenue streams as it aims for profitability within three years.

- In light of our recent growth report, it seems possible that Hasbro's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Hasbro's balance sheet health report.

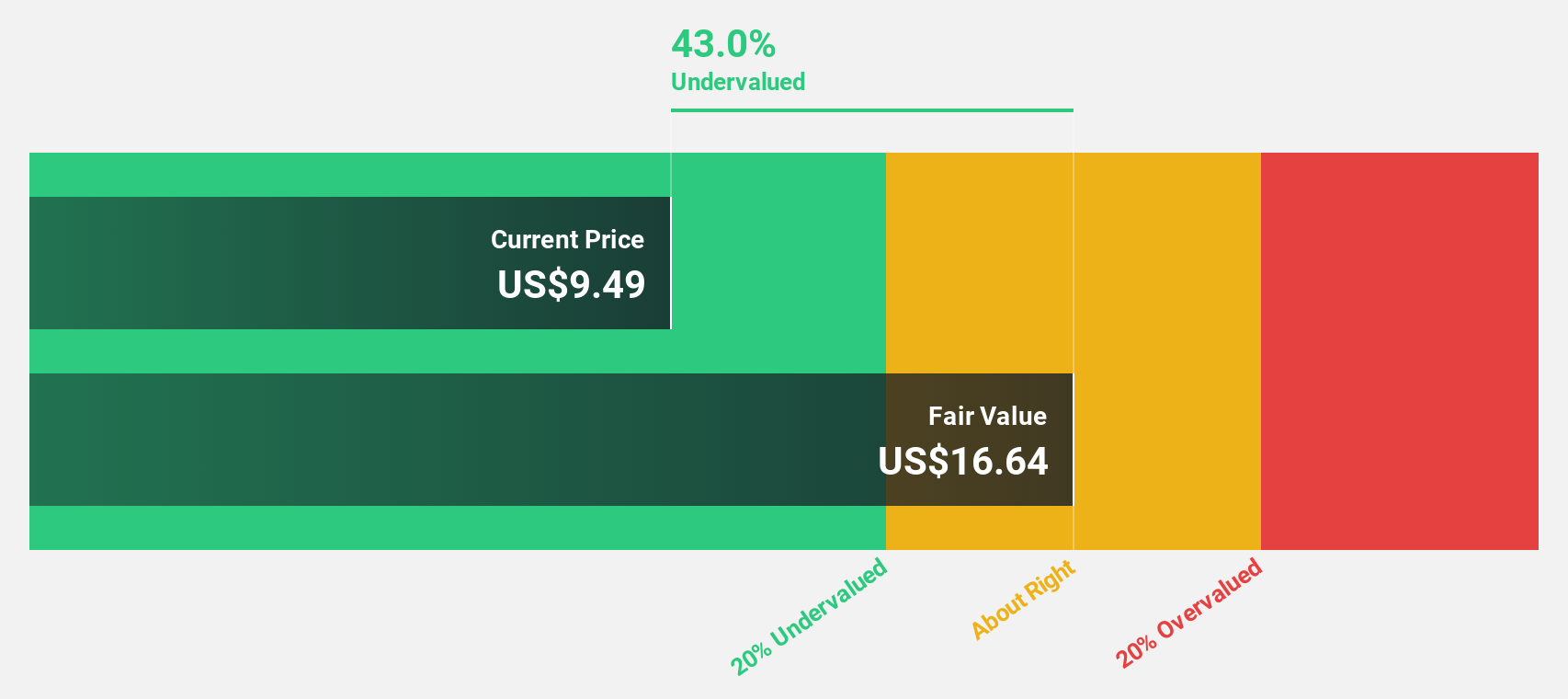

Coeur Mining (CDE)

Overview: Coeur Mining, Inc. is a gold and silver producer operating in the United States, Canada, and Mexico with a market cap of approximately $5.55 billion.

Operations: The company's revenue segments include Wharf at $249.04 million, Palmarejo at $378.49 million, Rochester at $268.61 million, and Kensington at $246.85 million, with a segment adjustment of $58.02 million.

Estimated Discount To Fair Value: 44.9%

Coeur Mining, trading at US$9.21, is valued below its fair estimate of US$16.71, reflecting potential undervaluation based on cash flows. The company has become profitable this year with significant earnings growth forecasted at 39.3% annually over the next three years. Recent inclusion in multiple Russell Growth indices and a US$75 million share buyback program further highlight investor confidence despite past shareholder dilution and low future return on equity projections.

- Upon reviewing our latest growth report, Coeur Mining's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Coeur Mining with our comprehensive financial health report here.

Key Takeaways

- Navigate through the entire inventory of 173 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives