- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Reports Q2 2025 Production of 410,244 Vehicles and 10 GWh Energy Storage

Reviewed by Simply Wall St

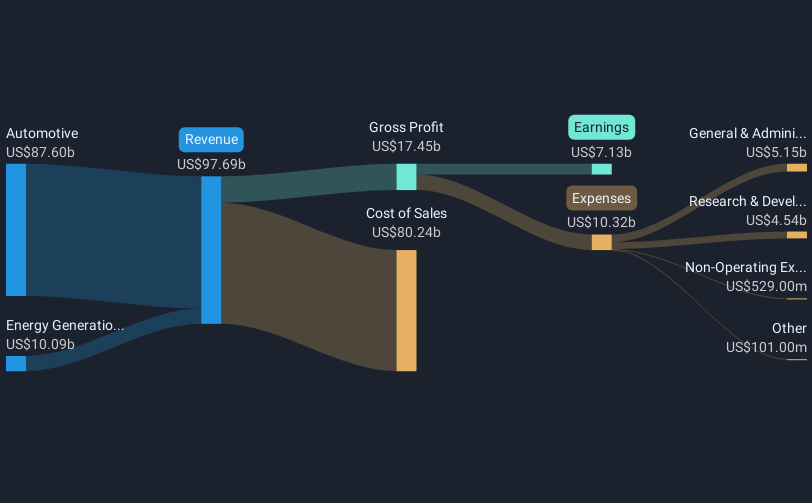

Tesla (NasdaqGS:TSLA) recently announced it produced 410,244 vehicles and deployed 9.6 GWh of energy storage products in Q2 2025, highlighting its manufacturing growth and commitment to sustainable energy. Despite reporting a 14% decline in deliveries, the stock saw a 6.35% rise last quarter, aligning somewhat with broader market increases. Business expansions in India and ongoing executive changes may have contributed positively to investor sentiment. Meanwhile, market dynamics, such as fluctuations in the tech sector and trade agreement announcements, likely provided additional context for Tesla's performance in contrast to wider economic indicators.

We've spotted 1 warning sign for Tesla you should be aware of.

Tesla's recent announcement of new manufacturing achievements ties directly into its broader narrative of expanding into autonomous vehicles and energy products. While achieving a 6.35% rise in its stock value over the last quarter despite a decline in deliveries, Tesla demonstrates the ability of its ongoing expansions in India and executive changes to buoy investor sentiment. Key to this upbeat outlook is the potential for its initiatives, like the robotaxi and Cybercab, to significantly drive future revenue and earnings, indicating meaningful impact on forthcoming performance metrics.

Over the past five years, Tesla shares have experienced a substantial total return of 224.54%, underscoring a longer-term appreciation and historic investor confidence. This contrasts with Tesla's performance relative to the US market over the previous year, where it managed to exceed the market's return of 13.9%, highlighting its resilience amid various challenges within the auto industry.

This quarter's news is expected to influence revenue and earnings forecasts, amplifying growth prospects. Analysts anticipate Tesla's revenue to increase annually by considerable margins, supported by ventures like the Optimus humanoid robots and expansion in energy storage. Despite a current share price of US$275.35 being slightly below the consensus price target of US$289.44, the close disparity suggests that analysts perceive Tesla as relatively fairly priced, reflecting modestly optimistic market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives