- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Reports Q2 2025 Production of 410,244 Vehicles

Reviewed by Simply Wall St

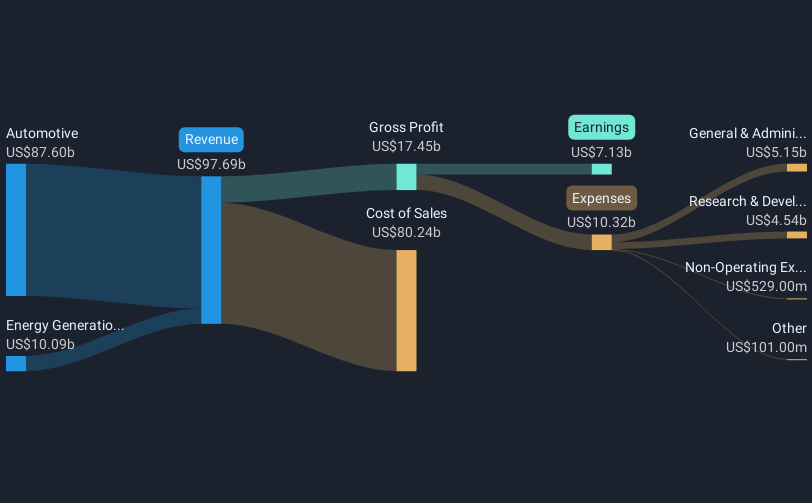

Tesla (NasdaqGS:TSLA) recently announced its Q2 2025 production results, highlighting the manufacture of 410,244 vehicles and deploying 9.6 GWh of energy storage products, emphasizing its growth in both automotive and energy sectors. Despite these achievements, the company's share price increased by 18.10% over the last quarter, a move that aligns more broadly with the market trends where technology stocks have rallied. The company's entry into the Indian market and vehicle sales data likely added weight to Tesla's performance, alongside market optimism driven by tech stock growth following a strong June jobs report.

Every company has risks, and we've spotted 1 risk for Tesla you should know about.

With Tesla's recent announcement focusing on Q2 2025 production results and the strategic push into India, the potential impact on revenue and earnings is significant. The introduction of autonomous vehicles and the expansion of energy storage solutions may drive substantial growth. These advancements suggest a favorable impact on revenue forecasts, potentially boosting Tesla's position in both automotive and energy segments. Analysts have projected revenues to grow at 16.6% annually over the next three years, supported by these initiatives. This aligns with the positive market sentiment that has seen Tesla's share price rise by 18.10% over the last quarter.

Over the past five years, Tesla's on-market total return, encompassing share price appreciation and dividends, surged 246.64%. This significant increase demonstrates the company's impressive performance over the longer term. In contrast, over the past year, Tesla has outperformed the US Auto industry, which returned 23.2%, indicating the company's robust market positioning. However, challenges such as execution risks on large-scale projects and geopolitical factors must be acknowledged as potential obstacles to sustaining these growth rates.

Despite the impressive share price movement, the current price of US$275.35 remains below the consensus price target of US$289.44, suggesting limited room for upside in the near term per analyst expectations. Investors should consider how Tesla's strategic initiatives align with these projections to determine if the market accurately reflects the company's potential in the context of its ambitious goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives