- United States

- /

- Software

- /

- NasdaqGM:SOUN

SoundHound AI (SOUN) Announces Vision AI Enhancing Voice-First Platform With Visual Capabilities

Reviewed by Simply Wall St

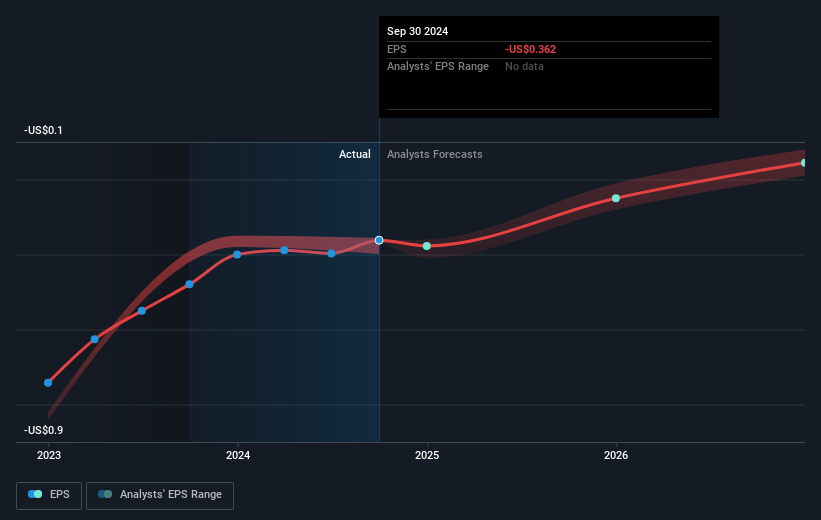

SoundHound AI (SOUN) recently made headlines with the launch of its Vision AI, enhancing its voice-first platform with visual capabilities. Alongside this, the rollout of SoundHound Chat AI Automotive in vehicles from major automotive brands highlighted the company's technological advancements. Meanwhile, SoundHound's partnership with Acrelec for voice-enabled drive-thru systems and its collaboration with AVANT Communications expanded its market reach. Despite posting a significant net loss in Q2, SoundHound reported impressive sales growth, aligning with its optimistic revenue guidance. While these developments would have supported market-positive movements, broader tech market trends propelled its shares 31% higher last quarter.

Be aware that SoundHound AI is showing 3 weaknesses in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

SoundHound AI's recent initiatives, including the launch of Vision AI and partnerships with Acrelec and AVANT Communications, align with the company's narrative of expanding into voice commerce and enhancing AI solutions. These developments could potentially support higher revenue, given the expanded market reach and technological advancements. However, challenges such as dependency on partnerships and high R&D expenses still pose risks to profitability. The significant uptick in share price by 31% last quarter reflects positive market reception, though the broader tech sector trends likely influenced this gain.

Over the past three years, SoundHound's total shareholder return has soared by a very large percentage, indicating robust investor confidence and strong growth prospects, despite recent earnings challenges. Against the backdrop of an industry that returned 25.6% over the past year, SoundHound has exceeded expectations, reflecting its competitive edge in the voice AI market. However, the current share price of US$12.56 remains below the consensus price target of US$14.50, indicating a discount of approximately 15.45%. This price target suggests room for future growth if current strategies and developments translate into sustained revenue increases and improved earnings forecasts.

Upon reviewing our latest valuation report, SoundHound AI's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives