- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:NSYS

Some Nortech Systems (NASDAQ:NSYS) Shareholders Are Down 26%

It is a pleasure to report that the Nortech Systems Incorporated (NASDAQ:NSYS) is up 43% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 26% in that time, significantly under-performing the market.

View 4 warning signs we detected for Nortech Systems

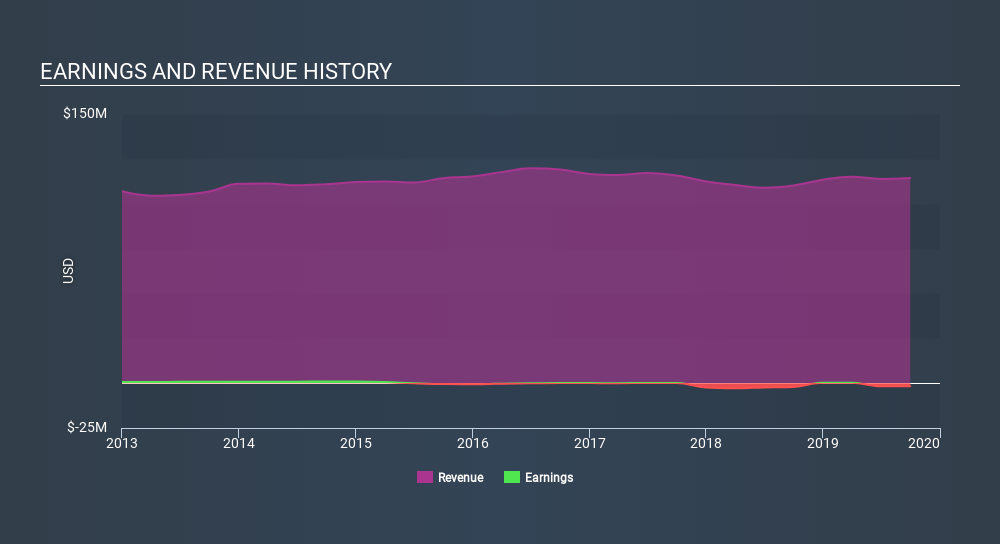

Because Nortech Systems is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Nortech Systems saw its revenue shrink by 0.1% per year. While far from catastrophic that is not good. The stock hasn't done well for shareholders in the last five years, falling 5.7%, annualized. Unfortunately, though, it makes sense given the lack of either profits or revenue growth. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 4 warning signs for Nortech Systems (of which 2 are major) which any shareholder or potential investor should be aware of.

A Different Perspective

Nortech Systems shareholders gained a total return of 8.4% during the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5.7% endured over half a decade. It could well be that the business is stabilizing. You could get a better understanding of Nortech Systems's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:NSYS

Nortech Systems

Provides engineering design and manufacturing solutions for electromedical devices, electromechanical systems, assemblies, and components in the United States, Mexico, and China.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives