- United Kingdom

- /

- Food

- /

- LSE:BAKK

Promising UK Penny Stocks To Consider In September 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, affecting companies closely tied to the Chinese economy. Despite these broader market difficulties, investors may find opportunities in smaller or newer companies often referred to as penny stocks—a term that might seem outdated but still holds significance for those seeking value. By focusing on penny stocks with strong financial foundations and potential for growth, investors can uncover promising opportunities even amidst uncertain times.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £516.68M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.40 | £43.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.515 | £435.27M | ✅ 4 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 1 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.79 | £286.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.20 | £115.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.45M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.54 | £77.39M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Brave Bison Group (AIM:BBSN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brave Bison Group plc offers digital advertising and technology services across the United Kingdom, Europe, and internationally with a market cap of £49.01 million.

Operations: Brave Bison Group plc does not have any reported revenue segments.

Market Cap: £49.01M

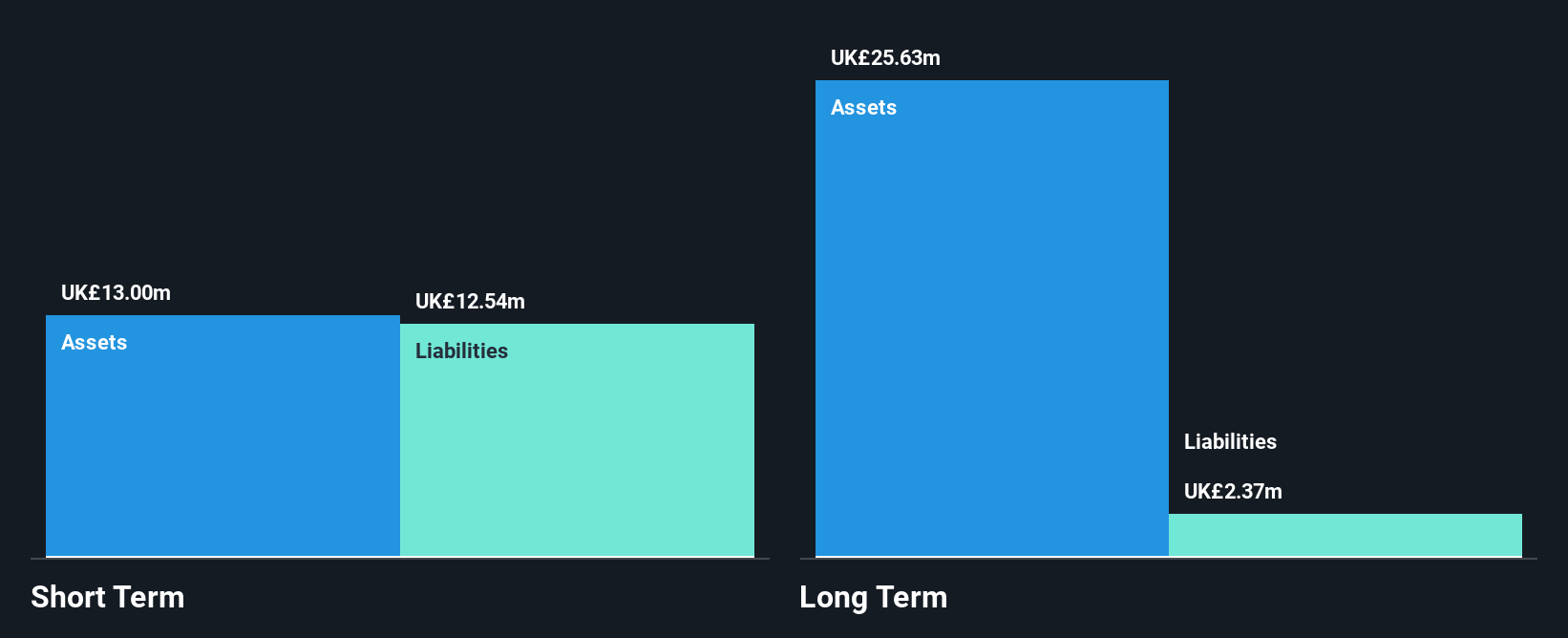

Brave Bison Group plc, with a market cap of £49.01 million, operates in the digital advertising and technology services sector. The company reported half-year sales of £17.8 million, an increase from the previous year, though net income declined to £0.147 million from £1.22 million. Despite low return on equity at 10.6%, its short-term assets cover both short and long-term liabilities comfortably, and debt is well-covered by operating cash flow at 1202%. While share price volatility remains high, the management team is experienced with stable earnings quality amidst challenges in profit growth acceleration compared to industry averages.

- Dive into the specifics of Brave Bison Group here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Brave Bison Group's track record.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, with a market cap of £1.30 billion, is involved in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China.

Operations: The company generates revenue from its operations primarily in the United Kingdom (£1.95 billion) and the United States (£233 million).

Market Cap: £1.3B

Bakkavor Group plc, with a market cap of £1.30 billion, recently reported half-year sales of £1.08 billion, showing a slight increase from the previous year. However, net income dropped to £16.8 million from £35.2 million due to large one-off losses impacting earnings quality. Despite this, Bakkavor's debt is well-covered by operating cash flow and interest payments are adequately managed with 5x EBIT coverage. The company's experienced management team has reduced its debt-to-equity ratio significantly over five years while maintaining stable weekly volatility and avoiding shareholder dilution despite challenges in profit margin improvement and negative recent earnings growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Bakkavor Group.

- Evaluate Bakkavor Group's prospects by accessing our earnings growth report.

Playtech (LSE:PTEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Playtech plc is a technology company that provides gambling software, services, content, and platform technologies across Italy, Mexico, the UK, Europe, Latin America, and internationally with a market cap of £1.27 billion.

Operations: Playtech's revenue segments are not specifically reported, but the company operates in various regions including Italy, Mexico, the UK, Europe, Latin America, and internationally.

Market Cap: £1.27B

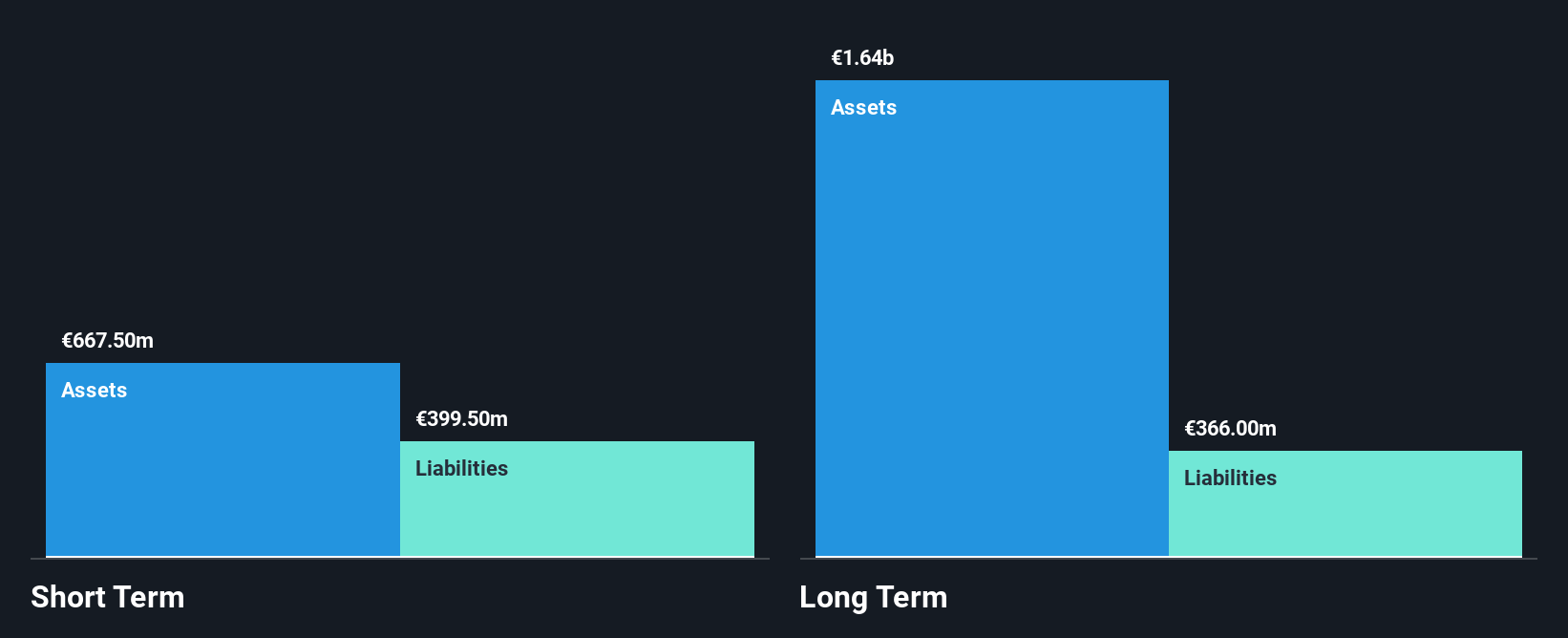

Playtech plc, with a market cap of £1.27 billion, has faced challenges as its losses have increased over the past five years by 24.6% annually, resulting in negative return on equity. Despite being unprofitable, Playtech's short-term assets of €1.6 billion exceed both its short and long-term liabilities, indicating strong liquidity management. The company's debt is well-covered by operating cash flow at 87.4%, and it has successfully reduced its debt-to-equity ratio from 76.6% to 24.7% over five years without significant shareholder dilution recently. Notably, Playtech expanded its partnership with MGM Resorts International to introduce innovative live gaming experiences from Las Vegas casinos.

- Jump into the full analysis health report here for a deeper understanding of Playtech.

- Understand Playtech's earnings outlook by examining our growth report.

Make It Happen

- Explore the 297 names from our UK Penny Stocks screener here.

- Ready For A Different Approach? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bakkavor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAKK

Bakkavor Group

Engages in the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives