- United States

- /

- Auto Components

- /

- NasdaqGS:PATK

M. Welch Is The Lead Independent Director of Patrick Industries, Inc. (NASDAQ:PATK) And They Just Spent US$390k On Shares

Potential Patrick Industries, Inc. (NASDAQ:PATK) shareholders may wish to note that the Lead Independent Director, M. Welch, recently bought US$390k worth of stock, paying US$39.00 for each share. That's a very solid buy in our book, and increased their holding by a noteworthy 10.7%.

See our latest analysis for Patrick Industries

The Last 12 Months Of Insider Transactions At Patrick Industries

In the last twelve months, the biggest single purchase by an insider was when Chairman & CEO Todd Cleveland bought US$926k worth of shares at a price of US$31.72 per share. So it's clear an insider wanted to buy, at around the current price, which is US$38.94. That means they have been optimistic about the company in the past, though they may have changed their mind. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the Patrick Industries insiders decided to buy shares at close to current prices.

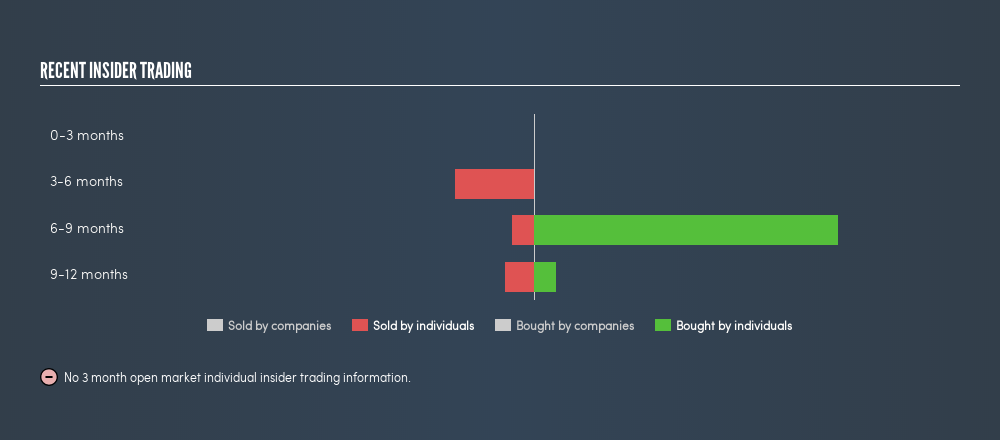

Happily, we note that in the last year insiders paid US$1.8m for 55236 shares. But insiders sold 17993 shares worth US$916k. In total, Patrick Industries insiders bought more than they sold over the last year. The chart below shows insider transactions (by individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Insider Ownership of Patrick Industries

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Patrick Industries insiders own about US$58m worth of shares. That equates to 6.3% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Patrick Industries Insiders?

It's certainly positive to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. Insiders likely see value in Patrick Industries shares, given these transactions (along with notable insider ownership of the company). If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

Of course Patrick Industries may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:PATK

Patrick Industries

Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)