Kepler Weber S.A.'s (BVMF:KEPL3) Stock Is Rallying But Financials Look Ambiguous: Will The Momentum Continue?

Kepler Weber's's (BVMF:KEPL3) stock is up by a considerable 56% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to Kepler Weber's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Kepler Weber

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kepler Weber is:

8.9% = R$42m ÷ R$476m (Based on the trailing twelve months to March 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each R$1 of shareholders' capital it has, the company made R$0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learnt that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Kepler Weber's Earnings Growth And 8.9% ROE

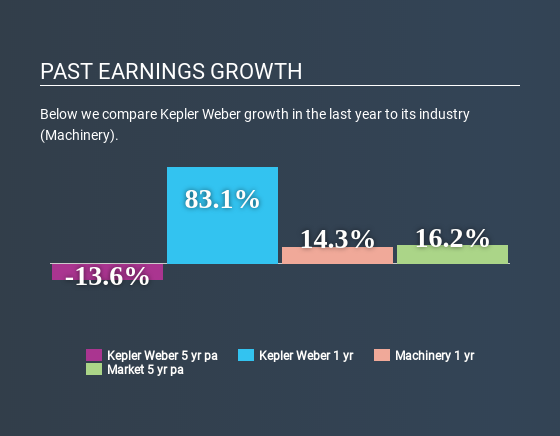

As you can see, Kepler Weber's ROE looks pretty weak. A comparison with the industry shows that the company's ROE is pretty similar to the average industry ROE of 10%. Given the low ROE Kepler Weber's five year net income decline of 14% is not surprising.

However, when we compared Kepler Weber's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 45% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Kepler Weber's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Kepler Weber Making Efficient Use Of Its Profits?

When we piece together Kepler Weber's low three-year median payout ratio of 21% (where it is retaining 79% of its profits), calculated for the last three-year period, we are puzzled by the lack of growth. The low payout should mean that the company is retaining most of its earnings and consequently, should see some growth. So there could be some other explanations in that regard. For example, the company's business may be deteriorating.

In addition, Kepler Weber has been paying dividends over a period of seven years suggesting that keeping up dividend payments is preferred by the management even though earnings have been in decline.

Summary

On the whole, we feel that the performance shown by Kepler Weber can be open to many interpretations. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Kepler Weber by visiting our risks dashboard for free on our platform here.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BOVESPA:KEPL3

Kepler Weber

Provides grain storage equipment and post-harvest grain solutions in Brazil, the Americas, Africa, Europe, and Asia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)