- United States

- /

- Aerospace & Defense

- /

- NYSE:RDW

June 2025's Stock Picks That May Offer Value Opportunities

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, but it has shown a notable rise of 11% over the past 12 months, with earnings expected to grow by 14% per annum in the coming years. In this environment, identifying undervalued stocks that have strong fundamentals and growth potential could present valuable opportunities for investors seeking to capitalize on these trends.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.38 | $47.89 | 49.1% |

| Redwire (RDW) | $17.68 | $35.10 | 49.6% |

| Peoples Financial Services (PFIS) | $47.56 | $93.66 | 49.2% |

| Pagaya Technologies (PGY) | $16.75 | $33.36 | 49.8% |

| MetroCity Bankshares (MCBS) | $27.31 | $53.06 | 48.5% |

| Lyft (LYFT) | $15.53 | $30.52 | 49.1% |

| Lincoln Educational Services (LINC) | $22.57 | $44.02 | 48.7% |

| First Internet Bancorp (INBK) | $22.58 | $43.85 | 48.5% |

| Central Pacific Financial (CPF) | $26.30 | $51.99 | 49.4% |

| Arrow Financial (AROW) | $25.41 | $49.74 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

Waystar Holding (WAY)

Overview: Waystar Holding Corp. develops a cloud-based software solution for healthcare payments and has a market cap of $6.85 billion.

Operations: Waystar Holding's revenue primarily comes from its healthcare software segment, which generated $975.19 million.

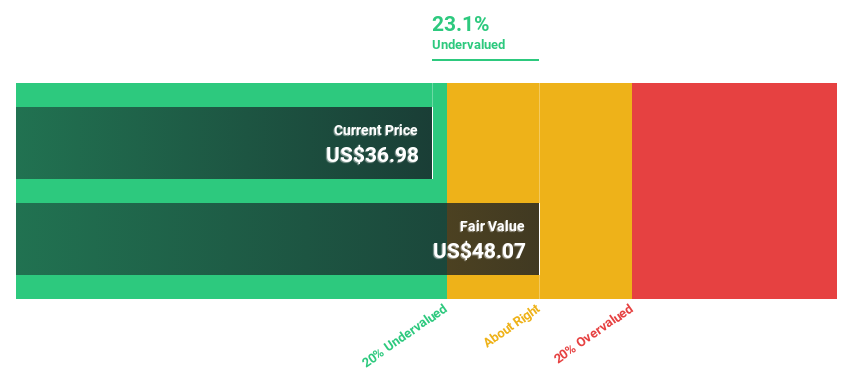

Estimated Discount To Fair Value: 18.6%

Waystar Holding, with recent strategic partnerships and innovative offerings, is trading at US$40.09, below its estimated fair value of US$49.24. Despite a low forecasted return on equity of 8.6%, earnings are expected to grow significantly at 31.8% annually over the next three years, surpassing market averages. The company has become profitable this year with a net income of US$29.27 million in Q1 2025 and continues to enhance revenue cycle performance through technology advancements and strategic board expansions.

- Our growth report here indicates Waystar Holding may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Waystar Holding's balance sheet health report.

Pure Storage (PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally with a market cap of $17.90 billion.

Operations: The company's revenue is primarily generated from its Computer Storage Devices segment, which accounts for $3.25 billion.

Estimated Discount To Fair Value: 40.3%

Pure Storage is trading at US$54.6, significantly below its estimated fair value of US$91.48, suggesting it may be undervalued based on cash flows. The company has demonstrated robust earnings growth of 36.9% over the past year and forecasts indicate continued strong annual earnings growth of 35% over the next three years, outpacing the market average. Recent strategic partnerships and product innovations further enhance its position in high-demand sectors like AI and data storage solutions.

- The analysis detailed in our Pure Storage growth report hints at robust future financial performance.

- Navigate through the intricacies of Pure Storage with our comprehensive financial health report here.

Redwire (RDW)

Overview: Redwire Corporation delivers essential space solutions and infrastructure for both government and commercial clients globally, with a market cap of $1.31 billion.

Operations: The company's revenue is primarily derived from its Space Infrastructure segment, which generated $277.70 million.

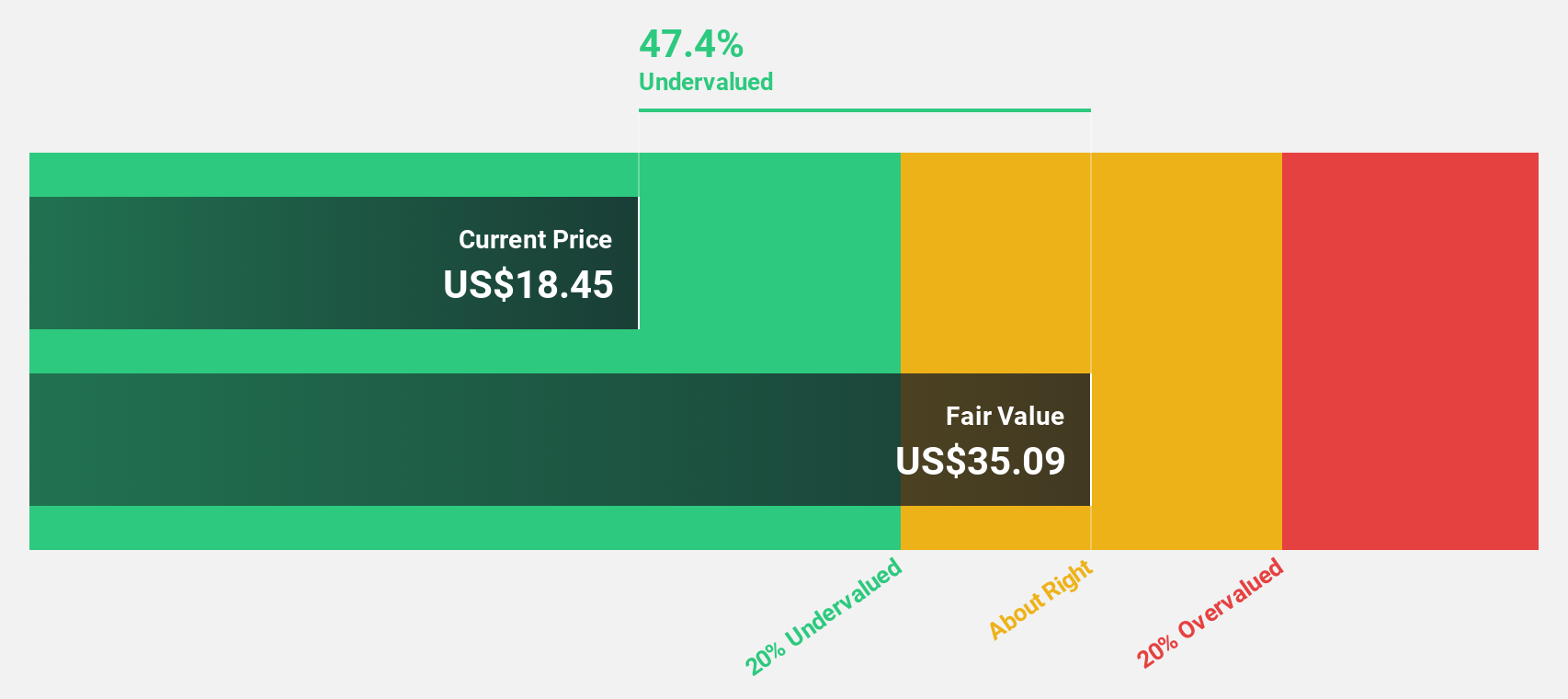

Estimated Discount To Fair Value: 49.6%

Redwire, trading at US$17.68, is priced significantly below its estimated fair value of US$35.1, indicating potential undervaluation based on cash flows. Despite recent shareholder dilution and volatility in share price, the company shows promising growth prospects with forecasted revenue expansion of 35.9% annually and expected profitability within three years. Recent technological advancements like Mason for lunar operations and strategic contracts with NASA bolster its innovative edge in space technology solutions.

- Our earnings growth report unveils the potential for significant increases in Redwire's future results.

- Delve into the full analysis health report here for a deeper understanding of Redwire.

Where To Now?

- Get an in-depth perspective on all 156 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDW

Redwire

Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives