- United States

- /

- Banks

- /

- NasdaqGS:OCFC

June 2025 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 3.4% over the last week and 14% in the past year, with earnings projected to grow by 15% annually in the coming years. In such a dynamic environment, selecting dividend stocks that offer both stability and growth potential can enhance your portfolio's resilience and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.59% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.36% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.73% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.60% | ★★★★★★ |

| Ennis (EBF) | 5.46% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.07% | ★★★★★☆ |

| Dillard's (DDS) | 6.26% | ★★★★★★ |

| Credicorp (BAP) | 4.91% | ★★★★★☆ |

| Columbia Banking System (COLB) | 6.17% | ★★★★★★ |

| Chevron (CVX) | 4.76% | ★★★★★★ |

Click here to see the full list of 146 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

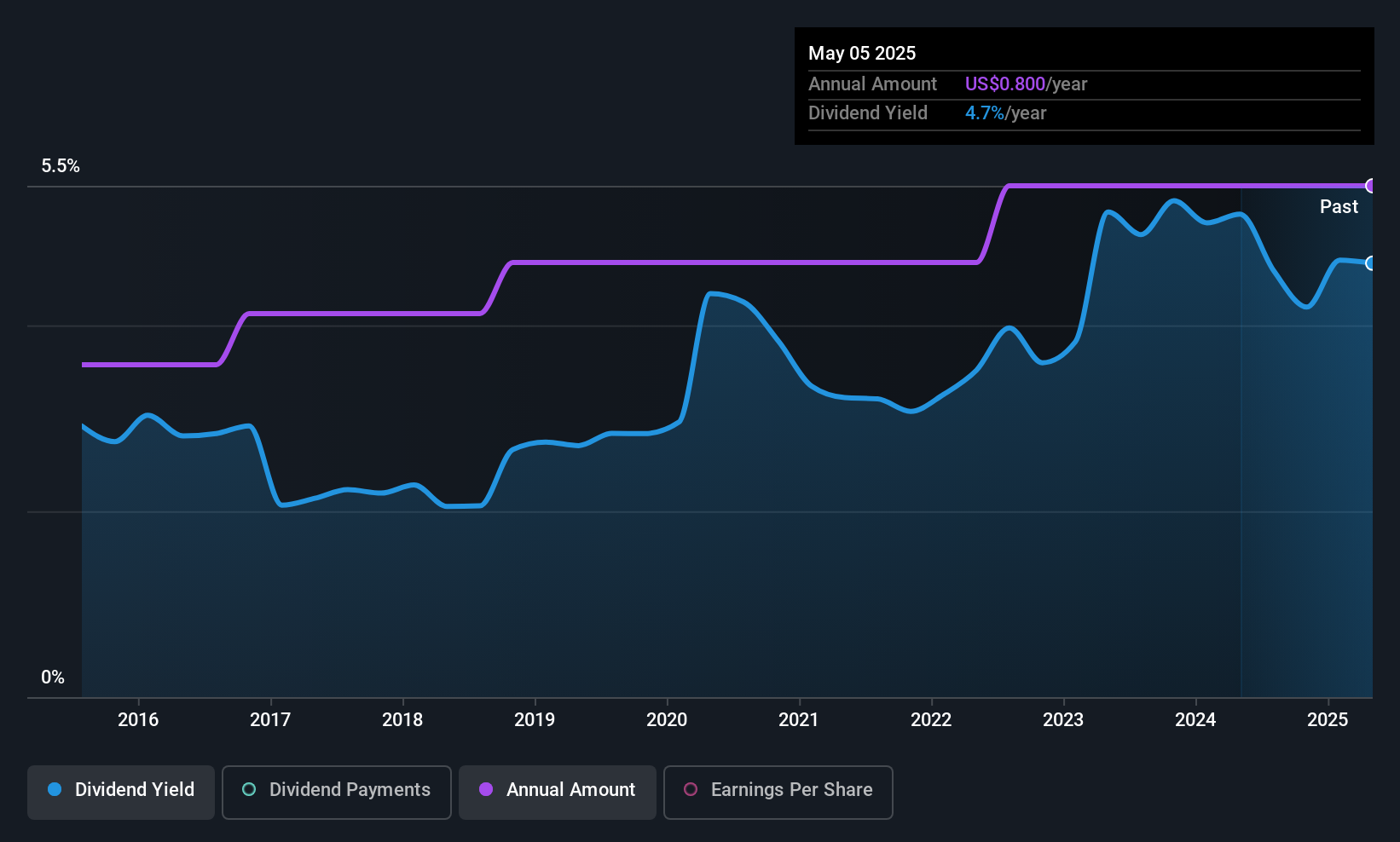

OceanFirst Financial (OCFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OceanFirst Financial Corp., with a market cap of approximately $1.03 billion, operates as the bank holding company for OceanFirst Bank N.A.

Operations: OceanFirst Financial Corp. generates revenue primarily through its Community Banking Operations, amounting to $369.88 million.

Dividend Yield: 4.5%

OceanFirst Financial's dividend payments have been stable and reliable over the past decade, with a current yield of 4.51%. Despite its recent removal from the Russell 2000 Dynamic Index, it maintains a reasonable payout ratio of 52.3%, indicating dividends are covered by earnings. The company's P/E ratio of 11.6x suggests it is undervalued relative to the US market average. Recent challenges include a decline in net income for Q1 2025 compared to the previous year.

- Click here and access our complete dividend analysis report to understand the dynamics of OceanFirst Financial.

- Insights from our recent valuation report point to the potential overvaluation of OceanFirst Financial shares in the market.

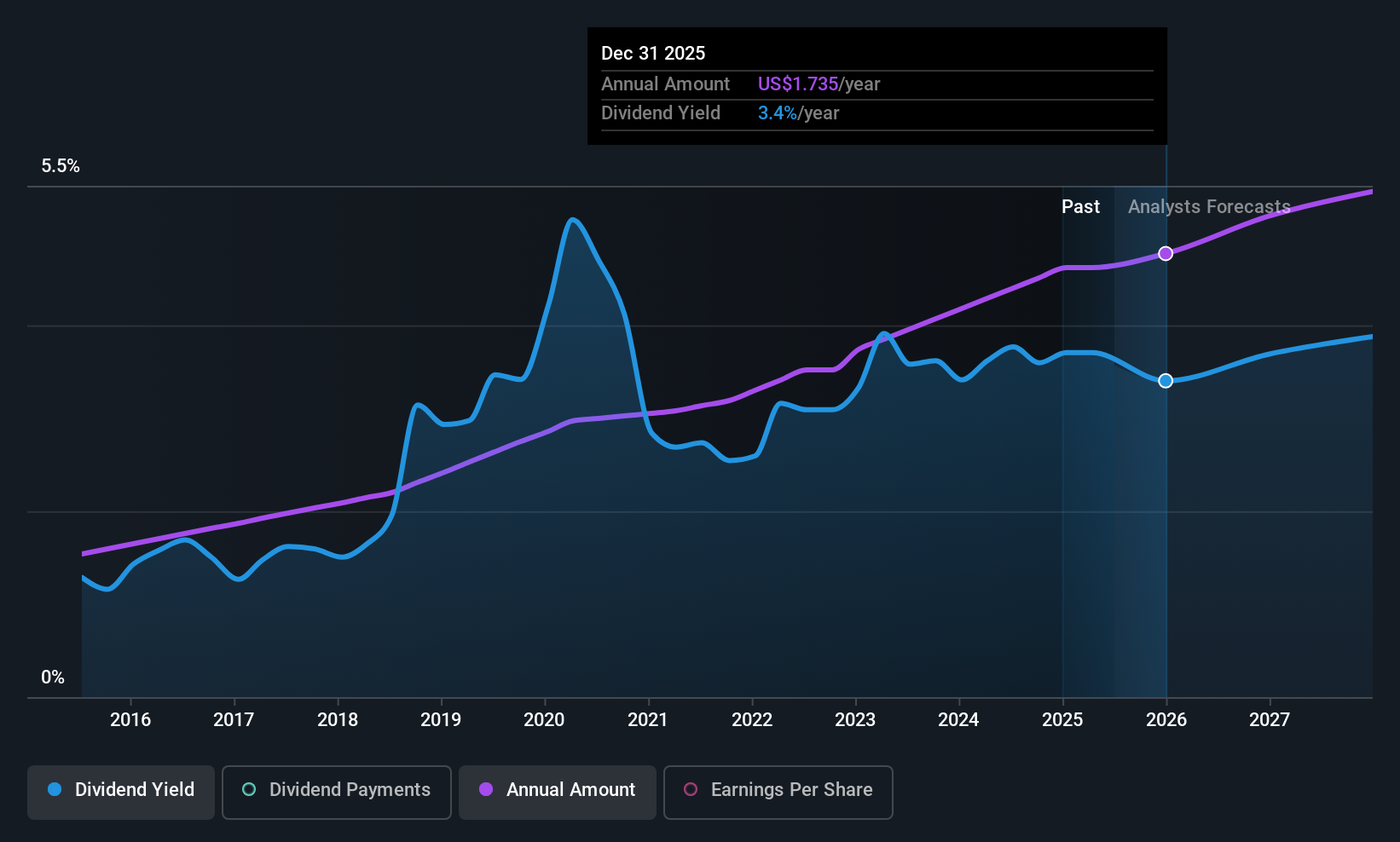

Bank OZK (OZK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank OZK is a full-service Arkansas state-chartered bank offering retail and commercial banking services across the United States, with a market cap of approximately $5.31 billion.

Operations: Bank OZK generates revenue primarily from its Community Banking segment, which accounts for $1.49 billion.

Dividend Yield: 3.6%

Bank OZK has consistently increased its dividends for fifty-nine consecutive quarters, with a current yield of 3.56%. Its dividend payments are well covered by earnings due to a low payout ratio of 26.4%, ensuring sustainability. Recent inclusion in the Russell 1000 Defensive and Value-Defensive Indices highlights its defensive appeal. Although recent earnings showed slight declines, the bank trades significantly below estimated fair value, suggesting potential undervaluation relative to peers and industry standards.

- Delve into the full analysis dividend report here for a deeper understanding of Bank OZK.

- Our valuation report unveils the possibility Bank OZK's shares may be trading at a discount.

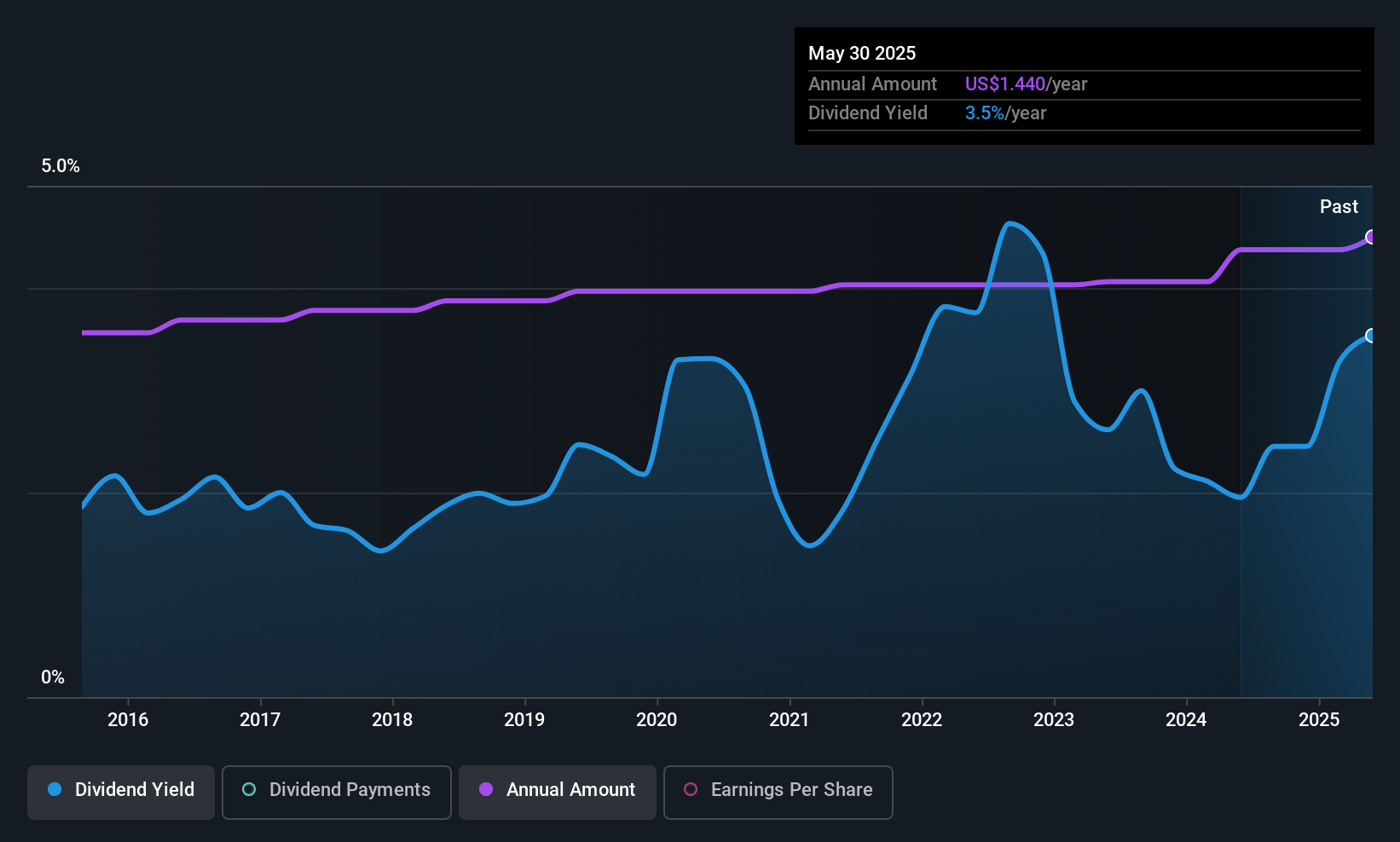

Hyster-Yale (HY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hyster-Yale, Inc. operates globally through its subsidiaries by designing, engineering, manufacturing, selling, and servicing lift trucks and related products with a market cap of approximately $710.79 million.

Operations: Hyster-Yale's revenue is primarily derived from its Lift Truck Business, with $3.15 billion from the Americas, $626.40 million from EMEA, and $193.30 million from JAPIC, along with $363.20 million from Bolzoni attachments and aftermarket parts.

Dividend Yield: 3.5%

Hyster-Yale's dividend has grown steadily over the past decade, with a recent increase to US$0.36 per share. Despite its reliable 3.49% yield, it lags behind top-tier U.S. dividend payers. The payout is sustainable, covered by both earnings and cash flows. Recent strategic realignments aim to boost profitability but follow a drop from several growth indices and declining profit margins, reflecting challenges in maintaining robust financial health amid high debt levels and reduced earnings forecasts.

- Get an in-depth perspective on Hyster-Yale's performance by reading our dividend report here.

- Our expertly prepared valuation report Hyster-Yale implies its share price may be lower than expected.

Where To Now?

- Click here to access our complete index of 146 Top US Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives