- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Unveils Center For Geopolitics To Guide Clients Through Global Trends

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) recently announced the launch of the JPMorganChase Center for Geopolitics, underscoring its commitment to aiding clients in the evolving global business environment. Over the past month, the company's stock price rose by 15%, a move that aligns with broader market trends. This price increase might have been bolstered by other announcements, such as the opening of a new Paris office and the release of open-source quantum research software. While market conditions have been mixed, with the S&P 500 down slightly, these strategic initiatives add weight to the stock's upward momentum.

The recent initiatives by JPMorgan Chase, including the launch of the JPMorganChase Center for Geopolitics and opening a new office in Paris, could significantly influence its long-term growth strategy. By enhancing its global presence and technological capabilities, the company may bolster its market position amid macroeconomic fluctuations. Over the past five years, the company's total shareholder returns, combining share price and dividends, were 218.64%. This historical performance provides a context of robust long-term gains, although recent movements primarily depend on current initiatives and market conditions.

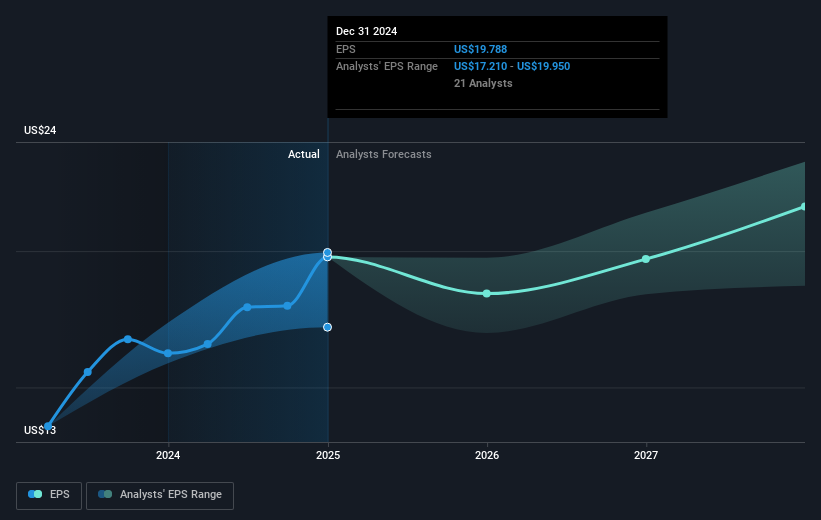

In the short term, JPMorgan Chase's stock price increased by 15%, reflecting positive market reception to recent announcements. This movement needs to be viewed in relation to analyst consensus, which sets a fair value price target at US$266.19, implying a slight discount compared to current trading levels. Despite recent gains, forecasts suggest potential challenges as higher credit losses and expenses might constrain earnings, with earnings expected to decline by an average of 3.1% annually for the next three years. Additionally, potential rate cuts could affect net interest income and overall profitability. Nevertheless, the company's efforts in investment banking and asset management show promise and may support their financial outlook.

Jump into the full analysis health report here for a deeper understanding of JPMorgan Chase.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives