- Australia

- /

- Metals and Mining

- /

- ASX:BSL

Is BlueScope Steel's (ASX:BSL) Share Price Gain Of 234% Well Earned?

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of BlueScope Steel Limited (ASX:BSL) stock is up an impressive 234% over the last five years. It's also good to see the share price up 17% over the last quarter. But this could be related to the strong market, which is up 13% in the last three months.

View our latest analysis for BlueScope Steel

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

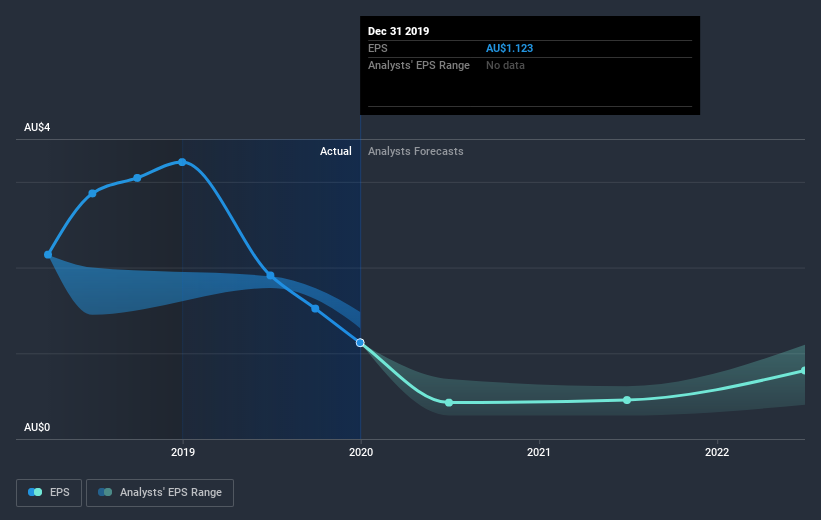

Over half a decade, BlueScope Steel managed to grow its earnings per share at 66% a year. This EPS growth is higher than the 27% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. The reasonably low P/E ratio of 10.47 also suggests market apprehension.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of BlueScope Steel, it has a TSR of 250% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that BlueScope Steel returned a loss of 1.0% in the last twelve months, the broader market was actually worse, returning a loss of 4.1%. Longer term investors wouldn't be so upset, since they would have made 29%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand BlueScope Steel better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with BlueScope Steel .

Of course BlueScope Steel may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading BlueScope Steel or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BlueScope Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:BSL

BlueScope Steel

Engages in the production and marketing of metal coated and painted steel building products in Australia, New Zealand, Asia, North America, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives